BISICHI MINING PLC ANNUAL REPORT 2017

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

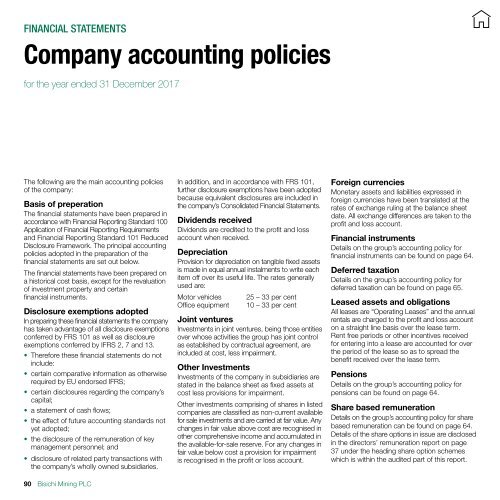

Financial statements<br />

Company accounting policies<br />

for the year ended 31 December <strong>2017</strong><br />

The following are the main accounting policies<br />

of the company:<br />

Basis of preperation<br />

The financial statements have been prepared in<br />

accordance with Financial Reporting Standard 100<br />

Application of Financial Reporting Requirements<br />

and Financial Reporting Standard 101 Reduced<br />

Disclosure Framework. The principal accounting<br />

policies adopted in the preparation of the<br />

financial statements are set out below.<br />

The financial statements have been prepared on<br />

a historical cost basis, except for the revaluation<br />

of investment property and certain<br />

financial instruments.<br />

Disclosure exemptions adopted<br />

In preparing these financial statements the company<br />

has taken advantage of all disclosure exemptions<br />

conferred by FRS 101 as well as disclosure<br />

exemptions conferred by IFRS 2, 7 and 13.<br />

• Therefore these financial statements do not<br />

include:<br />

• certain comparative information as otherwise<br />

required by EU endorsed IFRS;<br />

• certain disclosures regarding the company’s<br />

capital;<br />

• a statement of cash flows;<br />

• the effect of future accounting standards not<br />

yet adopted;<br />

• the disclosure of the remuneration of key<br />

management personnel; and<br />

• disclosure of related party transactions with<br />

the company’s wholly owned subsidiaries.<br />

90 Bisichi Mining <strong>PLC</strong><br />

In addition, and in accordance with FRS 101,<br />

further disclosure exemptions have been adopted<br />

because equivalent disclosures are included in<br />

the company’s Consolidated Financial Statements.<br />

Dividends received<br />

Dividends are credited to the profit and loss<br />

account when received.<br />

Depreciation<br />

Provision for depreciation on tangible fixed assets<br />

is made in equal annual instalments to write each<br />

item off over its useful life. The rates generally<br />

used are:<br />

Motor vehicles 25 – 33 per cent<br />

Office equipment 10 – 33 per cent<br />

Joint ventures<br />

Investments in joint ventures, being those entities<br />

over whose activities the group has joint control<br />

as established by contractual agreement, are<br />

included at cost, less impairment.<br />

Other Investments<br />

Investments of the company in subsidiaries are<br />

stated in the balance sheet as fixed assets at<br />

cost less provisions for impairment.<br />

Other investments comprising of shares in listed<br />

companies are classified as non-current available<br />

for sale investments and are carried at fair value. Any<br />

changes in fair value above cost are recognised in<br />

other comprehensive income and accumulated in<br />

the available-for-sale reserve. For any changes in<br />

fair value below cost a provision for impairment<br />

is recognised in the profit or loss account.<br />

Foreign currencies<br />

Monetary assets and liabilities expressed in<br />

foreign currencies have been translated at the<br />

rates of exchange ruling at the balance sheet<br />

date. All exchange differences are taken to the<br />

profit and loss account.<br />

Financial instruments<br />

Details on the group’s accounting policy for<br />

financial instruments can be found on page 64.<br />

Deferred taxation<br />

Details on the group’s accounting policy for<br />

deferred taxation can be found on page 65.<br />

Leased assets and obligations<br />

All leases are “Operating Leases” and the annual<br />

rentals are charged to the profit and loss account<br />

on a straight line basis over the lease term.<br />

Rent free periods or other incentives received<br />

for entering into a lease are accounted for over<br />

the period of the lease so as to spread the<br />

benefit received over the lease term.<br />

Pensions<br />

Details on the group’s accounting policy for<br />

pensions can be found on page 64.<br />

Share based remuneration<br />

Details on the group’s accounting policy for share<br />

based remuneration can be found on page 64.<br />

Details of the share options in issue are disclosed<br />

in the directors’ remuneration report on page<br />

37 under the heading share option schemes<br />

which is within the audited part of this report.