- Page 1 and 2:

PRINCIPLES OF ECONOMICS JEFF HOLT S

- Page 3 and 4:

Principles of Economics, 6th Editio

- Page 5 and 6:

16. Study Guide for Chapter 7 17. C

- Page 7 and 8:

11. Appendix: Book Review - “The

- Page 9 and 10:

20. Appendix: The NCAA Cartel 21. S

- Page 11 and 12:

Introduction: A Brief History of U.

- Page 13 and 14:

In the twentieth century, per capit

- Page 15 and 16:

Appendix: The 35 Largest National E

- Page 17 and 18:

Multiple Choice: ___ 1. The Jamesto

- Page 19 and 20:

2. Describe the economic cost of th

- Page 21 and 22:

Chapter 1 Scarcity and Choices The

- Page 23 and 24:

Example 5B: At the end of 1982, the

- Page 25 and 26:

Example 11: When Cindy quits her jo

- Page 27 and 28:

consequences may result in failure

- Page 29 and 30:

An upward sloping curve (as in Exam

- Page 31 and 32:

In making decisions, humans tend to

- Page 33 and 34:

5. ______________________ _________

- Page 35 and 36:

___ 13. If the value of one variabl

- Page 37 and 38:

Y Point X Y A 0 1 B 3 3 C 6 5 D 9 7

- Page 39 and 40:

Chapter 2 Trade and Economic System

- Page 41 and 42:

Example 4B: The following quantitie

- Page 43 and 44:

1. An increase in the quantity of r

- Page 45 and 46:

3. For whom to produce? This is det

- Page 47 and 48:

The graph below illustrates the shi

- Page 49 and 50:

The two primary economic systems ar

- Page 51 and 52:

___ 12. The capitalist vision sees

- Page 53 and 54:

___ 25. According to the book “Ca

- Page 55 and 56:

Chapter 3 Demand, Supply, and Equil

- Page 57 and 58:

. For inferior goods, income and de

- Page 59 and 60:

The same information can be placed

- Page 61 and 62:

Not only does a free market elimina

- Page 63 and 64:

$7 - 6 - 5 - S 3 S1 S 2 Price 4 - 3

- Page 65 and 66:

Example 17: The graph below illustr

- Page 67 and 68:

Questions for Chapter 3 Fill-in-the

- Page 69 and 70:

___ 12. Assuming a market originall

- Page 71 and 72:

$8 - 7 - 6 - 5 - Price 4 - 3 - 2 -

- Page 73 and 74:

Chapter 4 Inflation and Unemploymen

- Page 75 and 76:

Computing the Rate of Inflation The

- Page 77 and 78:

Full Employment Though unemployment

- Page 79 and 80:

3. Cyclical unemployment - due to d

- Page 81 and 82:

During the Great Depression, the ec

- Page 83 and 84:

Appendix: Think Like an Economist -

- Page 85 and 86:

Answer questions 8. and 9. based on

- Page 87 and 88:

___ 25. The extension of unemployme

- Page 89 and 90:

Chapter 5 Measuring Total Output: G

- Page 91 and 92:

5. Leisure. Leisure time is by defi

- Page 93 and 94:

The U.S. is a high per capita GDP c

- Page 95 and 96:

Example 17: In “An International

- Page 97 and 98:

The simple circular flow diagram be

- Page 99 and 100:

___ 3. Which of the following would

- Page 101 and 102:

2. Explain what nonproduction trans

- Page 103 and 104:

Chapter 6 The Aggregate Market The

- Page 105 and 106:

Example 2C: Assume the same facts a

- Page 107 and 108:

Example 5B: The price of crude oil

- Page 109 and 110:

Price Level Real GDP SRAS AD 2 AD 1

- Page 111 and 112:

Appendix: Why the Aggregate Demand

- Page 113 and 114:

___ 3. DEF Company can invest in ne

- Page 115 and 116:

2. List and explain the two factors

- Page 117 and 118:

Chapter 7 Classical Economic Theory

- Page 119 and 120:

Notice that the investment demand c

- Page 121 and 122:

Long-Run Equilibrium If Real GDP is

- Page 123 and 124:

Example 6B: When the economy is in

- Page 125 and 126:

Laissez-faire If the economy is sel

- Page 127 and 128:

___ 5. According to Say’s Law: a.

- Page 129 and 130:

3. On the graph below, draw an aggr

- Page 131 and 132:

Chapter 8 Keynesian Economic Theory

- Page 133 and 134:

Example 2B: The graph below illustr

- Page 135 and 136:

Example 5: Assume that the table be

- Page 137 and 138:

Notice on the graph on the previous

- Page 139 and 140:

