BISICHI MINING PLC ANNUAL REPORT 2017

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

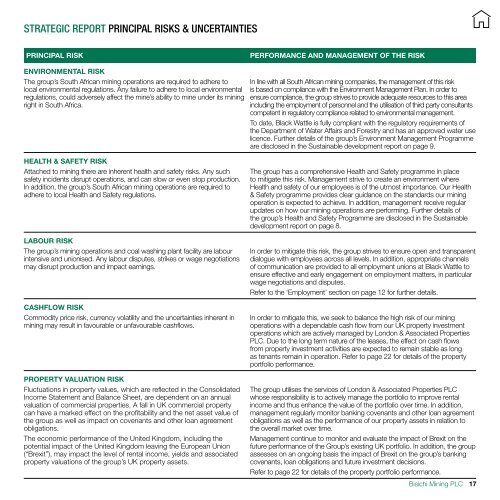

STRATEGIC <strong>REPORT</strong> PRINCIPAL RISKS & UNCERTAINTIES<br />

PRINCIPAL RISK<br />

PERFORMANCE AND MANAGEMENT OF THE RISK<br />

ENVIRONMENTAL RISK<br />

The group’s South African mining operations are required to adhere to<br />

local environmental regulations. Any failure to adhere to local environmental<br />

regulations, could adversely affect the mine’s ability to mine under its mining<br />

right in South Africa.<br />

In line with all South African mining companies, the management of this risk<br />

is based on compliance with the Environment Management Plan. In order to<br />

ensure compliance, the group strives to provide adequate resources to this area<br />

including the employment of personnel and the utilisation of third party consultants<br />

competent in regulatory compliance related to environmental management.<br />

To date, Black Wattle is fully compliant with the regulatory requirements of<br />

the Department of Water Affairs and Forestry and has an approved water use<br />

licence. Further details of the group’s Environment Management Programme<br />

are disclosed in the Sustainable development report on page 9.<br />

HEALTH & SAFETY RISK<br />

Attached to mining there are inherent health and safety risks. Any such<br />

safety incidents disrupt operations, and can slow or even stop production.<br />

In addition, the group’s South African mining operations are required to<br />

adhere to local Health and Safety regulations.<br />

LABOUR RISK<br />

The group’s mining operations and coal washing plant facility are labour<br />

intensive and unionised. Any labour disputes, strikes or wage negotiations<br />

may disrupt production and impact earnings.<br />

CASHFLOW RISK<br />

Commodity price risk, currency volatility and the uncertainties inherent in<br />

mining may result in favourable or unfavourable cashflows.<br />

PROPERTY VALUATION RISK<br />

Fluctuations in property values, which are reflected in the Consolidated<br />

Income Statement and Balance Sheet, are dependent on an annual<br />

valuation of commercial properties. A fall in UK commercial property<br />

can have a marked effect on the profitability and the net asset value of<br />

the group as well as impact on covenants and other loan agreement<br />

obligations.<br />

The economic performance of the United Kingdom, including the<br />

potential impact of the United Kingdom leaving the European Union<br />

(“Brexit”), may impact the level of rental income, yields and associated<br />

property valuations of the group’s UK property assets.<br />

The group has a comprehensive Health and Safety programme in place<br />

to mitigate this risk. Management strive to create an environment where<br />

Health and safety of our employees is of the utmost importance. Our Health<br />

& Safety programme provides clear guidance on the standards our mining<br />

operation is expected to achieve. In addition, management receive regular<br />

updates on how our mining operations are performing. Further details of<br />

the group’s Health and Safety Programme are disclosed in the Sustainable<br />

development report on page 8.<br />

In order to mitigate this risk, the group strives to ensure open and transparent<br />

dialogue with employees across all levels. In addition, appropriate channels<br />

of communication are provided to all employment unions at Black Wattle to<br />

ensure effective and early engagement on employment matters, in particular<br />

wage negotiations and disputes.<br />

Refer to the ‘Employment’ section on page 12 for further details.<br />

In order to mitigate this, we seek to balance the high risk of our mining<br />

operations with a dependable cash flow from our UK property investment<br />

operations which are actively managed by London & Associated Properties<br />

<strong>PLC</strong>. Due to the long term nature of the leases, the effect on cash flows<br />

from property investment activities are expected to remain stable as long<br />

as tenants remain in operation. Refer to page 22 for details of the property<br />

portfolio performance.<br />

The group utilises the services of London & Associated Properties <strong>PLC</strong><br />

whose responsibility is to actively manage the portfolio to improve rental<br />

income and thus enhance the value of the portfolio over time. In addition,<br />

management regularly monitor banking covenants and other loan agreement<br />

obligations as well as the performance of our property assets in relation to<br />

the overall market over time.<br />

Management continue to monitor and evaluate the impact of Brexit on the<br />

future performance of the Group’s existing UK portfolio. In addition, the group<br />

assesses on an ongoing basis the impact of Brexit on the group’s banking<br />

covenants, loan obligations and future investment decisions.<br />

Refer to page 22 for details of the property portfolio performance.<br />

Bisichi Mining <strong>PLC</strong><br />

17