BISICHI MINING PLC ANNUAL REPORT 2017

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

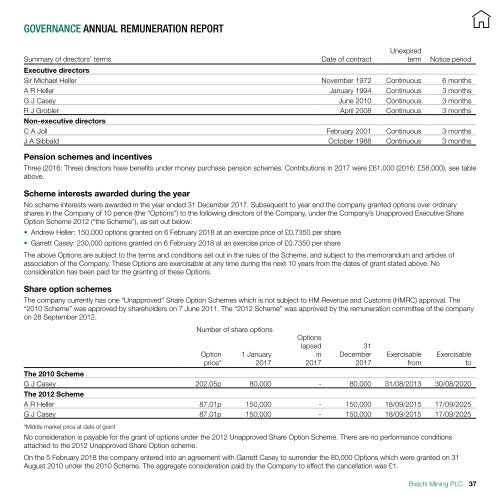

Governance Annual remuneration report<br />

Summary of directors’ terms<br />

Date of contract<br />

Unexpired<br />

term<br />

Notice period<br />

Executive directors<br />

Sir Michael Heller November 1972 Continuous 6 months<br />

A R Heller January 1994 Continuous 3 months<br />

G J Casey June 2010 Continuous 3 months<br />

R J Grobler April 2008 Continuous 3 months<br />

Non-executive directors<br />

C A Joll February 2001 Continuous 3 months<br />

J A Sibbald October 1988 Continuous 3 months<br />

Pension schemes and incentives<br />

Three (2016: Three) directors have benefits under money purchase pension schemes. Contributions in <strong>2017</strong> were £61,000 (2016: £58,000), see table<br />

above.<br />

Scheme interests awarded during the year<br />

No scheme interests were awarded in the year ended 31 December <strong>2017</strong>. Subsequent to year end the company granted options over ordinary<br />

shares in the Company of 10 pence (the “Options”) to the following directors of the Company, under the Company’s Unapproved Executive Share<br />

Option Scheme 2012 (“the Scheme”), as set out below:<br />

• Andrew Heller: 150,000 options granted on 6 February 2018 at an exercise price of £0.7350 per share<br />

• Garrett Casey: 230,000 options granted on 6 February 2018 at an exercise price of £0.7350 per share<br />

The above Options are subject to the terms and conditions set out in the rules of the Scheme, and subject to the memorandum and articles of<br />

association of the Company. These Options are exercisable at any time during the next 10 years from the dates of grant stated above. No<br />

consideration has been paid for the granting of these Options.<br />

Share option schemes<br />

The company currently has one “Unapproved” Share Option Schemes which is not subject to HM Revenue and Customs (HMRC) approval. The<br />

“2010 Scheme” was approved by shareholders on 7 June 2011. The “2012 Scheme” was approved by the remuneration committee of the company<br />

on 28 September 2012.<br />

Number of share options<br />

Option<br />

price*<br />

1 January<br />

<strong>2017</strong><br />

Options<br />

lapsed<br />

in<br />

<strong>2017</strong><br />

31<br />

December<br />

<strong>2017</strong><br />

Exercisable<br />

from<br />

Exercisable<br />

to<br />

The 2010 Scheme<br />

G J Casey 202.05p 80,000 - 80,000 31/08/2013 30/08/2020<br />

The 2012 Scheme<br />

A R Heller 87.01p 150,000 - 150,000 18/09/2015 17/09/2025<br />

G J Casey 87.01p 150,000 - 150,000 18/09/2015 17/09/2025<br />

*Middle market price at date of grant<br />

No consideration is payable for the grant of options under the 2012 Unapproved Share Option Scheme. There are no performance conditions<br />

attached to the 2012 Unapproved Share Option scheme.<br />

On the 5 February 2018 the company entered into an agreement with Garrett Casey to surrender the 80,000 Options which were granted on 31<br />

August 2010 under the 2010 Scheme. The aggregate consideration paid by the Company to effect the cancellation was £1.<br />

Bisichi Mining <strong>PLC</strong><br />

37