- Page 1 and 2:

ASBBS eJournal Volume 4, No.1, 2008

- Page 3 and 4:

THE SUPREME COURT GRANTS CERTIORARI

- Page 5 and 6:

Deductibility of investment fees…

- Page 7 and 8:

Deductibility of investment fees…

- Page 9 and 10:

Deductibility of investment fees…

- Page 11 and 12:

Deductibility of investment fees…

- Page 13 and 14:

Mellon Bank, N.A. v. United States,

- Page 15 and 16:

Browning Questions for consideratio

- Page 17 and 18:

Browning to fully realize each of t

- Page 19 and 20:

Browning email and document exchang

- Page 21 and 22:

Browning VirtualOfficeInternational

- Page 23 and 24:

Dhareshwar and Bacon poor earnings

- Page 25 and 26:

Dhareshwar and Bacon 10 11-Apr-07 G

- Page 27 and 28:

Dhareshwar and Bacon 28 20-Jul-07 C

- Page 29 and 30:

Dhareshwar and Bacon study as it is

- Page 31 and 32:

Dhareshwar and Bacon AER 0 -0.02 -0

- Page 33 and 34:

Dhareshwar and Bacon shows the exis

- Page 35 and 36:

Fekula and Hornyak of qualit y rese

- Page 37 and 38:

Fekula and Hornyak order of authors

- Page 39 and 40:

Fekula and Hornyak Cumulative % of

- Page 41 and 42:

Fekula and Hornyak 3 Figure 3 allow

- Page 43 and 44:

Fekula and Hornyak Alonso, C.J., Da

- Page 45 and 46:

Fekula and Hornyak WA St Louis 4.1

- Page 47 and 48:

Fekula and Hornyak VA Commonwealth

- Page 49 and 50:

Grady, Maniam and Leavell economic

- Page 51 and 52:

Grady, Maniam and Leavell my brothe

- Page 53 and 54: Grady, Maniam and Leavell Financial

- Page 55 and 56: Grady, Maniam and Leavell security

- Page 57 and 58: Grady, Maniam and Leavell Berghel,

- Page 59 and 60: Mining for Knowledge..Higher Ed sho

- Page 61 and 62: Mining for Knowledge..Higher Ed hea

- Page 63 and 64: Mining for Knowledge..Higher Ed Ano

- Page 65 and 66: Mining for Knowledge..Higher Ed Sol

- Page 67 and 68: Kehoe and Whitten of no trust betwe

- Page 69 and 70: Kehoe and Whitten economies. So why

- Page 71 and 72: Kehoe and Whitten your view, what i

- Page 73 and 74: Kehoe and Whitten system. Two facto

- Page 75 and 76: Kehoe and Whitten Soon-Yond, Hong (

- Page 77 and 78: King and Case Brigadier General or

- Page 79 and 80: King and Case The Morning Report Bo

- Page 81 and 82: King and Case Since soldiers were g

- Page 83 and 84: King and Case It is evident from th

- Page 85 and 86: King and Case example, officers who

- Page 87 and 88: King and Case In an effort to contr

- Page 89 and 90: King and Case The first control act

- Page 91 and 92: King and Case APPENDIX - REPORT 1 A

- Page 93 and 94: King and Case APPENDIX - REPORT 3 A

- Page 95 and 96: King and Case APPENDIX - REPORT 5 A

- Page 97 and 98: Kinsler and Bacon The purpose of th

- Page 99 and 100: Kinsler and Bacon The study selects

- Page 101 and 102: Kinsler and Bacon AA Alcoa July 12,

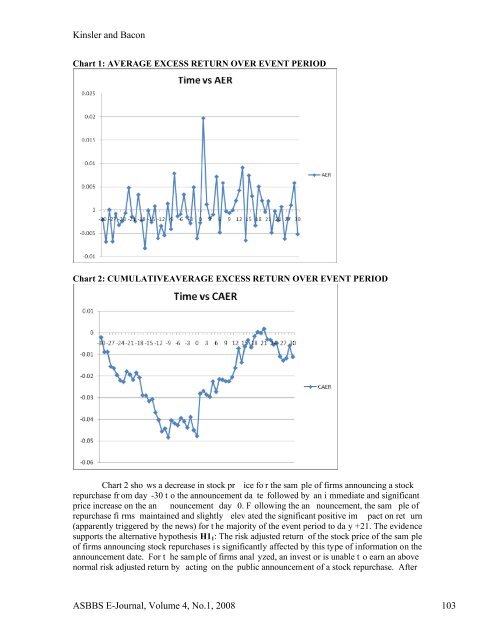

- Page 103: Kinsler and Bacon ELON -0.00155802

- Page 107 and 108: Kinsler and Bacon Marks, Kenneth R.

