Global Compact International Yearbook Ausgabe 2013

The UN Global Compact is the world’s leading platform for corporate sustainability. In describing the future aims of the Global Compact, UN Secretary-General H.E. Ban Ki-moon says: “A growing number of business in all regions recognize the importance of reflecting environmental, social, and economic considerations in their operations and strategies. Now the challenge is to move from incremental process to transformation – in society and markets alike.” The new 2013 edition of the Global Compact International Yearbook offers proactive and in-depth information on key sustainability issues and focuses on recent developments of stakeholder management such as managing corporate legitimacy, for example. Concomitant to this is the call for a more holistic reporting of companies’ financial and nonfinancial performance, which is expressed in the idea of integrated reporting. Furthermore, this edition highlights the connection between the sustainable development of African societies and the ways of managing and governing their natural wealth. The newest developments concerning the move toward a low-carbon economy are shown in the chapter on climate change, which emphasizes the importance of reducing the output of greenhouse gases. Corresponding to the idea of mutual learning, the Global Compact International Yearbook includes 43 good practices of corporate participants that showcase different approaches to the implementation of the Ten Principles of the Global Compact. The Global Compact International Yearbook is a product of the macondo media group and United Nation Publications in cooperation with the Global Compact Office in support of the UN Global Compact and the global advancement of corporate sustainability. It contains 196 pages.

The UN Global Compact is the world’s leading platform for corporate sustainability. In describing the future aims of the Global Compact, UN Secretary-General H.E. Ban Ki-moon says: “A growing number of business in all regions recognize the importance of reflecting environmental, social, and economic considerations in their operations and strategies. Now the challenge is to move from incremental process to transformation – in society and markets alike.”

The new 2013 edition of the Global Compact International Yearbook offers proactive and in-depth information on key sustainability issues and focuses on recent developments of stakeholder management such as managing corporate legitimacy, for example. Concomitant to this is the call for a more holistic reporting of companies’ financial and nonfinancial performance, which is expressed in the idea of integrated reporting. Furthermore, this edition highlights the connection between the sustainable development of African societies and the ways of managing and governing their natural wealth. The newest developments concerning the move toward a low-carbon economy are shown in the chapter on climate change, which emphasizes the importance of reducing the output of greenhouse gases.

Corresponding to the idea of mutual learning, the Global Compact International Yearbook includes 43 good practices of corporate participants that showcase different approaches to the implementation of the Ten Principles of the Global Compact. The Global Compact International Yearbook is a product of the macondo media group and United Nation Publications in cooperation with the Global Compact Office in support of the UN Global Compact and the global advancement of corporate sustainability. It contains 196 pages.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Extending the business case debate<br />

One reason for the inconclusiveness of the business case debate<br />

can be ascribed to the lack of long-term considerations.<br />

To illustrate this in more detail, it is important to distinguish<br />

between three generic positions within this business case debate.<br />

First, there is the “only profits matter” argument: Rooted in<br />

neo-classical economic theory, this argument considers firms<br />

to be efficiency-driven anyway, and thus no special emphasis<br />

on managing ecological or social issues is needed. The managerial<br />

advice would be to incorporate sustainability only to<br />

the extent as it is covered by business as usual processes. Any<br />

further efforts to increase CSP unnecessarily constrain the<br />

firms’ actions through increased costs. Following this line of<br />

thought, management should only focus on maximizing profits<br />

and creating shareholder value. It is obvious that, under these<br />

assumptions, there is not much room for more sustainable business<br />

practices, especially to the extent that is urgently needed.<br />

Second, there is the short-term payoff argument: This argument<br />

is rooted in the assumption that, because of information asymmetries,<br />

companies may not always follow efficiency-driven<br />

goals and make optimal decisions. Based on this assumption,<br />

environmental-strategy research suggests green management<br />

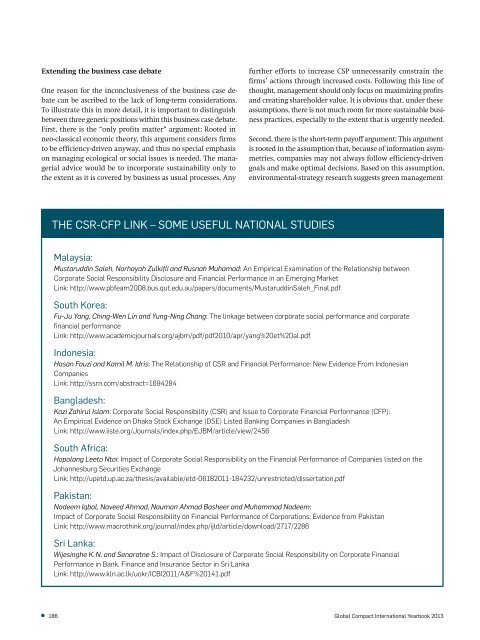

The CSR-CFP Link – Some Useful National Studies<br />

Malaysia:<br />

Mustaruddin Saleh, Norhayah Zulkifli and Rusnah Muhamad: An Empirical Examination of the Relationship between<br />

Corporate Social Responsibility Disclosure and Financial Performance in an Emerging Market<br />

Link: http://www.pbfeam2008.bus.qut.edu.au/papers/documents/MustaruddinSaleh_Final.pdf<br />

South Korea:<br />

Fu-Ju Yang, Ching-Wen Lin and Yung-Ning Chang: The linkage between corporate social performance and corporate<br />

financial performance<br />

Link: http://www.academicjournals.org/ajbm/pdf/pdf2010/apr/yang%20et%20al.pdf<br />

Indonesia:<br />

Hasan Fauzi and Kamil M. Idris: The Relationship of CSR and Financial Performance: New Evidence From Indonesian<br />

Companies<br />

Link: http://ssrn.com/abstract=1694284<br />

Bangladesh:<br />

Kazi Zahirul Islam: Corporate Social Responsibility (CSR) and Issue to Corporate Financial Performance (CFP):<br />

An Empirical Evidence on Dhaka Stock Exchange (DSE) Listed Banking Companies in Bangladesh<br />

Link: http://www.iiste.org/Journals/index.php/EJBM/article/view/2456<br />

South Africa:<br />

Hopolang Leeto Ntoi: Impact of Corporate Social Responsibility on the Financial Performance of Companies listed on the<br />

Johannesburg Securities Exchange<br />

Link: http://upetd.up.ac.za/thesis/available/etd-06182011-184232/unrestricted/dissertation.pdf<br />

Pakistan:<br />

Nadeem Iqbal, Naveed Ahmad, Nauman Ahmad Basheer and Muhammad Nadeem:<br />

Impact of Corporate Social Responsibility on Financial Performance of Corporations: Evidence from Pakistan<br />

Link: http://www.macrothink.org/journal/index.php/ijld/article/download/2717/2286<br />

Sri Lanka:<br />

Wijesinghe K. N. and Senaratne S.: Impact of Disclosure of Corporate Social Responsibility on Corporate Financial<br />

Performance in Bank, Finance and Insurance Sector in Sri Lanka<br />

Link: http://www.kln.ac.lk/uokr/ICBI2011/A&F%20141.pdf<br />

186<br />

<strong>Global</strong> <strong>Compact</strong> <strong>International</strong> <strong>Yearbook</strong> <strong>2013</strong>