According to Keynesian theory, a ch

- Page 141 and 142:

“The General Theory” also inclu

- Page 143 and 144:

___ 8. If the consumption function

- Page 145 and 146:

3. If the MPC is .667, and investme

- Page 147 and 148:

Chapter 9 Fiscal Policy The basic e

- Page 149 and 150:

Keynesian Fiscal Policy Theory and

- Page 151 and 152:

Example 5A: The federal government

- Page 153 and 154:

The Laffer Curve What will happen t

- Page 155 and 156:

Appendix: The Importance of Incenti

- Page 157 and 158:

___ 4. A decrease in government exp

- Page 159 and 160:

2. Explain what automatic stabilize

- Page 161 and 162:

Chapter 10 Money, Money Creation, a

- Page 163 and 164:

Example 4B: The castaways on Gillig

- Page 165 and 166:

Looking at the balance sheet below,

- Page 167 and 168:

Demand-side One-shot Inflation Exam

- Page 169 and 170:

4. Inflation increases uncertainty

- Page 171 and 172:

life; it came into existence not by

- Page 173 and 174:

calculated by using the potential d

- Page 175 and 176:

___ 12. If the required-reserve rat

- Page 177 and 178:

4. Referring to the balance sheet f

- Page 179 and 180:

Chapter 11 The Federal Reserve Syst

- Page 181 and 182:

5. After Bank X sells the $300,000

- Page 183 and 184:

Low Mortgage Interest Rates Mortgag

- Page 185 and 186:

Relaxed Standards for Mortgage Loan

- Page 187 and 188:

The Bursting of the Housing Bubble

- Page 189 and 190:

On February 17, 2009, the federal g

- Page 191 and 192:

Fed policies caused short-term inte

- Page 193 and 194:

___ 10. The Fed’s most important

- Page 195 and 196:

___ 25. In response to the recessio

- Page 197 and 198:

Chapter 12 Monetary Policy The basi

- Page 199 and 200:

2. A change in aggregate demand (AD

- Page 201 and 202:

Monetarist Transmission Mechanism C

- Page 203 and 204:

3. Borrowers do not have to seek ou

- Page 205 and 206:

Appendix: Book Review - “The Age

- Page 207 and 208:

Questions for Chapter 12 Fill-in-th

- Page 209 and 210:

___ 16. The primary source of incom

- Page 211 and 212:

7. According to Alan Greenspan, wha

- Page 213 and 214:

Chapter 13 Taxes, Deficits, and the

- Page 215 and 216:

Example 5: In 2015, Taxpayer A had

- Page 217 and 218:

of $5 and a quantity of 10 units. T

- Page 219 and 220:

The complexity of the tax law also

- Page 221 and 222:

the current government spending and

- Page 223 and 224:

cut of 1964. The top rate was lower

- Page 225 and 226:

___ 6. Federal excise taxes: a. are

- Page 227 and 228:

3. How would eliminating the loopho

- Page 229 and 230:

Chapter 14 Economic Growth The basi

- Page 231 and 232:

2. Labor. Labor can contribute to e

- Page 233 and 234:

estricting international trade (e.g

- Page 235 and 236:

An improvement in technology (e.g.

- Page 237 and 238:

The table below shows the economic

- Page 239 and 240:

will increase both Real GDP and per

- Page 241 and 242:

___ 8. Which of the following is co

- Page 243 and 244:

___ 26. The opinion that economic g

- Page 245 and 246:

Chapter 15 Less Developed Countries

- Page 247 and 248:

Example 8: Countries A, B, C, and D

- Page 249 and 250:

Obstacles to Economic Development f

- Page 251 and 252:

c. Restrictions on international tr

- Page 253 and 254:

Appendix: Book Review - “The Powe

- Page 255 and 256:

Example 25: In Brazil, about half t

- Page 257 and 258:

Study Guide for Chapter 15 Chapter

- Page 259 and 260:

___ 13. Among the counterproductive

- Page 261 and 262:

4. List four ways that governments

- Page 263 and 264:

Chapter 16 International Trade The

- Page 265 and 266:

Other Benefits of Free Internationa

- Page 267 and 268:

Example 6: The graph below illustra

- Page 269 and 270:

competitive disadvantage. But dumpi

- Page 271 and 272:

is only 25% as productive as before

- Page 273 and 274:

Smith was skeptical of government a

- Page 275 and 276:

___ 4. For Country X, what is the o

- Page 277 and 278:

___ 18. Frédéric Bastiat’s “P

- Page 279 and 280:

4. On the graph below: (1) What is

- Page 281 and 282:

Chapter 17 Elasticity We are often

- Page 283 and 284:

