BISICHI MINING PLC ANNUAL REPORT 2017

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial statements Notes to the financial statements<br />

21. FINANCIAL INSTRUMENTS CONTINUED<br />

Foreign exchange risk<br />

All trading is undertaken in the local currencies except for certain export sales which are invoiced in dollars. It is not the group’s policy to obtain<br />

forward contracts to mitigate foreign exchange risk on these contracts as payment terms are within 15 days of invoice or earlier. Funding is also in<br />

local currencies other than inter-company investments and loans and it is also not the group’s policy to obtain forward contracts to mitigate foreign<br />

exchange risk on these amounts. During <strong>2017</strong> and 2016 the group did not hedge its exposure of foreign investments held in foreign currencies.<br />

The directors consider there to be no significant risk from exchange rate movements of foreign currencies against the functional currencies of the<br />

reporting companies within the group, excluding inter-company balances. The principle currency risk to which the group is exposed in regard to<br />

inter-company balances is the exchange rate between Pounds sterling and South African Rand. It arises as a result of the retranslation of Rand<br />

denominated inter-company trade receivable balances held within the UK which are payable by South African Rand functional currency subsidiaries.<br />

Based on the group’s net financial assets and liabilities as at 31 December <strong>2017</strong>, a 25% strengthening of Sterling against the South African Rand,<br />

with all other variables held constant, would decrease the group’s profit after taxation by £34,000 (2016: £435,000). A 25% weakening of Sterling<br />

against the South African Rand, with all other variables held constant would increase the group’s profit after taxation by £56,000 (2016: £725,000).<br />

The 25% sensitivity has been determined based on the average historic volatility of the exchange rate for 2016 and <strong>2017</strong>.<br />

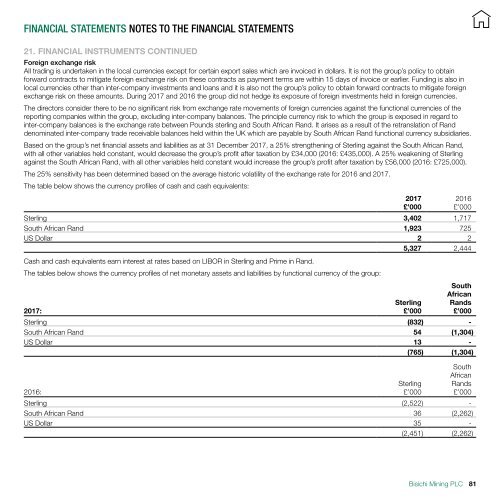

The table below shows the currency profiles of cash and cash equivalents:<br />

Sterling 3,402 1,717<br />

South African Rand 1,923 725<br />

US Dollar 2 2<br />

5,327 2,444<br />

Cash and cash equivalents earn interest at rates based on LIBOR in Sterling and Prime in Rand.<br />

The tables below shows the currency profiles of net monetary assets and liabilities by functional currency of the group:<br />

<strong>2017</strong>:<br />

<strong>2017</strong><br />

£’000<br />

Sterling<br />

£’000<br />

2016<br />

£’000<br />

South<br />

African<br />

Rands<br />

£’000<br />

Sterling (832) -<br />

South African Rand 54 (1,304)<br />

US Dollar 13 -<br />

(765) (1,304)<br />

2016:<br />

Sterling<br />

£’000<br />

South<br />

African<br />

Rands<br />

£’000<br />

Sterling (2,522) -<br />

South African Rand 36 (2,262)<br />

US Dollar 35 -<br />

(2,451) (2,262)<br />

Bisichi Mining <strong>PLC</strong><br />

81