BISICHI MINING PLC ANNUAL REPORT 2017

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial statements Notes to the financial statements<br />

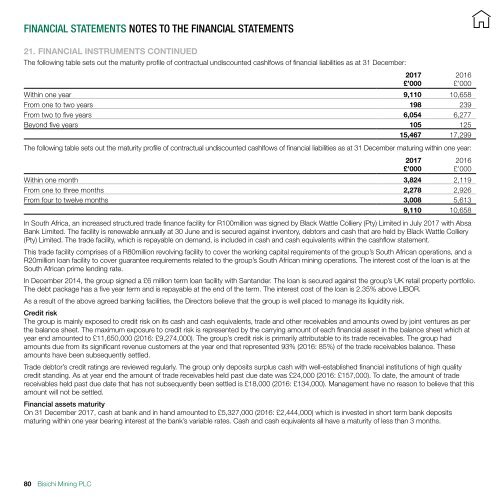

21. FINANCIAL INSTRUMENTS CONTINUED<br />

The following table sets out the maturity profile of contractual undiscounted cashlfows of financial liabilities as at 31 December:<br />

Within one year 9,110 10,658<br />

From one to two years 198 239<br />

From two to five years 6,054 6,277<br />

Beyond five years 105 125<br />

15,467 17,299<br />

The following table sets out the maturity profile of contractual undiscounted cashlfows of financial liabilities as at 31 December maturing within one year:<br />

Within one month 3,824 2,119<br />

From one to three months 2,278 2,926<br />

From four to twelve months 3,008 5,613<br />

9,110 10,658<br />

In South Africa, an increased structured trade finance facility for R100million was signed by Black Wattle Colliery (Pty) Limited in July <strong>2017</strong> with Absa<br />

Bank Limited. The facility is renewable annually at 30 June and is secured against inventory, debtors and cash that are held by Black Wattle Colliery<br />

(Pty) Limited. The trade facility, which is repayable on demand, is included in cash and cash equivalents within the cashflow statement.<br />

This trade facility comprises of a R80million revolving facility to cover the working capital requirements of the group’s South African operations, and a<br />

R20million loan facility to cover guarantee requirements related to the group’s South African mining operations. The interest cost of the loan is at the<br />

South African prime lending rate.<br />

In December 2014, the group signed a £6 million term loan facility with Santander. The loan is secured against the group’s UK retail property portfolio.<br />

The debt package has a five year term and is repayable at the end of the term. The interest cost of the loan is 2.35% above LIBOR.<br />

As a result of the above agreed banking facilities, the Directors believe that the group is well placed to manage its liquidity risk.<br />

Credit risk<br />

The group is mainly exposed to credit risk on its cash and cash equivalents, trade and other receivables and amounts owed by joint ventures as per<br />

the balance sheet. The maximum exposure to credit risk is represented by the carrying amount of each financial asset in the balance sheet which at<br />

year end amounted to £11,650,000 (2016: £9,274,000). The group’s credit risk is primarily attributable to its trade receivables. The group had<br />

amounts due from its significant revenue customers at the year end that represented 93% (2016: 85%) of the trade receivables balance. These<br />

amounts have been subsequently settled.<br />

Trade debtor’s credit ratings are reviewed regularly. The group only deposits surplus cash with well-established financial institutions of high quality<br />

credit standing. As at year end the amount of trade receivables held past due date was £24,000 (2016: £157,000). To date, the amount of trade<br />

receivables held past due date that has not subsequently been settled is £18,000 (2016: £134,000). Management have no reason to believe that this<br />

amount will not be settled.<br />

Financial assets maturity<br />

On 31 December <strong>2017</strong>, cash at bank and in hand amounted to £5,327,000 (2016: £2,444,000) which is invested in short term bank deposits<br />

maturing within one year bearing interest at the bank’s variable rates. Cash and cash equivalents all have a maturity of less than 3 months.<br />

<strong>2017</strong><br />

£’000<br />

<strong>2017</strong><br />

£’000<br />

2016<br />

£’000<br />

2016<br />

£’000<br />

80 Bisichi Mining <strong>PLC</strong>