OFR_2016_Financial-Stability-Report

OFR_2016_Financial-Stability-Report

OFR_2016_Financial-Stability-Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

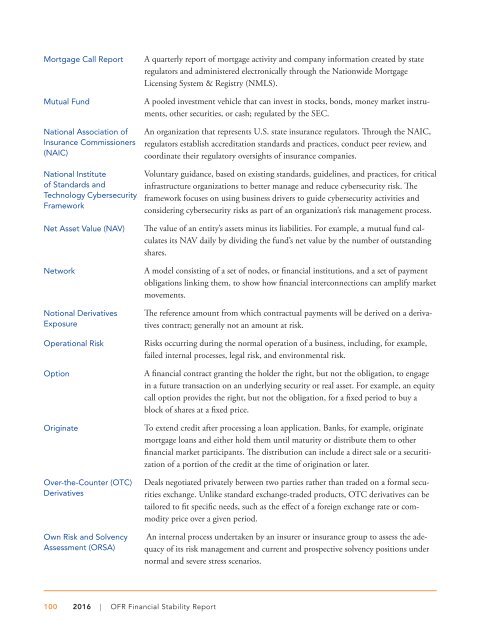

Mortgage Call <strong>Report</strong><br />

Mutual Fund<br />

National Association of<br />

Insurance Commissioners<br />

(NAIC)<br />

National Institute<br />

of Standards and<br />

Technology Cybersecurity<br />

Framework<br />

Net Asset Value (NAV)<br />

Network<br />

Notional Derivatives<br />

Exposure<br />

Operational Risk<br />

Option<br />

Originate<br />

Over-the-Counter (OTC)<br />

Derivatives<br />

Own Risk and Solvency<br />

Assessment (ORSA)<br />

A quarterly report of mortgage activity and company information created by state<br />

regulators and administered electronically through the Nationwide Mortgage<br />

Licensing System & Registry (NMLS).<br />

A pooled investment vehicle that can invest in stocks, bonds, money market instruments,<br />

other securities, or cash; regulated by the SEC.<br />

An organization that represents U.S. state insurance regulators. Through the NAIC,<br />

regulators establish accreditation standards and practices, conduct peer review, and<br />

coordinate their regulatory oversights of insurance companies.<br />

Voluntary guidance, based on existing standards, guidelines, and practices, for critical<br />

infrastructure organizations to better manage and reduce cybersecurity risk. The<br />

framework focuses on using business drivers to guide cybersecurity activities and<br />

considering cybersecurity risks as part of an organization’s risk management process.<br />

The value of an entity’s assets minus its liabilities. For example, a mutual fund calculates<br />

its NAV daily by dividing the fund’s net value by the number of outstanding<br />

shares.<br />

A model consisting of a set of nodes, or financial institutions, and a set of payment<br />

obligations linking them, to show how financial interconnections can amplify market<br />

movements.<br />

The reference amount from which contractual payments will be derived on a derivatives<br />

contract; generally not an amount at risk.<br />

Risks occurring during the normal operation of a business, including, for example,<br />

failed internal processes, legal risk, and environmental risk.<br />

A financial contract granting the holder the right, but not the obligation, to engage<br />

in a future transaction on an underlying security or real asset. For example, an equity<br />

call option provides the right, but not the obligation, for a fixed period to buy a<br />

block of shares at a fixed price.<br />

To extend credit after processing a loan application. Banks, for example, originate<br />

mortgage loans and either hold them until maturity or distribute them to other<br />

financial market participants. The distribution can include a direct sale or a securitization<br />

of a portion of the credit at the time of origination or later.<br />

Deals negotiated privately between two parties rather than traded on a formal securities<br />

exchange. Unlike standard exchange-traded products, OTC derivatives can be<br />

tailored to fit specific needs, such as the effect of a foreign exchange rate or commodity<br />

price over a given period.<br />

An internal process undertaken by an insurer or insurance group to assess the adequacy<br />

of its risk management and current and prospective solvency positions under<br />

normal and severe stress scenarios.<br />

100 <strong>2016</strong> | <strong>OFR</strong> <strong>Financial</strong> <strong>Stability</strong> <strong>Report</strong>