stock repurchase announcements: a test of market ... - Asbbs.org

stock repurchase announcements: a test of market ... - Asbbs.org

stock repurchase announcements: a test of market ... - Asbbs.org

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

McGrath<br />

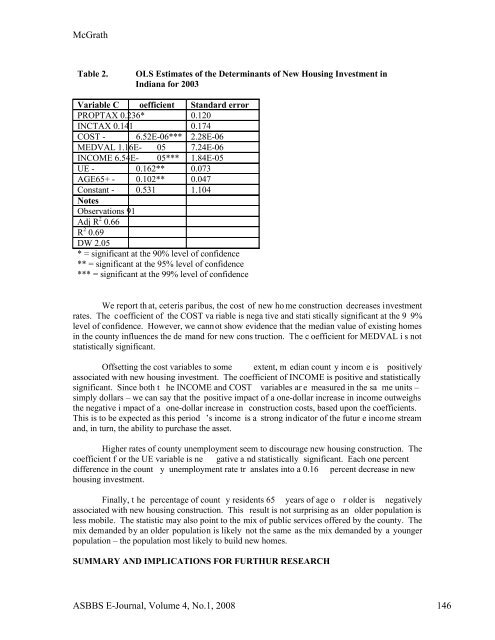

Table 2. OLS Estimates <strong>of</strong> the Determinants <strong>of</strong> New Housing Investment in<br />

Indiana for 2003<br />

Variable C oefficient Standard error<br />

PROPTAX 0.236* 0.120<br />

INCTAX 0.141 0.174<br />

COST - 6.52E-06*** 2.28E-06<br />

MEDVAL 1.16E- 05 7.24E-06<br />

INCOME 6.54E- 05*** 1.84E-05<br />

UE - 0.162** 0.073<br />

AGE65+ - 0.102** 0.047<br />

Constant - 0.531 1.104<br />

Notes<br />

Observations 91<br />

Adj R 2 0.66<br />

R 2 0.69<br />

DW 2.05<br />

* = significant at the 90% level <strong>of</strong> confidence<br />

** = significant at the 95% level <strong>of</strong> confidence<br />

*** = significant at the 99% level <strong>of</strong> confidence<br />

We report th at, ceteris paribus, the cost <strong>of</strong> new ho me construction decreases investment<br />

rates. The coefficient <strong>of</strong> the COST va riable is nega tive and stati stically significant at the 9 9%<br />

level <strong>of</strong> confidence. However, we cannot show evidence that the median value <strong>of</strong> existing homes<br />

in the county influences the de mand for new cons truction. The c oefficient for MEDVAL i s not<br />

statistically significant.<br />

Offsetting the cost variables to some extent, m edian count y incom e is positively<br />

associated with new housing investment. The coefficient <strong>of</strong> INCOME is positive and statistically<br />

significant. Since both t he INCOME and COST variables ar e measured in the sa me units –<br />

simply dollars – we can say that the positive impact <strong>of</strong> a one-dollar increase in income outweighs<br />

the negative i mpact <strong>of</strong> a one-dollar increase in construction costs, based upon the coefficients.<br />

This is to be expected as this period ’s income is a strong indicator <strong>of</strong> the futur e income stream<br />

and, in turn, the ability to purchase the asset.<br />

Higher rates <strong>of</strong> county unemployment seem to discourage new housing construction. The<br />

coefficient f or the UE variable is ne gative a nd statistically significant. Each one percent<br />

difference in the count y unemployment rate tr anslates into a 0.16 percent decrease in new<br />

housing investment.<br />

Finally, t he percentage <strong>of</strong> count y residents 65 years <strong>of</strong> age o r older is negatively<br />

associated with new housing construction. This result is not surprising as an older population is<br />

less mobile. The statistic may also point to the mix <strong>of</strong> public services <strong>of</strong>fered by the county. The<br />

mix demanded by an older population is likely not the same as the mix demanded by a younger<br />

population – the population most likely to build new homes.<br />

SUMMARY AND IMPLICATIONS FOR FURTHUR RESEARCH<br />

ASBBS E-Journal, Volume 4, No.1, 2008 146