stock repurchase announcements: a test of market ... - Asbbs.org

stock repurchase announcements: a test of market ... - Asbbs.org

stock repurchase announcements: a test of market ... - Asbbs.org

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Quarterly Earnings Announcements<br />

the event <strong>of</strong> inside information, and still does not make an above normal return, the <strong>market</strong> is<br />

strong form efficient.<br />

“Because information is reflected in prices immediately, investors should only expect to<br />

obtain a normal rate <strong>of</strong> return” (Ross, 342). However, does <strong>market</strong> efficiency hold for public<br />

<strong>announcements</strong> <strong>of</strong> quarterly earnings? Semi-strong form efficiency states that a company’s <strong>stock</strong><br />

price reflects all publicly available information, while strong form efficiency argues that the price<br />

is a reflection <strong>of</strong> all information, public and private. While efficient <strong>market</strong> theories have merit,<br />

this study confirms the existence <strong>of</strong> the post earnings announcement drift in the case <strong>of</strong> positive<br />

earnings surprise and negative earnings surprise <strong>stock</strong>s for at least 30 days after the earnings<br />

announcement. This study also confirms the information content <strong>of</strong> quarterly earnings<br />

announcement by establishing a correlation between observed change in <strong>market</strong> value <strong>of</strong> the<br />

company and the information about quarterly earnings.<br />

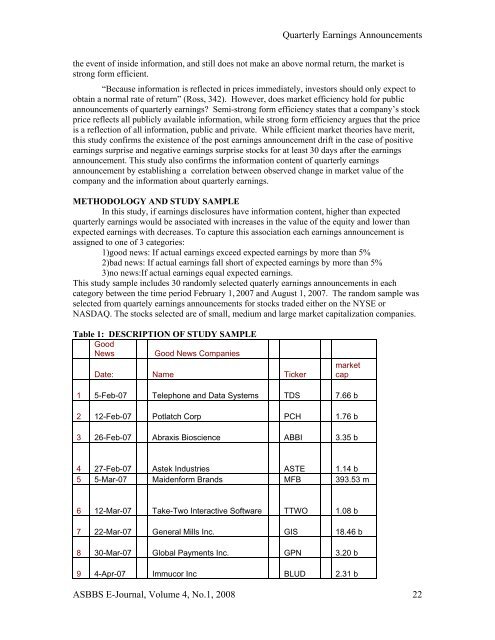

METHODOLOGY AND STUDY SAMPLE<br />

In this study, if earnings disclosures have information content, higher than expected<br />

quarterly earnings would be associated with increases in the value <strong>of</strong> the equity and lower than<br />

expected earnings with decreases. To capture this association each earnings announcement is<br />

assigned to one <strong>of</strong> 3 categories:<br />

1)good news: If actual earnings exceed expected earnings by more than 5%<br />

2)bad news: If actual earnings fall short <strong>of</strong> expected earnings by more than 5%<br />

3)no news:If actual earnings equal expected earnings.<br />

This study sample includes 30 randomly selected quaterly earnings <strong>announcements</strong> in each<br />

category between the time period February 1, 2007 and August 1, 2007. The random sample was<br />

selected from quartely earnings <strong>announcements</strong> for <strong>stock</strong>s traded either on the NYSE or<br />

NASDAQ. The <strong>stock</strong>s selected are <strong>of</strong> small, medium and large <strong>market</strong> capitalization companies.<br />

Table 1: DESCRIPTION OF STUDY SAMPLE<br />

Good<br />

News Good News Companies<br />

Date: Name Ticker<br />

<strong>market</strong><br />

cap<br />

1 5-Feb-07 Telephone and Data Systems TDS 7.66 b<br />

2 12-Feb-07 Potlatch Corp PCH 1.76 b<br />

3 26-Feb-07 Abraxis Bioscience ABBI 3.35 b<br />

4 27-Feb-07 Astek Industries ASTE 1.14 b<br />

5 5-Mar-07 Maidenform Brands MFB 393.53 m<br />

6 12-Mar-07 Take-Two Interactive S<strong>of</strong>tware TTWO 1.08 b<br />

7 22-Mar-07 General Mills Inc. GIS 18.46 b<br />

8 30-Mar-07 Global Payments Inc. GPN 3.20 b<br />

9 4-Apr-07 Immucor Inc BLUD 2.31 b<br />

ASBBS E-Journal, Volume 4, No.1, 2008 22