MacroeconomicsI_working_version (1)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

70<br />

Chapter 7<br />

7.7. The Money Market<br />

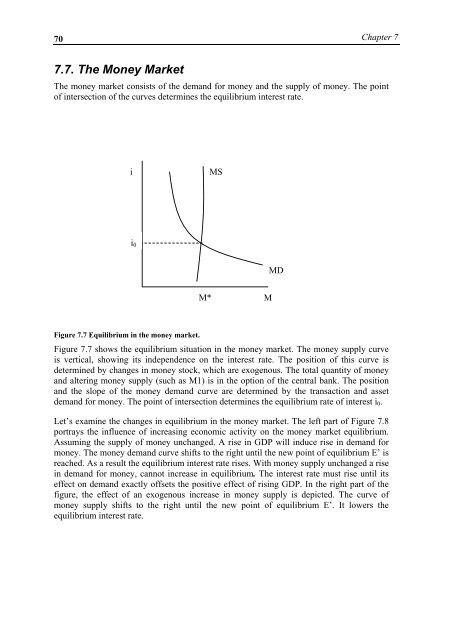

The money market consists of the demand for money and the supply of money. The point<br />

of intersection of the curves determines the equilibrium interest rate.<br />

i<br />

MS<br />

i 0<br />

M*<br />

MD<br />

M<br />

Figure 7.7 Equilibrium in the money market.<br />

Figure 7.7 shows the equilibrium situation in the money market. The money supply curve<br />

is vertical, showing its independence on the interest rate. The position of this curve is<br />

determined by changes in money stock, which are exogenous. The total quantity of money<br />

and altering money supply (such as M1) is in the option of the central bank. The position<br />

and the slope of the money demand curve are determined by the transaction and asset<br />

demand for money. The point of intersection determines the equilibrium rate of interest i 0 .<br />

Let’s examine the changes in equilibrium in the money market. The left part of Figure 7.8<br />

portrays the influence of increasing economic activity on the money market equilibrium.<br />

Assuming the supply of money unchanged. A rise in GDP will induce rise in demand for<br />

money. The money demand curve shifts to the right until the new point of equilibrium E’ is<br />

reached. As a result the equilibrium interest rate rises. With money supply unchanged a rise<br />

in demand for money, cannot increase in equilibrium. The interest rate must rise until its<br />

effect on demand exactly offsets the positive effect of rising GDP. In the right part of the<br />

figure, the effect of an exogenous increase in money supply is depicted. The curve of<br />

money supply shifts to the right until the new point of equilibrium E’. It lowers the<br />

equilibrium interest rate.