MacroeconomicsI_working_version (1)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

54<br />

Chapter 6<br />

6.3.2.2. Disposable Income (DI)<br />

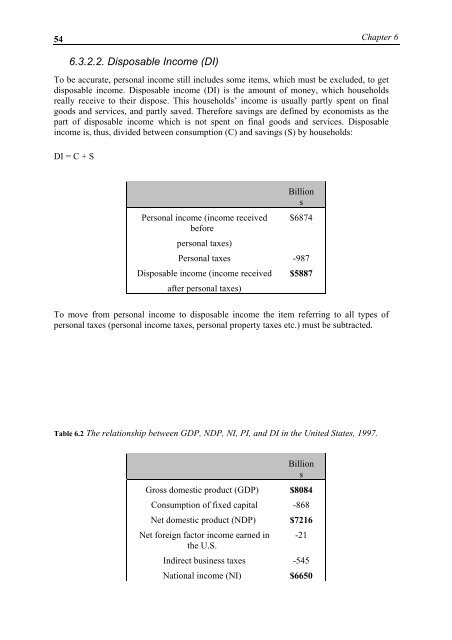

To be accurate, personal income still includes some items, which must be excluded, to get<br />

disposable income. Disposable income (DI) is the amount of money, which households<br />

really receive to their dispose. This households’ income is usually partly spent on final<br />

goods and services, and partly saved. Therefore savings are defined by economists as the<br />

part of disposable income which is not spent on final goods and services. Disposable<br />

income is, thus, divided between consumption (C) and savings (S) by households:<br />

DI = C + S<br />

Personal income (income received<br />

before<br />

personal taxes)<br />

Billion<br />

s<br />

$6874<br />

Personal taxes -987<br />

Disposable income (income received<br />

after personal taxes)<br />

$5887<br />

To move from personal income to disposable income the item referring to all types of<br />

personal taxes (personal income taxes, personal property taxes etc.) must be subtracted.<br />

Table 6.2 The relationship between GDP, NDP, NI, PI, and DI in the United States, 1997.<br />

Billion<br />

s<br />

Gross domestic product (GDP) $8084<br />

Consumption of fixed capital -868<br />

Net domestic product (NDP) $7216<br />

Net foreign factor income earned in<br />

the U.S.<br />

-21<br />

Indirect business taxes -545<br />

National income (NI) $6650