Example 4A: What is price elasticit

- Page 285 and 286: Example 5A: Gertie’s Gas and Go i

- Page 287 and 288: Example 10A: When the price of Good

- Page 289 and 290: Example 13B: On the graph below, su

- Page 291 and 292: $7 - 6 - 5 - Price 4 - 3 - 2 - 1 -

- Page 293 and 294: In the long run, would the deadweig

- Page 295 and 296: ___ 7. The factors that determine w

- Page 297 and 298: 3. a. Which price (or prices) from

- Page 299 and 300: Chapter 18 Utility The basic econom

- Page 301 and 302: Nonetheless, society generally assu

- Page 303 and 304: Example 9: Capital City operates a

- Page 305 and 306: Marginal rate of substitution - the

- Page 307 and 308: The diamond-water paradox is the ob

- Page 309 and 310: Complete the table below to answer

- Page 311 and 312: 4. The graph below shows indifferen

- Page 313 and 314: Chapter 19 The Firm The basic econo

- Page 315 and 316: than contributing to team productio

- Page 317 and 318: 1. Difficulty in raising large amou

- Page 319 and 320: Corporations also use self-financin

- Page 321 and 322: Example 24: A blacksmith who produc

- Page 323 and 324: For financing needs, proprietorship

- Page 325 and 326: ___ 13. Corporations: a. are comple

- Page 327 and 328: 5. List two things that the absence

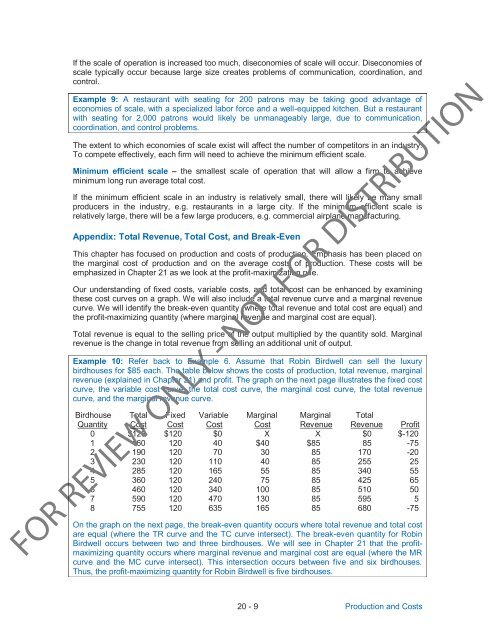

- Page 329 and 330: Chapter 20 Production and Costs The

- Page 331 and 332: In Example 5B, Birdwell finds that

- Page 333 and 334: variable cost initially decreases,

- Page 335: Quantity TC MC AFC AVC ATC 0 240 X

- Page 339 and 340: average total cost. Average fixed c

- Page 341 and 342: ___ 11. Concerning the cost curves:

- Page 343 and 344: 5. Complete the following cost tabl

- Page 345 and 346: Chapter 21 Perfect Competition The

- Page 347 and 348: Even though a perfect competitor ca

- Page 349 and 350: Example 6C: This example builds on

- Page 351 and 352: At what price will there be neither

- Page 353 and 354: Appendix: Perfect Competition in th

- Page 355 and 356: Multiple Choice: ___ 1. A perfect c

- Page 357 and 358: ___ 17. Perfect competition: a. req

- Page 359 and 360: Answers for Chapter 21 Fill-in-the-

- Page 361 and 362: Chapter 22 Monopoly Of the four mar

- Page 363 and 364: 3. Exclusive ownership of an essent

- Page 365 and 366: maximizing quantity (4 units) creat

- Page 367 and 368: $22 - 20 - 18 - 16 - 14 - Deadweigh

- Page 369 and 370: 2. Negotiating, beginning at a high

- Page 371 and 372: Legal barriers are created by gover

- Page 373 and 374: ___ 8. The slope of the demand curv

- Page 375 and 376: Price Quantity 3. List some of the

- Page 377 and 378: Chapter 23 Monopolistic Competition

- Page 379 and 380: For Percomp (the perfect competitor

- Page 381 and 382: Example 7A: The graph below represe

- Page 383 and 384: Example 9: The Organization of the

- Page 385 and 386: Example 12 illustrates the dilemma

- Page 387 and 388:

its current price and quantity. The

- Page 389 and 390:

___ 14. Game theory: a. is a method

- Page 391 and 392:

Answers for Chapter 23 Fill-in-the-

- Page 393 and 394:

Chapter 24 Factor Markets The basic

- Page 395 and 396:

$ $240 - 200 - 160 - 120 - 80 - 40

- Page 397 and 398:

Since producers will attempt to equ

- Page 399 and 400:

2. Differences in nonmoney aspects

- Page 401 and 402:

were his strikeouts, walks, and hom

- Page 403 and 404:

___ 3. To maximize profits, a produ

- Page 405 and 406:

___ 19. According to the book, “M

- Page 407 and 408:

Multiple Choice: 1. a. 8. c. 15. d.

