MacroeconomicsI_working_version (1)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

112<br />

Chapter 12<br />

P<br />

AD’<br />

AD<br />

AS<br />

Q*<br />

Q<br />

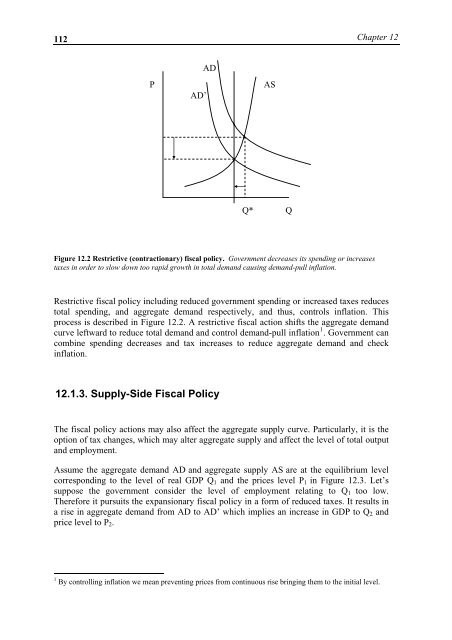

Figure 12.2 Restrictive (contractionary) fiscal policy. Government decreases its spending or increases<br />

taxes in order to slow down too rapid growth in total demand causing demand-pull inflation.<br />

Restrictive fiscal policy including reduced government spending or increased taxes reduces<br />

total spending, and aggregate demand respectively, and thus, controls inflation. This<br />

process is described in Figure 12.2. A restrictive fiscal action shifts the aggregate demand<br />

curve leftward to reduce total demand and control demand-pull inflation 1 . Government can<br />

combine spending decreases and tax increases to reduce aggregate demand and check<br />

inflation.<br />

12.1.3. Supply-Side Fiscal Policy<br />

The fiscal policy actions may also affect the aggregate supply curve. Particularly, it is the<br />

option of tax changes, which may alter aggregate supply and affect the level of total output<br />

and employment.<br />

Assume the aggregate demand AD and aggregate supply AS are at the equilibrium level<br />

corresponding to the level of real GDP Q 1 and the prices level P 1 in Figure 12.3. Let’s<br />

suppose the government consider the level of employment relating to Q 1 too low.<br />

Therefore it pursuits the expansionary fiscal policy in a form of reduced taxes. It results in<br />

a rise in aggregate demand from AD to AD’ which implies an increase in GDP to Q 2 and<br />

price level to P 2 .<br />

1 By controlling inflation we mean preventing prices from continuous rise bringing them to the initial level.