BISICHI MINING PLC ANNUAL REPORT 2017

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial statements<br />

Group accounting policies<br />

for the year ended 31 December <strong>2017</strong><br />

Basis of accounting<br />

The results for the year ended 31 December<br />

<strong>2017</strong> have been prepared in accordance with<br />

International Financial Reporting Standards<br />

(IFRS) as adopted by the European Union and<br />

with those parts of the Companies Act 2006<br />

applicable to companies reporting under IFRS.<br />

In applying the group’s accounting policies and<br />

assessing areas of judgment and estimation<br />

materiality is applied as detailed on page 44<br />

of the Audit Committee Report. The principal<br />

accounting policies are described below:<br />

The group financial statements are presented<br />

in £ sterling and all values are rounded to the<br />

nearest thousand pounds (£000) except when<br />

otherwise stated.<br />

The functional currency for each entity in the<br />

group, and for joint arrangements and associates,<br />

is the currency of the country in which the entity<br />

has been incorporated. Details of which country<br />

each entity has been incorporated can be<br />

found in Note 14 for subsidiaries and Note 13<br />

for joint arrangements and associates.<br />

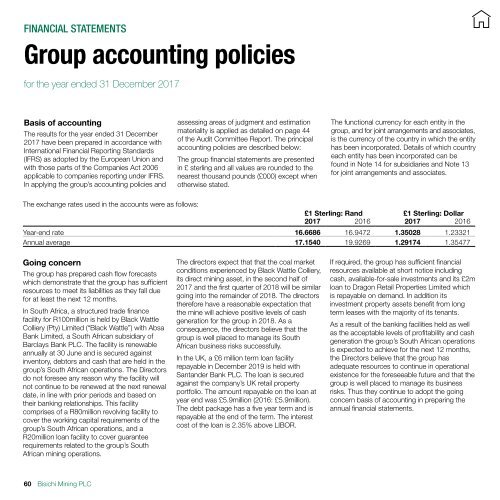

The exchange rates used in the accounts were as follows:<br />

£1 Sterling: Rand £1 Sterling: Dollar<br />

<strong>2017</strong> 2016 <strong>2017</strong> 2016<br />

Year-end rate 16.6686 16.9472 1.35028 1.23321<br />

Annual average 17.1540 19.9269 1.29174 1.35477<br />

Going concern<br />

The group has prepared cash flow forecasts<br />

which demonstrate that the group has sufficient<br />

resources to meet its liabilities as they fall due<br />

for at least the next 12 months.<br />

In South Africa, a structured trade finance<br />

facility for R100million is held by Black Wattle<br />

Colliery (Pty) Limited (“Black Wattle”) with Absa<br />

Bank Limited, a South African subsidiary of<br />

Barclays Bank <strong>PLC</strong>. The facility is renewable<br />

annually at 30 June and is secured against<br />

inventory, debtors and cash that are held in the<br />

group’s South African operations. The Directors<br />

do not foresee any reason why the facility will<br />

not continue to be renewed at the next renewal<br />

date, in line with prior periods and based on<br />

their banking relationships. This facility<br />

comprises of a R80million revolving facility to<br />

cover the working capital requirements of the<br />

group’s South African operations, and a<br />

R20million loan facility to cover guarantee<br />

requirements related to the group’s South<br />

African mining operations.<br />

The directors expect that that the coal market<br />

conditions experienced by Black Wattle Colliery,<br />

its direct mining asset, in the second half of<br />

<strong>2017</strong> and the first quarter of 2018 will be similar<br />

going into the remainder of 2018. The directors<br />

therefore have a reasonable expectation that<br />

the mine will achieve positive levels of cash<br />

generation for the group in 2018. As a<br />

consequence, the directors believe that the<br />

group is well placed to manage its South<br />

African business risks successfully.<br />

In the UK, a £6 million term loan facility<br />

repayable in December 2019 is held with<br />

Santander Bank <strong>PLC</strong>. The loan is secured<br />

against the company’s UK retail property<br />

portfolio. The amount repayable on the loan at<br />

year end was £5.9million (2016: £5.9million).<br />

The debt package has a five year term and is<br />

repayable at the end of the term. The interest<br />

cost of the loan is 2.35% above LIBOR.<br />

If required, the group has sufficient financial<br />

resources available at short notice including<br />

cash, available-for-sale investments and its £2m<br />

loan to Dragon Retail Properties Limited which<br />

is repayable on demand. In addition its<br />

investment property assets benefit from long<br />

term leases with the majority of its tenants.<br />

As a result of the banking facilities held as well<br />

as the acceptable levels of profitability and cash<br />

generation the group’s South African operations<br />

is expected to achieve for the next 12 months,<br />

the Directors believe that the group has<br />

adequate resources to continue in operational<br />

existence for the foreseeable future and that the<br />

group is well placed to manage its business<br />

risks. Thus they continue to adopt the going<br />

concern basis of accounting in preparing the<br />

annual financial statements.<br />

60 Bisichi Mining <strong>PLC</strong>