BISICHI MINING PLC ANNUAL REPORT 2017

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

STRATEGIC <strong>REPORT</strong> FINANCIAL & PERFORMANCE REVIEW<br />

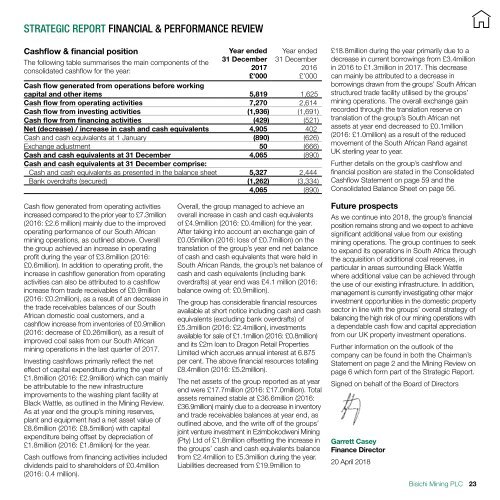

Cashflow & financial position<br />

The following table summarises the main components of the<br />

consolidated cashflow for the year:<br />

Year ended<br />

31 December<br />

<strong>2017</strong><br />

£’000<br />

Year ended<br />

31 December<br />

2016<br />

£’000<br />

Cash flow generated from operations before working<br />

capital and other items 5,819 1,625<br />

Cash flow from operating activities 7,270 2,614<br />

Cash flow from investing activities (1,936) (1,691)<br />

Cash flow from financing activities (429) (521)<br />

Net (decrease) / increase in cash and cash equivalents 4,905 402<br />

Cash and cash equivalents at 1 January (890) (626)<br />

Exchange adjustment 50 (666)<br />

Cash and cash equivalents at 31 December 4,065 (890)<br />

Cash and cash equivalents at 31 December comprise:<br />

Cash and cash equivalents as presented in the balance sheet 5,327 2,444<br />

Bank overdrafts (secured) (1,262) (3,334)<br />

4,065 (890)<br />

£18.8million during the year primarily due to a<br />

decrease in current borrowings from £3.4million<br />

in 2016 to £1.3million in <strong>2017</strong>. This decrease<br />

can mainly be attributed to a decrease in<br />

borrowings drawn from the groups’ South African<br />

structured trade facility utilised by the groups’<br />

mining operations. The overall exchange gain<br />

recorded through the translation reserve on<br />

translation of the group’s South African net<br />

assets at year end decreased to £0.1million<br />

(2016: £1.0million) as a result of the reduced<br />

movement of the South African Rand against<br />

UK sterling year to year.<br />

Further details on the group’s cashflow and<br />

financial position are stated in the Consolidated<br />

Cashflow Statement on page 59 and the<br />

Consolidated Balance Sheet on page 56.<br />

Cash flow generated from operating activities<br />

increased compared to the prior year to £7.3million<br />

(2016: £2.6 million) mainly due to the improved<br />

operating performance of our South African<br />

mining operations, as outlined above. Overall<br />

the group achieved an increase in operating<br />

profit during the year of £3.8million (2016:<br />

£0.6million). In addition to operating profit, the<br />

increase in cashflow generation from operating<br />

activities can also be attributed to a cashflow<br />

increase from trade receivables of £0.9million<br />

(2016: £0.2million), as a result of an decrease in<br />

the trade receivables balances of our South<br />

African domestic coal customers, and a<br />

cashflow increase from inventories of £0.9million<br />

(2016: decrease of £0.26million), as a result of<br />

improved coal sales from our South African<br />

mining operations in the last quarter of <strong>2017</strong>.<br />

Investing cashflows primarily reflect the net<br />

effect of capital expenditure during the year of<br />

£1.8million (2016: £2.9million) which can mainly<br />

be attributable to the new infrastructure<br />

improvements to the washing plant facility at<br />

Black Wattle, as outlined in the Mining Review.<br />

As at year end the group’s mining reserves,<br />

plant and equipment had a net asset value of<br />

£8.6million (2016: £8.5million) with capital<br />

expenditure being offset by depreciation of<br />

£1.8million (2016: £1.8milion) for the year.<br />

Cash outflows from financing activities included<br />

dividends paid to shareholders of £0.4million<br />

(2016: 0.4 million).<br />

Overall, the group managed to achieve an<br />

overall increase in cash and cash equivalents<br />

of £4.9million (2016: £0.4million) for the year.<br />

After taking into account an exchange gain of<br />

£0.05million (2016: loss of £0.7million) on the<br />

translation of the group’s year end net balance<br />

of cash and cash equivalents that were held in<br />

South African Rands, the group’s net balance of<br />

cash and cash equivalents (including bank<br />

overdrafts) at year end was £4.1 million (2016:<br />

balance owing of: £0.9million).<br />

The group has considerable financial resources<br />

available at short notice including cash and cash<br />

equivalents (excluding bank overdrafts) of<br />

£5.3million (2016: £2.4million), investments<br />

available for sale of £1.1million (2016: £0.8million)<br />

and its £2m loan to Dragon Retail Properties<br />

Limited which accrues annual interest at 6.875<br />

per cent. The above financial resources totalling<br />

£8.4million (2016: £5.2million).<br />

The net assets of the group reported as at year<br />

end were £17.7million (2016: £17.0million). Total<br />

assets remained stable at £36.6million (2016:<br />

£36.9million) mainly due to a decrease in inventory<br />

and trade receivables balances at year end, as<br />

outlined above, and the write off of the groups’<br />

joint venture investment in Ezimbokodweni Mining<br />

(Pty) Ltd of £1.8million offsetting the increase in<br />

the groups’ cash and cash equivalents balance<br />

from £2.4million to £5.3million during the year.<br />

Liabilities decreased from £19.9million to<br />

Future prospects<br />

As we continue into 2018, the group’s financial<br />

position remains strong and we expect to achieve<br />

significant additional value from our existing<br />

mining operations. The group continues to seek<br />

to expand its operations in South Africa through<br />

the acquisition of additional coal reserves, in<br />

particular in areas surrounding Black Wattle<br />

where additional value can be achieved through<br />

the use of our existing infrastructure. In addition,<br />

management is currently investigating other major<br />

investment opportunities in the domestic property<br />

sector in line with the groups’ overall strategy of<br />

balancing the high risk of our mining operations with<br />

a dependable cash flow and capital appreciation<br />

from our UK property investment operations.<br />

Further information on the outlook of the<br />

company can be found in both the Chairman’s<br />

Statement on page 2 and the Mining Review on<br />

page 6 which form part of the Strategic Report.<br />

Signed on behalf of the Board of Directors<br />

Garrett Casey<br />

Finance Director<br />

20 April 2018<br />

Bisichi Mining <strong>PLC</strong><br />

23