MacroeconomicsI_working_version (1)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

130<br />

Chapter 14<br />

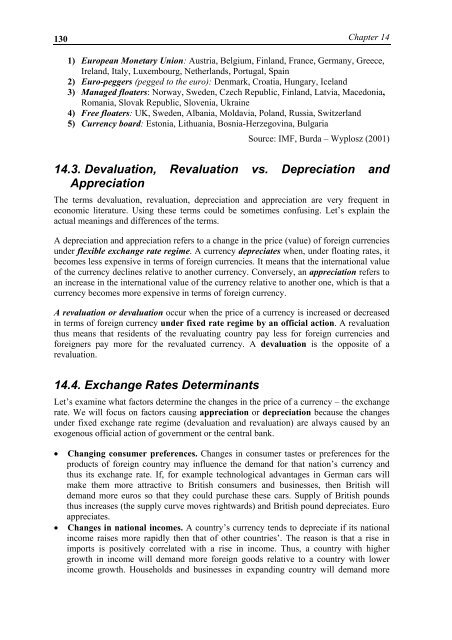

1) European Monetary Union: Austria, Belgium, Finland, France, Germany, Greece,<br />

Ireland, Italy, Luxembourg, Netherlands, Portugal, Spain<br />

2) Euro-peggers (pegged to the euro): Denmark, Croatia, Hungary, Iceland<br />

3) Managed floaters: Norway, Sweden, Czech Republic, Finland, Latvia, Macedonia,<br />

Romania, Slovak Republic, Slovenia, Ukraine<br />

4) Free floaters: UK, Sweden, Albania, Moldavia, Poland, Russia, Switzerland<br />

5) Currency board: Estonia, Lithuania, Bosnia-Herzegovina, Bulgaria<br />

Source: IMF, Burda – Wyplosz (2001)<br />

14.3. Devaluation, Revaluation vs. Depreciation and<br />

Appreciation<br />

The terms devaluation, revaluation, depreciation and appreciation are very frequent in<br />

economic literature. Using these terms could be sometimes confusing. Let’s explain the<br />

actual meanings and differences of the terms.<br />

A depreciation and appreciation refers to a change in the price (value) of foreign currencies<br />

under flexible exchange rate regime. A currency depreciates when, under floating rates, it<br />

becomes less expensive in terms of foreign currencies. It means that the international value<br />

of the currency declines relative to another currency. Conversely, an appreciation refers to<br />

an increase in the international value of the currency relative to another one, which is that a<br />

currency becomes more expensive in terms of foreign currency.<br />

A revaluation or devaluation occur when the price of a currency is increased or decreased<br />

in terms of foreign currency under fixed rate regime by an official action. A revaluation<br />

thus means that residents of the revaluating country pay less for foreign currencies and<br />

foreigners pay more for the revaluated currency. A devaluation is the opposite of a<br />

revaluation.<br />

14.4. Exchange Rates Determinants<br />

Let’s examine what factors determine the changes in the price of a currency – the exchange<br />

rate. We will focus on factors causing appreciation or depreciation because the changes<br />

under fixed exchange rate regime (devaluation and revaluation) are always caused by an<br />

exogenous official action of government or the central bank.<br />

• Changing consumer preferences. Changes in consumer tastes or preferences for the<br />

products of foreign country may influence the demand for that nation’s currency and<br />

thus its exchange rate. If, for example technological advantages in German cars will<br />

make them more attractive to British consumers and businesses, then British will<br />

demand more euros so that they could purchase these cars. Supply of British pounds<br />

thus increases (the supply curve moves rightwards) and British pound depreciates. Euro<br />

appreciates.<br />

• Changes in national incomes. A country’s currency tends to depreciate if its national<br />

income raises more rapidly then that of other countries’. The reason is that a rise in<br />

imports is positively correlated with a rise in income. Thus, a country with higher<br />

growth in income will demand more foreign goods relative to a country with lower<br />

income growth. Households and businesses in expanding country will demand more