OFR_2016_Financial-Stability-Report

OFR_2016_Financial-Stability-Report

OFR_2016_Financial-Stability-Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

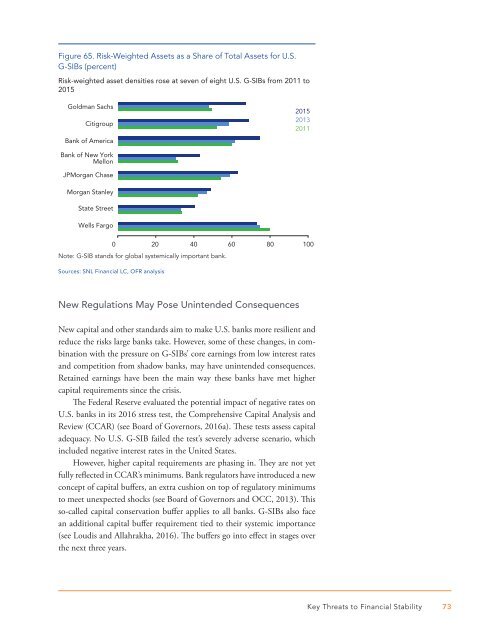

Figure 65. Risk-Weighted Assets as a Share of Total Assets for U.S.<br />

G-SIBs (percent)<br />

Risk-weighted asset densities rose at seven of eight U.S. G-SIBs from 2011 to<br />

2015<br />

Goldman Sachs<br />

Citigroup<br />

Bank of America<br />

2015<br />

2013<br />

2011<br />

Bank of New York<br />

Mellon<br />

JPMorgan Chase<br />

Morgan Stanley<br />

State Street<br />

Wells Fargo<br />

0 20 40 60 80 100<br />

Note: G-SIB stands for global systemically important bank.<br />

Sources: SNL <strong>Financial</strong> LC, <strong>OFR</strong> analysis<br />

New Regulations May Pose Unintended Consequences<br />

New capital and other standards aim to make U.S. banks more resilient and<br />

reduce the risks large banks take. However, some of these changes, in combination<br />

with the pressure on G-SIBs’ core earnings from low interest rates<br />

and competition from shadow banks, may have unintended consequences.<br />

Retained earnings have been the main way these banks have met higher<br />

capital requirements since the crisis.<br />

The Federal Reserve evaluated the potential impact of negative rates on<br />

U.S. banks in its <strong>2016</strong> stress test, the Comprehensive Capital Analysis and<br />

Review (CCAR) (see Board of Governors, <strong>2016</strong>a). These tests assess capital<br />

adequacy. No U.S. G-SIB failed the test’s severely adverse scenario, which<br />

included negative interest rates in the United States.<br />

However, higher capital requirements are phasing in. They are not yet<br />

fully reflected in CCAR’s minimums. Bank regulators have introduced a new<br />

concept of capital buffers, an extra cushion on top of regulatory minimums<br />

to meet unexpected shocks (see Board of Governors and OCC, 2013). This<br />

so-called capital conservation buffer applies to all banks. G-SIBs also face<br />

an additional capital buffer requirement tied to their systemic importance<br />

(see Loudis and Allahrakha, <strong>2016</strong>). The buffers go into effect in stages over<br />

the next three years.<br />

Key Threats to <strong>Financial</strong> <strong>Stability</strong> 73