BISICHI MINING PLC ANNUAL REPORT 2017

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial statements Notes to the financial statements<br />

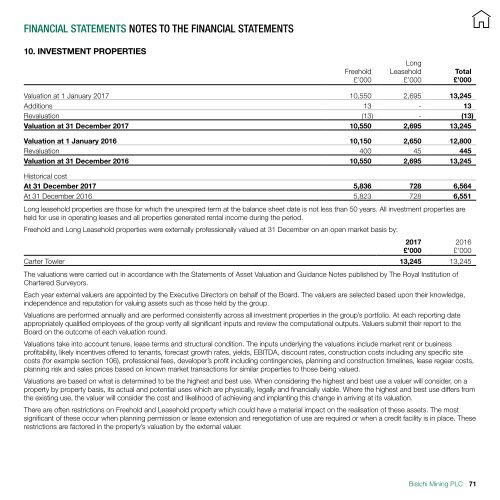

10. INVESTMENT PROPERTIES<br />

Freehold<br />

£’000<br />

Long<br />

Leasehold<br />

£’000<br />

Total<br />

£’000<br />

Valuation at 1 January <strong>2017</strong> 10,550 2,695 13,245<br />

Additions 13 - 13<br />

Revaluation (13) - (13)<br />

Valuation at 31 December <strong>2017</strong> 10,550 2,695 13,245<br />

Valuation at 1 January 2016 10,150 2,650 12,800<br />

Revaluation 400 45 445<br />

Valuation at 31 December 2016 10,550 2,695 13,245<br />

Historical cost<br />

At 31 December <strong>2017</strong> 5,836 728 6,564<br />

At 31 December 2016 5,823 728 6,551<br />

Long leasehold properties are those for which the unexpired term at the balance sheet date is not less than 50 years. All investment properties are<br />

held for use in operating leases and all properties generated rental income during the period.<br />

Freehold and Long Leasehold properties were externally professionally valued at 31 December on an open market basis by:<br />

Carter Towler 13,245 13,245<br />

The valuations were carried out in accordance with the Statements of Asset Valuation and Guidance Notes published by The Royal Institution of<br />

Chartered Surveyors.<br />

Each year external valuers are appointed by the Executive Directors on behalf of the Board. The valuers are selected based upon their knowledge,<br />

independence and reputation for valuing assets such as those held by the group.<br />

Valuations are performed annually and are performed consistently across all investment properties in the group’s portfolio. At each reporting date<br />

appropriately qualified employees of the group verify all significant inputs and review the computational outputs. Valuers submit their report to the<br />

Board on the outcome of each valuation round.<br />

Valuations take into account tenure, lease terms and structural condition. The inputs underlying the valuations include market rent or business<br />

profitability, likely incentives offered to tenants, forecast growth rates, yields, EBITDA, discount rates, construction costs including any specific site<br />

costs (for example section 106), professional fees, developer’s profit including contingencies, planning and construction timelines, lease regear costs,<br />

planning risk and sales prices based on known market transactions for similar properties to those being valued.<br />

Valuations are based on what is determined to be the highest and best use. When considering the highest and best use a valuer will consider, on a<br />

property by property basis, its actual and potential uses which are physically, legally and financially viable. Where the highest and best use differs from<br />

the existing use, the valuer will consider the cost and likelihood of achieving and implanting this change in arriving at its valuation.<br />

There are often restrictions on Freehold and Leasehold property which could have a material impact on the realisation of these assets. The most<br />

significant of these occur when planning permission or lease extension and renegotiation of use are required or when a credit facility is in place. These<br />

restrictions are factored in the property’s valuation by the external valuer.<br />

<strong>2017</strong><br />

£’000<br />

2016<br />

£’000<br />

Bisichi Mining <strong>PLC</strong><br />

71