OFR_2016_Financial-Stability-Report

OFR_2016_Financial-Stability-Report

OFR_2016_Financial-Stability-Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Figure 55. Life Insurance Securities Lending Activity<br />

($ billions) and Insurer Participation (number of<br />

insurers)<br />

More insurers are participating in securities lending<br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

Insurers engaged in securities lending (left axis)<br />

Securities lending activity (right axis)<br />

2010 2011 2012 2013 2014 2015<br />

Sources: SNL <strong>Financial</strong> LC, <strong>OFR</strong> analysis<br />

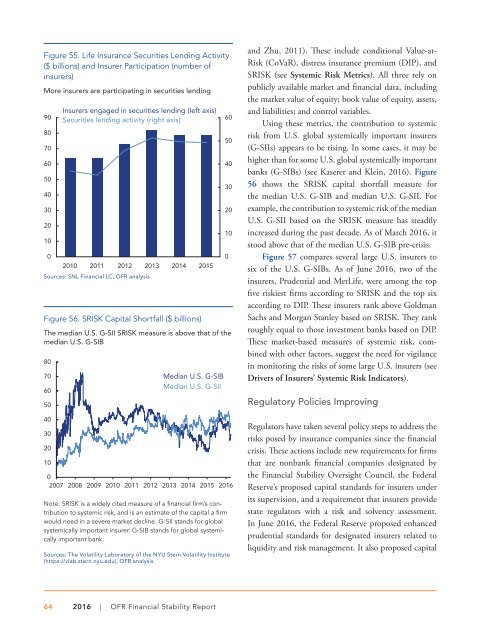

Figure 56. SRISK Capital Shortfall ($ billions)<br />

The median U.S. G-SII SRISK measure is above that of the<br />

median U.S. G-SIB<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

Median U.S. G-SIB<br />

Median U.S. G-SII<br />

0<br />

2007 2008 2009 2010 2011 2012 2013 2014 2015 <strong>2016</strong><br />

Note: SRISK is a widely cited measure of a financial firm’s contribution<br />

to systemic risk, and is an estimate of the capital a firm<br />

would need in a severe market decline. G-SII stands for global<br />

systemically important insurer. G-SIB stands for global systemically<br />

important bank.<br />

Sources: The Volatility Laboratory of the NYU Stern Volatility Institute<br />

(https://vlab.stern.nyu.edu), <strong>OFR</strong> analysis<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

and Zhu, 2011). These include conditional Value-at-<br />

Risk (CoVaR), distress insurance premium (DIP), and<br />

SRISK (see Systemic Risk Metrics). All three rely on<br />

publicly available market and financial data, including<br />

the market value of equity; book value of equity, assets,<br />

and liabilities; and control variables.<br />

Using these metrics, the contribution to systemic<br />

risk from U.S. global systemically important insurers<br />

(G-SIIs) appears to be rising. In some cases, it may be<br />

higher than for some U.S. global systemically important<br />

banks (G-SIBs) (see Kaserer and Klein, <strong>2016</strong>). Figure<br />

56 shows the SRISK capital shortfall measure for<br />

the median U.S. G-SIB and median U.S. G-SII. For<br />

example, the contribution to systemic risk of the median<br />

U.S. G-SII based on the SRISK measure has steadily<br />

increased during the past decade. As of March <strong>2016</strong>, it<br />

stood above that of the median U.S. G-SIB pre-crisis.<br />

Figure 57 compares several large U.S. insurers to<br />

six of the U.S. G-SIBs. As of June <strong>2016</strong>, two of the<br />

insurers, Prudential and MetLife, were among the top<br />

five riskiest firms according to SRISK and the top six<br />

according to DIP. These insurers rank above Goldman<br />

Sachs and Morgan Stanley based on SRISK. They rank<br />

roughly equal to those investment banks based on DIP.<br />

These market-based measures of systemic risk, combined<br />

with other factors, suggest the need for vigilance<br />

in monitoring the risks of some large U.S. insurers (see<br />

Drivers of Insurers’ Systemic Risk Indicators).<br />

Regulatory Policies Improving<br />

Regulators have taken several policy steps to address the<br />

risks posed by insurance companies since the financial<br />

crisis. These actions include new requirements for firms<br />

that are nonbank financial companies designated by<br />

the <strong>Financial</strong> <strong>Stability</strong> Oversight Council, the Federal<br />

Reserve’s proposed capital standards for insurers under<br />

its supervision, and a requirement that insurers provide<br />

state regulators with a risk and solvency assessment.<br />

In June <strong>2016</strong>, the Federal Reserve proposed enhanced<br />

prudential standards for designated insurers related to<br />

liquidity and risk management. It also proposed capital<br />

64 <strong>2016</strong> | <strong>OFR</strong> <strong>Financial</strong> <strong>Stability</strong> <strong>Report</strong>