- Page 409 and 410:

Chapter 25 Labor Unions The primary

- Page 411 and 412:

The elasticity of demand for union

- Page 413 and 414:

Example 4A: Assume that the graph b

- Page 415 and 416:

Notice from the graph in Example 6

- Page 417 and 418:

Wage Factory A Quantity of Labor S

- Page 419 and 420:

As a cartel, a labor union faces a

- Page 421 and 422:

___ 10. For a monopsony: a. there i

- Page 423 and 424:

3. The graph below represents a lab

- Page 425 and 426:

Chapter 26 Interest, Present Value,

- Page 427 and 428:

An increase in expected rates of re

- Page 429 and 430:

An asset is valuable because we exp

- Page 431 and 432:

Example 13B: General Ordnance prove

- Page 433 and 434:

Appendix: Present Value Table One f

- Page 435 and 436:

___ 4. An increase in expected rate

- Page 437 and 438:

Problems: 1. List and explain the t

- Page 439 and 440:

Chapter 27 Market Failure The basic

- Page 441 and 442:

External Benefit If a market genera

- Page 443 and 444:

Example 2: To encourage the consump

- Page 445 and 446:

$100 - 90 - 80 - MSC 70 - $ 60 - 50

- Page 447 and 448:

A common good is nonexcludable. Non

- Page 449 and 450:

Study Guide for Chapter 27 Chapter

- Page 451 and 452:

___ 5. What government policy would

- Page 453 and 454:

4. Based on the information on the

- Page 455 and 456:

Chapter 28 Public Choice and Govern

- Page 457 and 458:

Candidates and the Median Voter Mod

- Page 459 and 460:

Example 8: According to State and F

- Page 461 and 462:

Example 10: When Elvis Presley was

- Page 463 and 464:

4. Pessimistic bias. This is the te

- Page 465 and 466:

___ 5. An elected official will: a.

- Page 467 and 468:

2. If a certain policy will yield s

- Page 469 and 470:

Chapter 29 Government Regulation of

- Page 471 and 472:

underproduction is the amount that

- Page 473 and 474:

micromanagement results in business

- Page 475 and 476:

market. They may agree with their c

- Page 477 and 478:

Questions for Chapter 29 Fill-in-th

- Page 479 and 480:

___ 10. The public interest theory

- Page 481 and 482:

4. List the four types of costs imp

- Page 483 and 484:

Chapter 30 Agriculture and Health C

- Page 485 and 486:

weather may cause bumper crops. Bad

- Page 487 and 488:

Security and Rural Investment Act o

- Page 489 and 490:

Example 12: From 1960 to 2013, the

- Page 491 and 492:

1. NHI would provide universal heal

- Page 493 and 494:

d. Insurance providers are not allo

- Page 495 and 496:

Study Guide for Chapter 30 Chapter

- Page 497 and 498:

Answer questions 7. through 10. by

- Page 499 and 500:

___ 21. If there were no individual

- Page 501 and 502:

Chapter 31 Income Distribution and

- Page 503 and 504:

Income is more equally distributed

- Page 505 and 506:

over a typical career is the accumu

- Page 507 and 508:

Ideal Income Redistribution The ide

- Page 509 and 510:

Poverty - a family whose income fal

- Page 511 and 512:

Appendix: Income Inequality around

- Page 513 and 514:

How is this story an analogy for th

- Page 515 and 516:

___ 2. In 2013, the Lowest Income 6

- Page 517 and 518:

Problems: 1. Explain the two primar

- Page 519 and 520:

Absolute advantage - when one natio

- Page 521 and 522:

Fiat money - money by government de

- Page 523 and 524:

Nonrivalrous good - a good for whic

- Page 525 and 526:

Absolute advantage, 16-9 Absolute e

- Page 527 and 528:

“Company town”, 25-6 Comparativ

- Page 529 and 530:

Eli Lilly and Company, 22-1 Emergen

- Page 531 and 532:

Houston, Texas, 15-10 Human capital

- Page 533 and 534:

Market, 3-1, 3-8-9 Market basket, 4

- Page 535 and 536:

Political bias, 9-4, 12-7 Political

- Page 537 and 538:

Short run production, 20-2-3 Short-

- Page 539 and 540:

Upturns, 9-4 USDA, 27-9, 30-1-2, 30