BISICHI MINING PLC ANNUAL REPORT 2017

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial statements Notes to the financial statements<br />

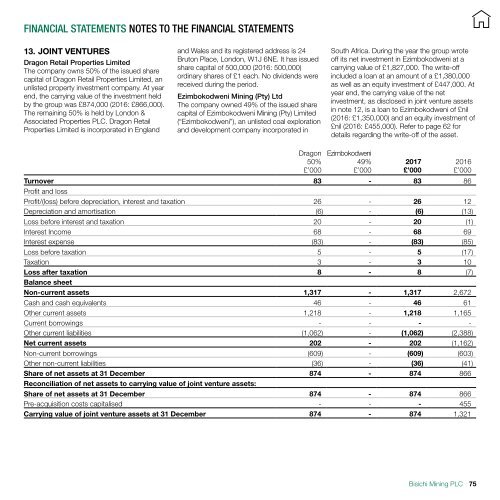

13. JOINT VENTURES<br />

Dragon Retail Properties Limited<br />

The company owns 50% of the issued share<br />

capital of Dragon Retail Properties Limited, an<br />

unlisted property investment company. At year<br />

end, the carrying value of the investment held<br />

by the group was £874,000 (2016: £866,000).<br />

The remaining 50% is held by London &<br />

Associated Properties <strong>PLC</strong>. Dragon Retail<br />

Properties Limited is incorporated in England<br />

and Wales and its registered address is 24<br />

Bruton Place, London, W1J 6NE. It has issued<br />

share capital of 500,000 (2016: 500,000)<br />

ordinary shares of £1 each. No dividends were<br />

received during the period.<br />

Ezimbokodweni Mining (Pty) Ltd<br />

The company owned 49% of the issued share<br />

capital of Ezimbokodweni Mining (Pty) Limited<br />

(“Ezimbokodweni”), an unlisted coal exploration<br />

and development company incorporated in<br />

South Africa. During the year the group wrote<br />

off its net investment in Ezimbokodweni at a<br />

carrying value of £1,827,000. The write-off<br />

included a loan at an amount of a £1,380,000<br />

as well as an equity investment of £447,000. At<br />

year end, the carrying value of the net<br />

investment, as disclosed in joint venture assets<br />

in note 12, is a loan to Ezimbokodweni of £nil<br />

(2016: £1,350,000) and an equity investment of<br />

£nil (2016: £455,000). Refer to page 62 for<br />

details regarding the write-off of the asset.<br />

Dragon<br />

50%<br />

£’000<br />

Ezimbokodweni<br />

49%<br />

£’000<br />

Turnover 83 - 83 86<br />

Profit and loss<br />

Profit/(loss) before depreciation, interest and taxation 26 - 26 12<br />

Depreciation and amortisation (6) - (6) (13)<br />

Loss before interest and taxation 20 - 20 (1)<br />

Interest Income 68 - 68 69<br />

Interest expense (83) - (83) (85)<br />

Loss before taxation 5 - 5 (17)<br />

Taxation 3 - 3 10<br />

Loss after taxation 8 - 8 (7)<br />

Balance sheet<br />

Non-current assets 1,317 - 1,317 2,672<br />

Cash and cash equivalents 46 - 46 61<br />

Other current assets 1,218 - 1,218 1,165<br />

Current borrowings - - - -<br />

Other current liabilities (1,062) - (1,062) (2,388)<br />

Net current assets 202 - 202 (1,162)<br />

Non-current borrowings (609) - (609) (603)<br />

Other non-current liabilities (36) - (36) (41)<br />

Share of net assets at 31 December 874 - 874 866<br />

Reconciliation of net assets to carrying value of joint venture assets:<br />

Share of net assets at 31 December 874 - 874 866<br />

Pre-acquisition costs capitalised - - - 455<br />

Carrying value of joint venture assets at 31 December 874 - 874 1,321<br />

<strong>2017</strong><br />

£’000<br />

2016<br />

£’000<br />

Bisichi Mining <strong>PLC</strong><br />

75