MacroeconomicsI_working_version (1)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

68<br />

Chapter 7<br />

Original Deposit = $1,000<br />

Firstbank Lending = (1 – rr) x $1,000<br />

Secondbank Lending = (1 – rr) 2 x $1,000<br />

Thirdbank Lending = (1 – rr) 3 x $1,000<br />

. .<br />

. .<br />

. .<br />

Total Money Supply = [1 + (1 – rr) + (1 – rr) 2 + (1 – rr) 3 + …1 x $1,000 = (1 / rr) x $1,000<br />

Accordingly, each rise in reserves by $1 generates $ (1 / rr) of created money. In our<br />

example, rr = 0,2, so the original $1,000 generates $5,000 of money 5 .<br />

7.6.2. Simplified Money Multiplier Formula<br />

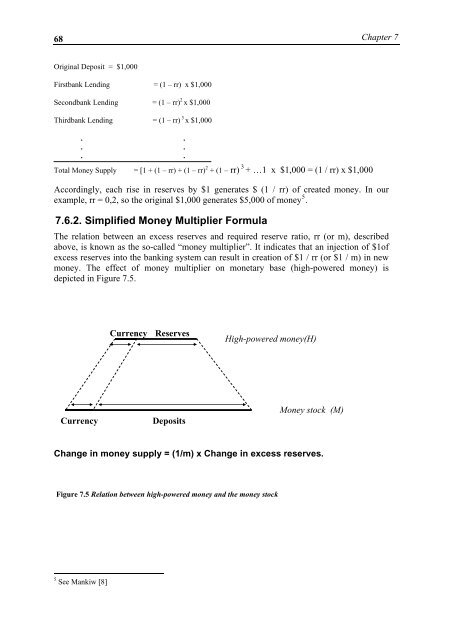

The relation between an excess reserves and required reserve ratio, rr (or m), described<br />

above, is known as the so-called “money multiplier”. It indicates that an injection of $1of<br />

excess reserves into the banking system can result in creation of $1 / rr (or $1 / m) in new<br />

money. The effect of money multiplier on monetary base (high-powered money) is<br />

depicted in Figure 7.5.<br />

Currency Reserves<br />

High-powered money(H)<br />

Currency<br />

Deposits<br />

Money stock (M)<br />

Change in money supply = (1/m) x Change in excess reserves.<br />

Figure 7.5 Relation between high-powered money and the money stock<br />

5 See Mankiw [8]