OFR_2016_Financial-Stability-Report

OFR_2016_Financial-Stability-Report

OFR_2016_Financial-Stability-Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

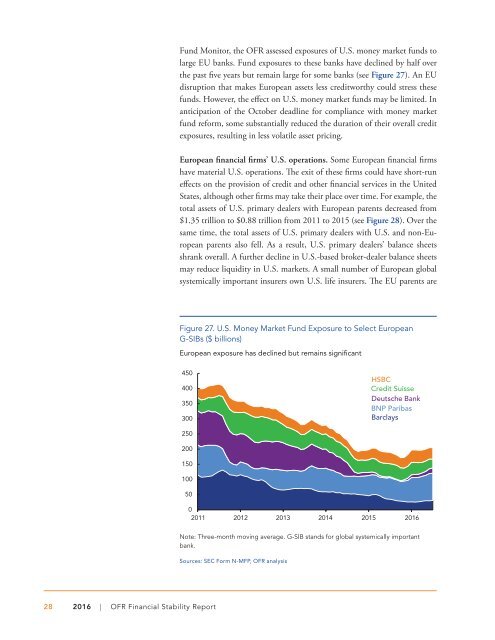

Fund Monitor, the <strong>OFR</strong> assessed exposures of U.S. money market funds to<br />

large EU banks. Fund exposures to these banks have declined by half over<br />

the past five years but remain large for some banks (see Figure 27). An EU<br />

disruption that makes European assets less creditworthy could stress these<br />

funds. However, the effect on U.S. money market funds may be limited. In<br />

anticipation of the October deadline for compliance with money market<br />

fund reform, some substantially reduced the duration of their overall credit<br />

exposures, resulting in less volatile asset pricing.<br />

European financial firms’ U.S. operations. Some European financial firms<br />

have material U.S. operations. The exit of these firms could have short-run<br />

effects on the provision of credit and other financial services in the United<br />

States, although other firms may take their place over time. For example, the<br />

total assets of U.S. primary dealers with European parents decreased from<br />

$1.35 trillion to $0.88 trillion from 2011 to 2015 (see Figure 28). Over the<br />

same time, the total assets of U.S. primary dealers with U.S. and non-European<br />

parents also fell. As a result, U.S. primary dealers’ balance sheets<br />

shrank overall. A further decline in U.S.-based broker-dealer balance sheets<br />

may reduce liquidity in U.S. markets. A small number of European global<br />

systemically important insurers own U.S. life insurers. The EU parents are<br />

Figure 27. U.S. Money Market Fund Exposure to Select European<br />

G-SIBs ($ billions)<br />

European exposure has declined but remains significant<br />

450<br />

400<br />

350<br />

300<br />

HSBC<br />

Credit Suisse<br />

Deutsche Bank<br />

BNP Paribas<br />

Barclays<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

2011 2012 2013 2014 2015 <strong>2016</strong><br />

Note: Three-month moving average. G-SIB stands for global systemically important<br />

bank.<br />

Sources: SEC Form N-MFP, <strong>OFR</strong> analysis<br />

28 <strong>2016</strong> | <strong>OFR</strong> <strong>Financial</strong> <strong>Stability</strong> <strong>Report</strong>