MacroeconomicsI_working_version (1)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Monetary Policy in Details 119<br />

banks, which lend funds from the central bank. These additional funds provided by the<br />

central bank extend credit of commercial banks and enhance the ability to create new<br />

money by the banking system.<br />

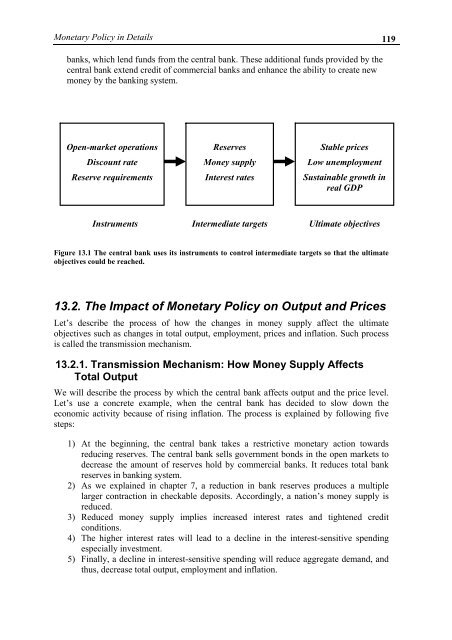

Open-market operations<br />

Discount rate<br />

Reserve requirements<br />

Reserves<br />

Money supply<br />

Interest rates<br />

Stable prices<br />

Low unemployment<br />

Sustainable growth in<br />

real GDP<br />

Instruments Intermediate targets Ultimate objectives<br />

Figure 13.1 The central bank uses its instruments to control intermediate targets so that the ultimate<br />

objectives could be reached.<br />

13.2. The Impact of Monetary Policy on Output and Prices<br />

Let’s describe the process of how the changes in money supply affect the ultimate<br />

objectives such as changes in total output, employment, prices and inflation. Such process<br />

is called the transmission mechanism.<br />

13.2.1. Transmission Mechanism: How Money Supply Affects<br />

Total Output<br />

We will describe the process by which the central bank affects output and the price level.<br />

Let’s use a concrete example, when the central bank has decided to slow down the<br />

economic activity because of rising inflation. The process is explained by following five<br />

steps:<br />

1) At the beginning, the central bank takes a restrictive monetary action towards<br />

reducing reserves. The central bank sells government bonds in the open markets to<br />

decrease the amount of reserves hold by commercial banks. It reduces total bank<br />

reserves in banking system.<br />

2) As we explained in chapter 7, a reduction in bank reserves produces a multiple<br />

larger contraction in checkable deposits. Accordingly, a nation’s money supply is<br />

reduced.<br />

3) Reduced money supply implies increased interest rates and tightened credit<br />

conditions.<br />

4) The higher interest rates will lead to a decline in the interest-sensitive spending<br />

especially investment.<br />

5) Finally, a decline in interest-sensitive spending will reduce aggregate demand, and<br />

thus, decrease total output, employment and inflation.