OFR_2016_Financial-Stability-Report

OFR_2016_Financial-Stability-Report

OFR_2016_Financial-Stability-Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

exposure consistently is associated with an increase in systemic<br />

risk indicators and in realized equity volatility.<br />

Consolidated assets are also correlated with an increase<br />

in insurers’ systemic risk as measured by DIP. By contrast,<br />

a decrease in portfolio yield, non-insurance liabilities<br />

(a proxy for non-insurance businesses), and securities<br />

lending are correlated with an increase in realized equity<br />

volatility for U.S. insurers. The effect on portfolio yield is<br />

suggestive of risks due to low long-term interest rates<br />

and consistent with some other research suggesting low<br />

interest rates may pose a risk to the U.S. life insurance<br />

industry (see Hartley, Paulson, and Rosen, <strong>2016</strong>).<br />

There was no apparent positive correlation between systemic<br />

risk metrics and securities lending and non-insurance<br />

liabilities. However, due to lack of data, this analysis<br />

does not capture AIG’s activities during the crisis. These<br />

results may suggest that equity markets reward insurers<br />

for these nontraditional activities. These activities can<br />

increase and diversify an insurer’s profits and strengthen<br />

its capital, but they may pose risks if done to excess, as the<br />

example of AIG illustrates.<br />

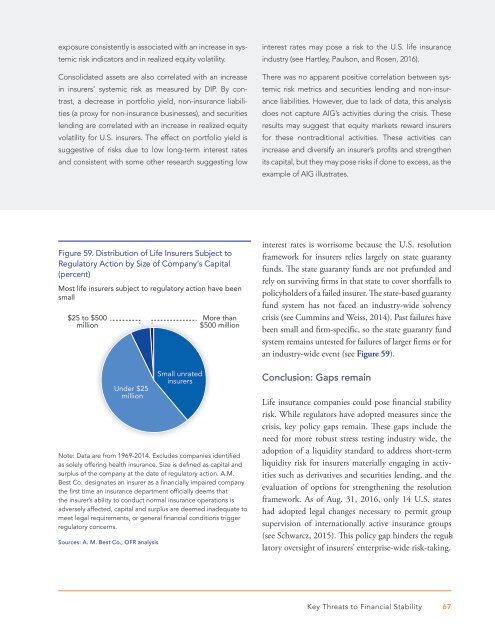

Figure 59. Distribution of Life Insurers Subject to<br />

Regulatory Action by Size of Company’s Capital<br />

(percent)<br />

Most life insurers subject to regulatory action have been<br />

small<br />

$25 to $500<br />

million<br />

Under $25<br />

million<br />

Small unrated<br />

insurers<br />

More than<br />

$500 million<br />

Note: Data are from 1969-2014. Excludes companies identified<br />

as solely offering health insurance. Size is defined as capital and<br />

surplus of the company at the date of regulatory action. A.M.<br />

Best Co. designates an insurer as a financially impaired company<br />

the first time an insurance department officially deems that<br />

the insurer’s ability to conduct normal insurance operations is<br />

adversely affected, capital and surplus are deemed inadequate to<br />

meet legal requirements, or general financial conditions trigger<br />

regulatory concerns.<br />

Sources: A. M. Best Co., <strong>OFR</strong> analysis<br />

interest rates is worrisome because the U.S. resolution<br />

framework for insurers relies largely on state guaranty<br />

funds. The state guaranty funds are not prefunded and<br />

rely on surviving firms in that state to cover shortfalls to<br />

policyholders of a failed insurer. The state-based guaranty<br />

fund system has not faced an industry-wide solvency<br />

crisis (see Cummins and Weiss, 2014). Past failures have<br />

been small and firm-specific, so the state guaranty fund<br />

system remains untested for failures of larger firms or for<br />

an industry-wide event (see Figure 59).<br />

Conclusion: Gaps remain<br />

Life insurance companies could pose financial stability<br />

risk. While regulators have adopted measures since the<br />

crisis, key policy gaps remain. These gaps include the<br />

need for more robust stress testing industry wide, the<br />

adoption of a liquidity standard to address short-term<br />

liquidity risk for insurers materially engaging in activities<br />

such as derivatives and securities lending, and the<br />

evaluation of options for strengthening the resolution<br />

framework. As of Aug. 31, <strong>2016</strong>, only 14 U.S. states<br />

had adopted legal changes necessary to permit group<br />

supervision of internationally active insurance groups<br />

(see Schwarcz, 2015). This policy gap hinders the reguhlatory<br />

oversight of insurers’ enterprise-wide risk-taking.<br />

Key Threats to <strong>Financial</strong> <strong>Stability</strong> 67