BISICHI MINING PLC ANNUAL REPORT 2017

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial statements Notes to the financial statements<br />

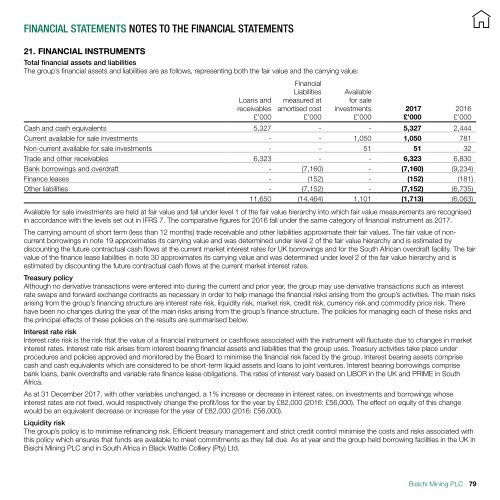

21. FINANCIAL INSTRUMENTS<br />

Total financial assets and liabilities<br />

The group’s financial assets and liabilities are as follows, representing both the fair value and the carrying value:<br />

Loans and<br />

receivables<br />

£’000<br />

Financial<br />

Liabilities<br />

measured at<br />

amortised cost<br />

£’000<br />

Available<br />

for sale<br />

investments<br />

£’000<br />

Cash and cash equivalents 5,327 - - 5,327 2,444<br />

Current available for sale investments - - 1,050 1,050 781<br />

Non-current available for sale investments - - 51 51 32<br />

Trade and other receivables 6,323 - - 6,323 6,830<br />

Bank borrowings and overdraft - (7,160) - (7,160) (9,234)<br />

Finance leases - (152) - (152) (181)<br />

Other liabilities - (7,152) - (7,152) (6,735)<br />

11,650 (14,464) 1,101 (1,713) (6,063)<br />

Available for sale investments are held at fair value and fall under level 1 of the fair value hierarchy into which fair value measurements are recognised<br />

in accordance with the levels set out in IFRS 7. The comparative figures for 2016 fall under the same category of financial instrument as <strong>2017</strong>.<br />

The carrying amount of short term (less than 12 months) trade receivable and other liabilities approximate their fair values. The fair value of noncurrent<br />

borrowings in note 19 approximates its carrying value and was determined under level 2 of the fair value hierarchy and is estimated by<br />

discounting the future contractual cash flows at the current market interest rates for UK borrowings and for the South African overdraft facility. The fair<br />

value of the finance lease liabilities in note 30 approximates its carrying value and was determined under level 2 of the fair value hierarchy and is<br />

estimated by discounting the future contractual cash flows at the current market interest rates.<br />

Treasury policy<br />

Although no derivative transactions were entered into during the current and prior year, the group may use derivative transactions such as interest<br />

rate swaps and forward exchange contracts as necessary in order to help manage the financial risks arising from the group’s activities. The main risks<br />

arising from the group’s financing structure are interest rate risk, liquidity risk, market risk, credit risk, currency risk and commodity price risk. There<br />

have been no changes during the year of the main risks arising from the group’s finance structure. The policies for managing each of these risks and<br />

the principal effects of these policies on the results are summarised below.<br />

Interest rate risk<br />

Interest rate risk is the risk that the value of a financial instrument or cashflows associated with the instrument will fluctuate due to changes in market<br />

interest rates. Interest rate risk arises from interest bearing financial assets and liabilities that the group uses. Treasury activities take place under<br />

procedures and policies approved and monitored by the Board to minimise the financial risk faced by the group. Interest bearing assets comprise<br />

cash and cash equivalents which are considered to be short-term liquid assets and loans to joint ventures. Interest bearing borrowings comprise<br />

bank loans, bank overdrafts and variable rate finance lease obligations. The rates of interest vary based on LIBOR in the UK and PRIME in South<br />

Africa.<br />

As at 31 December <strong>2017</strong>, with other variables unchanged, a 1% increase or decrease in interest rates, on investments and borrowings whose<br />

interest rates are not fixed, would respectively change the profit/loss for the year by £82,000 (2016: £56,000). The effect on equity of this change<br />

would be an equivalent decrease or increase for the year of £82,000 (2016: £56,000).<br />

Liquidity risk<br />

The group’s policy is to minimise refinancing risk. Efficient treasury management and strict credit control minimise the costs and risks associated with<br />

this policy which ensures that funds are available to meet commitments as they fall due. As at year end the group held borrowing facilities in the UK in<br />

Bisichi Mining <strong>PLC</strong> and in South Africa in Black Wattle Colliery (Pty) Ltd.<br />

<strong>2017</strong><br />

£’000<br />

2016<br />

£’000<br />

Bisichi Mining <strong>PLC</strong><br />

79