MacroeconomicsI_working_version (1)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

62<br />

Chapter 7<br />

However such assets are not money because they don’t serve as a mediums of<br />

exchange or units of account due to their low liquidity.<br />

7.5. Demand for Money<br />

Before we start examining the demand for money we must make a clear distinction among<br />

money as the most liquid asset (including cash, checking accounts and closely related<br />

assets) and the other less liquid assets bearing interest such as bonds. The demand for<br />

money describes wants of people to held money instead of other assets bearing higher<br />

interest yield. To explain the demand for money, we must ask why people want to hold<br />

money. In general, there are two reasons for holding money: to make purchases with<br />

money and keep money as an asset.<br />

7.5.1. Transaction Demand for Money<br />

Money serves as a medium of exchange, which makes it convenient for purchasing goods,<br />

services or resources. Households hold money to pay for their daily needs – to buy food,<br />

clothes, pay for services. Firms must hold enough money to pay for all resources engaged<br />

in production process (such as labour, power, materials etc.). All these purchases for<br />

holding money forms the transaction demand for money.<br />

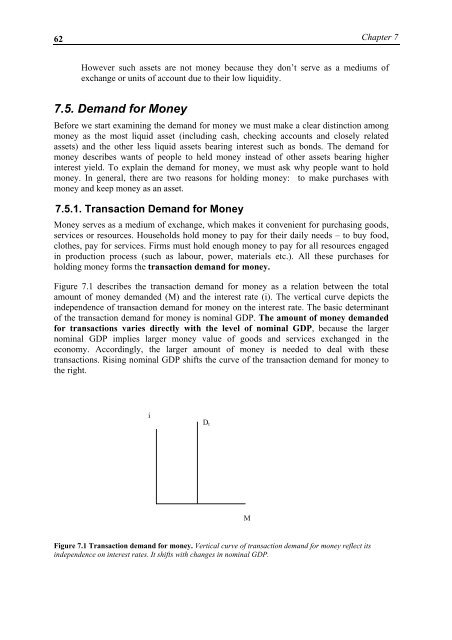

Figure 7.1 describes the transaction demand for money as a relation between the total<br />

amount of money demanded (M) and the interest rate (i). The vertical curve depicts the<br />

independence of transaction demand for money on the interest rate. The basic determinant<br />

of the transaction demand for money is nominal GDP. The amount of money demanded<br />

for transactions varies directly with the level of nominal GDP, because the larger<br />

nominal GDP implies larger money value of goods and services exchanged in the<br />

economy. Accordingly, the larger amount of money is needed to deal with these<br />

transactions. Rising nominal GDP shifts the curve of the transaction demand for money to<br />

the right.<br />

i<br />

D t<br />

M<br />

Figure 7.1 Transaction demand for money. Vertical curve of transaction demand for money reflect its<br />

independence on interest rates. It shifts with changes in nominal GDP.