stock repurchase announcements: a test of market ... - Asbbs.org

stock repurchase announcements: a test of market ... - Asbbs.org

stock repurchase announcements: a test of market ... - Asbbs.org

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Kinsler and Bacon<br />

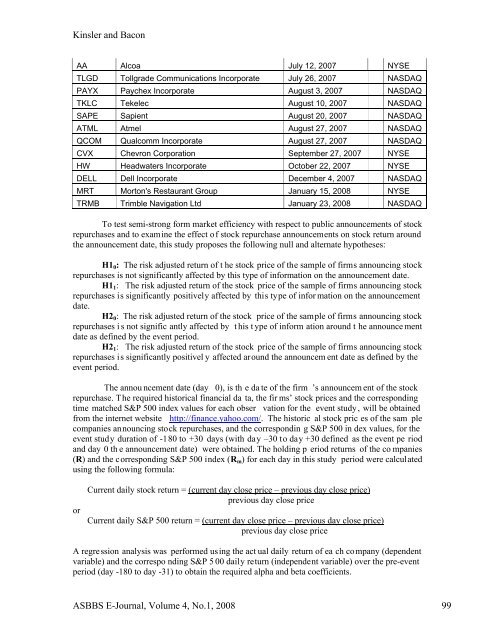

AA Alcoa July 12, 2007 NYSE<br />

TLGD Tollgrade Communications Incorporate July 26, 2007 NASDAQ<br />

PAYX Paychex Incorporate August 3, 2007 NASDAQ<br />

TKLC Tekelec August 10, 2007 NASDAQ<br />

SAPE Sapient August 20, 2007 NASDAQ<br />

ATML Atmel August 27, 2007 NASDAQ<br />

QCOM Qualcomm Incorporate August 27, 2007 NASDAQ<br />

CVX Chevron Corporation September 27, 2007 NYSE<br />

HW Headwaters Incorporate October 22, 2007 NYSE<br />

DELL Dell Incorporate December 4, 2007 NASDAQ<br />

MRT Morton's Restaurant Group January 15, 2008 NYSE<br />

TRMB Trimble Navigation Ltd January 23, 2008 NASDAQ<br />

To <strong>test</strong> semi-strong form <strong>market</strong> efficiency with respect to public <strong>announcements</strong> <strong>of</strong> <strong>stock</strong><br />

<strong>repurchase</strong>s and to examine the effect <strong>of</strong> <strong>stock</strong> <strong>repurchase</strong> <strong>announcements</strong> on <strong>stock</strong> return around<br />

the announcement date, this study proposes the following null and alternate hypotheses:<br />

H10: The risk adjusted return <strong>of</strong> t he <strong>stock</strong> price <strong>of</strong> the sample <strong>of</strong> firms announcing <strong>stock</strong><br />

<strong>repurchase</strong>s is not significantly affected by this type <strong>of</strong> information on the announcement date.<br />

H11: The risk adjusted return <strong>of</strong> the <strong>stock</strong> price <strong>of</strong> the sample <strong>of</strong> firms announcing <strong>stock</strong><br />

<strong>repurchase</strong>s is significantly positively affected by this type <strong>of</strong> infor mation on the announcement<br />

date.<br />

H20: The risk adjusted return <strong>of</strong> the <strong>stock</strong> price <strong>of</strong> the sample <strong>of</strong> firms announcing <strong>stock</strong><br />

<strong>repurchase</strong>s i s not signific antly affected by t his t ype <strong>of</strong> inform ation around t he announce ment<br />

date as defined by the event period.<br />

H21: The risk adjusted return <strong>of</strong> the <strong>stock</strong> price <strong>of</strong> the sample <strong>of</strong> firms announcing <strong>stock</strong><br />

<strong>repurchase</strong>s is significantly positivel y affected around the announcem ent date as defined by the<br />

event period.<br />

The annou ncement date (day 0), is th e da te <strong>of</strong> the firm ’s announcem ent <strong>of</strong> the <strong>stock</strong><br />

<strong>repurchase</strong>. The required historical financial da ta, the fir ms’ <strong>stock</strong> prices and the corresponding<br />

time matched S&P 500 index values for each obser vation for the event study, will be obtained<br />

from the internet website http://finance.yahoo.com/. The historic al <strong>stock</strong> pric es <strong>of</strong> the sam ple<br />

companies announcing <strong>stock</strong> <strong>repurchase</strong>s, and the correspondin g S&P 500 in dex values, for the<br />

event study duration <strong>of</strong> -180 to +30 days (with day –30 to day +30 defined as the event pe riod<br />

and day 0 th e announcement date) were obtained. The holding p eriod returns <strong>of</strong> the co mpanies<br />

(R) and the corresponding S&P 500 index (Rm) for each day in this study period were calculated<br />

using the following formula:<br />

or<br />

Current daily <strong>stock</strong> return = (current day close price – previous day close price)<br />

previous day close price<br />

Current daily S&P 500 return = (current day close price – previous day close price)<br />

previous day close price<br />

A regression analysis was performed using the act ual daily return <strong>of</strong> ea ch company (dependent<br />

variable) and the correspo nding S&P 5 00 daily return (independent variable) over the pre-event<br />

period (day -180 to day -31) to obtain the required alpha and beta coefficients.<br />

ASBBS E-Journal, Volume 4, No.1, 2008 99