OFR_2016_Financial-Stability-Report

OFR_2016_Financial-Stability-Report

OFR_2016_Financial-Stability-Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

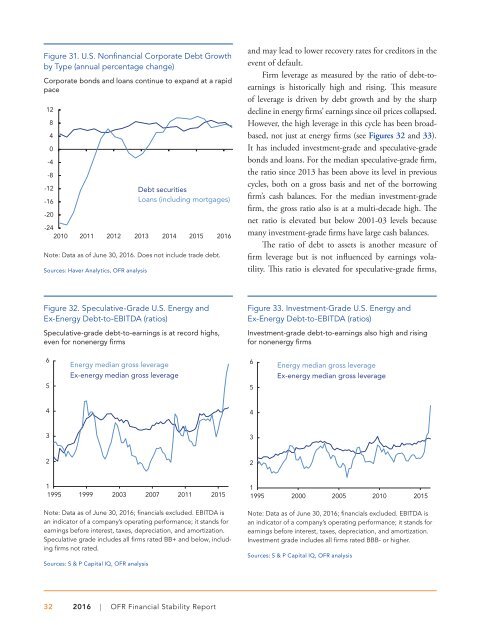

Figure 31. U.S. Nonfinancial Corporate Debt Growth<br />

by Type (annual percentage change)<br />

Corporate bonds and loans continue to expand at a rapid<br />

pace<br />

12<br />

8<br />

4<br />

0<br />

-4<br />

-8<br />

-12<br />

-16<br />

-20<br />

Debt securities<br />

Loans (including mortgages)<br />

-24<br />

2010 2011 2012 2013 2014 2015 <strong>2016</strong><br />

Note: Data as of June 30, <strong>2016</strong>. Does not include trade debt.<br />

Sources: Haver Analytics, <strong>OFR</strong> analysis<br />

and may lead to lower recovery rates for creditors in the<br />

event of default.<br />

Firm leverage as measured by the ratio of debt-toearnings<br />

is historically high and rising. This measure<br />

of leverage is driven by debt growth and by the sharp<br />

decline in energy firms’ earnings since oil prices collapsed.<br />

However, the high leverage in this cycle has been broadbased,<br />

not just at energy firms (see Figures 32 and 33).<br />

It has included investment-grade and speculative-grade<br />

bonds and loans. For the median speculative-grade firm,<br />

the ratio since 2013 has been above its level in previous<br />

cycles, both on a gross basis and net of the borrowing<br />

firm’s cash balances. For the median investment-grade<br />

firm, the gross ratio also is at a multi-decade high. The<br />

net ratio is elevated but below 2001-03 levels because<br />

many investment-grade firms have large cash balances.<br />

The ratio of debt to assets is another measure of<br />

firm leverage but is not influenced by earnings volatility.<br />

This ratio is elevated for speculative-grade firms,<br />

Figure 32. Speculative-Grade U.S. Energy and<br />

Ex-Energy Debt-to-EBITDA (ratios)<br />

Speculative-grade debt-to-earnings is at record highs,<br />

even for nonenergy firms<br />

Figure 33. Investment-Grade U.S. Energy and<br />

Ex-Energy Debt-to-EBITDA (ratios)<br />

Investment-grade debt-to-earnings also high and rising<br />

for nonenergy firms<br />

6<br />

5<br />

Energy median gross leverage<br />

Ex-energy median gross leverage<br />

6<br />

5<br />

Energy median gross leverage<br />

Ex-energy median gross leverage<br />

4<br />

4<br />

3<br />

3<br />

2<br />

2<br />

1<br />

1995 1999 2003 2007 2011 2015<br />

Note: Data as of June 30, <strong>2016</strong>; financials excluded. EBITDA is<br />

an indicator of a company’s operating performance; it stands for<br />

earnings before interest, taxes, depreciation, and amortization.<br />

Speculative grade includes all firms rated BB+ and below, including<br />

firms not rated.<br />

Sources: S & P Capital IQ, <strong>OFR</strong> analysis<br />

1<br />

1995 2000 2005 2010 2015<br />

Note: Data as of June 30, <strong>2016</strong>; financials excluded. EBITDA is<br />

an indicator of a company’s operating performance; it stands for<br />

earnings before interest, taxes, depreciation, and amortization.<br />

Investment grade includes all firms rated BBB- or higher.<br />

Sources: S & P Capital IQ, <strong>OFR</strong> analysis<br />

32 <strong>2016</strong> | <strong>OFR</strong> <strong>Financial</strong> <strong>Stability</strong> <strong>Report</strong>