BISICHI MINING PLC ANNUAL REPORT 2017

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

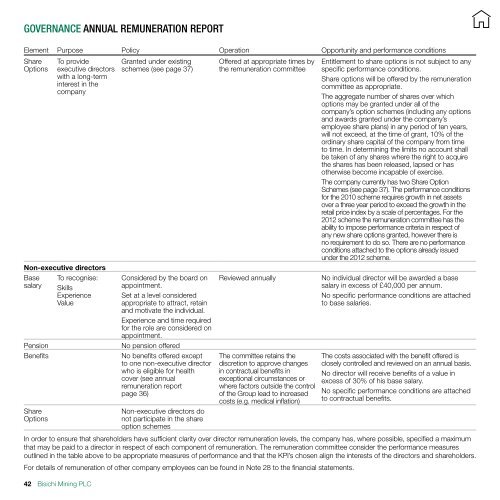

Governance Annual remuneration report<br />

Element Purpose Policy Operation Opportunity and performance conditions<br />

Share<br />

Options<br />

To provide<br />

executive directors<br />

with a long-term<br />

interest in the<br />

company<br />

Non-executive directors<br />

Base<br />

salary<br />

Pension<br />

Benefits<br />

Share<br />

Options<br />

To recognise:<br />

Skills<br />

Experience<br />

Value<br />

Granted under existing<br />

schemes (see page 37)<br />

Considered by the board on<br />

appointment.<br />

Set at a level considered<br />

appropriate to attract, retain<br />

and motivate the individual.<br />

Experience and time required<br />

for the role are considered on<br />

appointment.<br />

No pension offered<br />

No benefits offered except<br />

to one non-executive director<br />

who is eligible for health<br />

cover (see annual<br />

remuneration report<br />

page 36)<br />

Non-executive directors do<br />

not participate in the share<br />

option schemes<br />

Offered at appropriate times by<br />

the remuneration committee<br />

Reviewed annually<br />

The committee retains the<br />

discretion to approve changes<br />

in contractual benefits in<br />

exceptional circumstances or<br />

where factors outside the control<br />

of the Group lead to increased<br />

costs (e.g. medical inflation)<br />

Entitlement to share options is not subject to any<br />

specific performance conditions.<br />

Share options will be offered by the remuneration<br />

committee as appropriate.<br />

The aggregate number of shares over which<br />

options may be granted under all of the<br />

company’s option schemes (including any options<br />

and awards granted under the company’s<br />

employee share plans) in any period of ten years,<br />

will not exceed, at the time of grant, 10% of the<br />

ordinary share capital of the company from time<br />

to time. In determining the limits no account shall<br />

be taken of any shares where the right to acquire<br />

the shares has been released, lapsed or has<br />

otherwise become incapable of exercise.<br />

The company currently has two Share Option<br />

Schemes (see page 37). The performance conditions<br />

for the 2010 scheme requires growth in net assets<br />

over a three year period to exceed the growth in the<br />

retail price index by a scale of percentages. For the<br />

2012 scheme the remuneration committee has the<br />

ability to impose performance criteria in respect of<br />

any new share options granted, however there is<br />

no requirement to do so. There are no performance<br />

conditions attached to the options already issued<br />

under the 2012 scheme.<br />

No individual director will be awarded a base<br />

salary in excess of £40,000 per annum.<br />

No specific performance conditions are attached<br />

to base salaries.<br />

The costs associated with the benefit offered is<br />

closely controlled and reviewed on an annual basis.<br />

No director will receive benefits of a value in<br />

excess of 30% of his base salary.<br />

No specific performance conditions are attached<br />

to contractual benefits.<br />

In order to ensure that shareholders have sufficient clarity over director remuneration levels, the company has, where possible, specified a maximum<br />

that may be paid to a director in respect of each component of remuneration. The remuneration committee consider the performance measures<br />

outlined in the table above to be appropriate measures of performance and that the KPI’s chosen align the interests of the directors and shareholders.<br />

For details of remuneration of other company employees can be found in Note 28 to the financial statements.<br />

42 Bisichi Mining <strong>PLC</strong>