MacroeconomicsI_working_version (1)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Money Market, Money Supply, Money Demand 71<br />

i<br />

MS<br />

i<br />

MS<br />

MS‘<br />

E‘<br />

E<br />

E<br />

MD<br />

E‘<br />

MD<br />

M<br />

MD<br />

M<br />

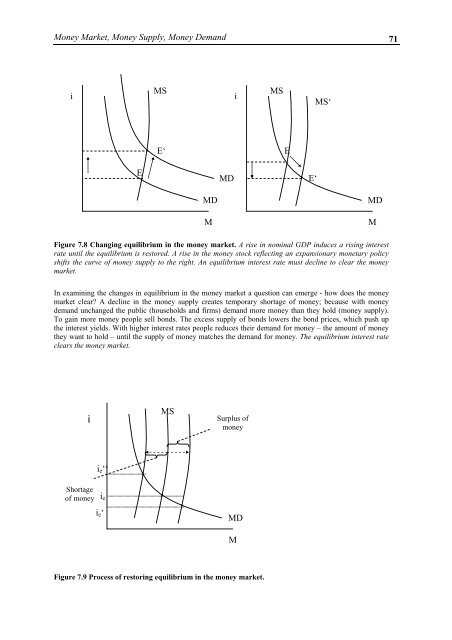

Figure 7.8 Changing equilibrium in the money market. A rise in nominal GDP induces a rising interest<br />

rate until the equilibrium is restored. A rise in the money stock reflecting an expansionary monetary policy<br />

shifts the curve of money supply to the right. An equilibrium interest rate must decline to clear the money<br />

market.<br />

In examining the changes in equilibrium in the money market a question can emerge - how does the money<br />

market clear? A decline in the money supply creates temporary shortage of money; because with money<br />

demand unchanged the public (households and firms) demand more money than they hold (money supply).<br />

To gain more money people sell bonds. The excess supply of bonds lowers the bond prices, which push up<br />

the interest yields. With higher interest rates people reduces their demand for money – the amount of money<br />

they want to hold – until the supply of money matches the demand for money. The equilibrium interest rate<br />

clears the money market.<br />

i<br />

MS<br />

Surplus of<br />

money<br />

i e ‘‘<br />

Shortage<br />

of money<br />

i e<br />

i e ‘<br />

MD<br />

M<br />

Figure 7.9 Process of restoring equilibrium in the money market.