OFR_2016_Financial-Stability-Report

OFR_2016_Financial-Stability-Report

OFR_2016_Financial-Stability-Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

and contracts would be crucial. The QFC 24-hour rule could become a<br />

natural framework for regulatory fire drills to test data management readiness.<br />

Firms subject to the new rules will be required to report their LEIs.<br />

Otherwise, given the volume and variety of data, rapid resolution could<br />

falter because of untested processes and insufficient data standards. Still, as<br />

of mid-<strong>2016</strong>, the Federal Deposit Insurance Corporation does not require<br />

firms to use the LEI.<br />

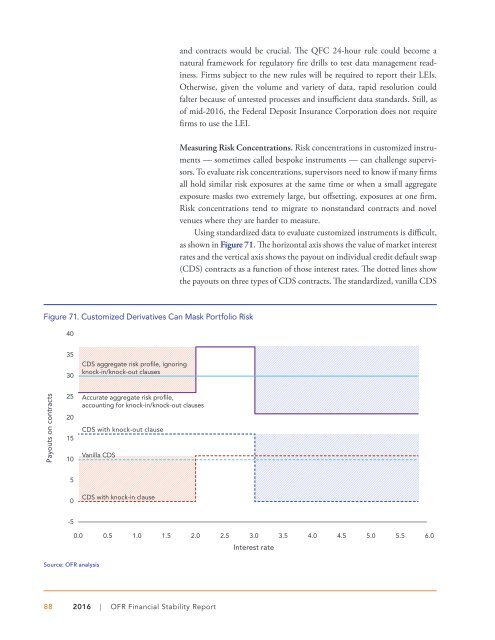

Measuring Risk Concentrations. Risk concentrations in customized instruments<br />

— sometimes called bespoke instruments — can challenge supervisors.<br />

To evaluate risk concentrations, supervisors need to know if many firms<br />

all hold similar risk exposures at the same time or when a small aggregate<br />

exposure masks two extremely large, but offsetting, exposures at one firm.<br />

Risk concentrations tend to migrate to nonstandard contracts and novel<br />

venues where they are harder to measure.<br />

Using standardized data to evaluate customized instruments is difficult,<br />

as shown in Figure 71. The horizontal axis shows the value of market interest<br />

rates and the vertical axis shows the payout on individual credit default swap<br />

(CDS) contracts as a function of those interest rates. The dotted lines show<br />

the payouts on three types of CDS contracts. The standardized, vanilla CDS<br />

Figure 71. Customized Derivatives Can Mask Portfolio Risk<br />

40<br />

35<br />

30<br />

CDS aggregate risk profile, ignoring<br />

knock-in/knock-out clauses<br />

Payouts on contracts<br />

25<br />

20<br />

15<br />

10<br />

Accurate aggregate risk profile,<br />

accounting for knock-in/knock-out clauses<br />

CDS with knock-out clause<br />

Vanilla CDS<br />

5<br />

0<br />

CDS with knock-in clause<br />

-5<br />

Source: <strong>OFR</strong> analysis<br />

0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 4.5 5.0 5.5 6.0<br />

Interest rate<br />

88 <strong>2016</strong> | <strong>OFR</strong> <strong>Financial</strong> <strong>Stability</strong> <strong>Report</strong>