- Page 109 and 110: Koyame-Marsh with Angola and Congo

- Page 111 and 112: Koyame-Marsh in the 1980s while the

- Page 113 and 114: Koyame-Marsh Table B1. Congo’s Ke

- Page 115 and 116: Koyame-Marsh UNITA’s war against

- Page 117 and 118: Koyame-Marsh Given the fact that fo

- Page 119 and 120: Koyame-Marsh Box 2. Selected Socio-

- Page 121 and 122: Koyame-Marsh CONCLUSION The paper a

- Page 123 and 124: Koyame-Marsh Nations Homepage, 12 A

- Page 125 and 126: MacArthur, Houmes and Stranahan vol

- Page 127 and 128: MacArthur, Houmes and Stranahan OLi

- Page 129 and 130: MacArthur, Houmes and Stranahan Kei

- Page 131 and 132: Lavin was in prior years. When I go

- Page 133 and 134: THE SPIRITUAL DIMENSION OF QUALITY:

- Page 135 and 136: Spiritual Dimension ..Biblical Pers

- Page 137 and 138: Spiritual Dimension ..Biblical Pers

- Page 139 and 140: Spiritual Dimension ..Biblical Pers

- Page 141 and 142: Spiritual Dimension ..Biblical Pers

- Page 143 and 144: HOUSING INVESTMENT AND PROPERTY TAX

- Page 145 and 146: Table 1. Summary Statistics of Soci

- Page 147 and 148: Property Taxes in Indiana new housi

- Page 149 and 150: Property Taxes in Indiana In 20 03

- Page 151 and 152: ABSTRACT Major trends in hotel gues

- Page 153 and 154: Hotel Guestroom Technology The impa

- Page 155 and 156:

Hotel Guestroom Technology ourselve

- Page 157 and 158:

Hotel Guestroom Technology booking

- Page 159 and 160:

Hotel Guestroom Technology Most peo

- Page 161 and 162:

Hotel Guestroom Technology Minibar

- Page 163 and 164:

AN HISTORICAL PERSPECTIVE OF ACCOUN

- Page 165 and 166:

Accounting for Income Taxes 1920-19

- Page 167 and 168:

Accounting for Income Taxes 1920-19

- Page 169 and 170:

Accounting for Income Taxes 1920-19

- Page 171 and 172:

Accounting for Income Taxes 1920-19

- Page 173 and 174:

SUSTAINABLE GROWTH MODELING: A LONG

- Page 175 and 176:

Growth …Analysis of Harley-Davids

- Page 177 and 178:

Growth …Analysis of Harley-Davids

- Page 179 and 180:

FIRM EXPANSION AND REGIONAL DEVELOP

- Page 181 and 182:

Importance of Geographic Space and

- Page 183 and 184:

Importance of Geographic Space and

- Page 185 and 186:

Importance of Geographic Space and

- Page 187 and 188:

Importance of Geographic Space and

- Page 189 and 190:

Importance of Geographic Space and

- Page 191 and 192:

Importance of Geographic Space and

- Page 193 and 194:

Importance of Geographic Space and

- Page 195 and 196:

Importance of Geographic Space and

- Page 197 and 198:

Importance of Geographic Space and

- Page 199 and 200:

INNOVATIVE HRM: HOW HR ACTIVITIES C

- Page 201 and 202:

Innovative HRM intention would be t

- Page 203 and 204:

strategy implementation best. It se

- Page 205 and 206:

Innovative HRM It must be noted tha

- Page 207 and 208:

approach to compensation does not o

- Page 209 and 210:

Allied Signal, Dupont, Honeywell, B

- Page 211 and 212:

Figure 5: General Schemata of BSC:

- Page 213 and 214:

Innovative HRM where open communica

- Page 215:

Zomorrodian, A (1999) “Learning O