BISICHI MINING PLC ANNUAL REPORT 2017

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial statements Notes to the financial statements<br />

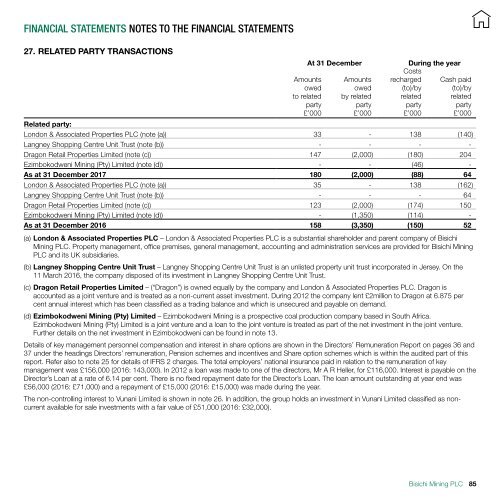

27. RELATED PARTY TRANSACTIONS<br />

Amounts<br />

owed<br />

to related<br />

party<br />

£’000<br />

At 31 December<br />

Amounts<br />

owed<br />

by related<br />

party<br />

£’000<br />

Costs<br />

recharged<br />

(to)/by<br />

related<br />

party<br />

£’000<br />

During the year<br />

Cash paid<br />

(to)/by<br />

related<br />

party<br />

£’000<br />

Related party:<br />

London & Associated Properties <strong>PLC</strong> (note (a)) 33 - 138 (140)<br />

Langney Shopping Centre Unit Trust (note (b)) - - - -<br />

Dragon Retail Properties Limited (note (c)) 147 (2,000) (180) 204<br />

Ezimbokodweni Mining (Pty) Limited (note (d)) - - (46) -<br />

As at 31 December <strong>2017</strong> 180 (2,000) (88) 64<br />

London & Associated Properties <strong>PLC</strong> (note (a)) 35 - 138 (162)<br />

Langney Shopping Centre Unit Trust (note (b)) - - - 64<br />

Dragon Retail Properties Limited (note (c)) 123 (2,000) (174) 150<br />

Ezimbokodweni Mining (Pty) Limited (note (d)) - (1,350) (114) -<br />

As at 31 December 2016 158 (3,350) (150) 52<br />

(a) London & Associated Properties <strong>PLC</strong> – London & Associated Properties <strong>PLC</strong> is a substantial shareholder and parent company of Bisichi<br />

Mining <strong>PLC</strong>. Property management, office premises, general management, accounting and administration services are provided for Bisichi Mining<br />

<strong>PLC</strong> and its UK subsidiaries.<br />

(b) Langney Shopping Centre Unit Trust – Langney Shopping Centre Unit Trust is an unlisted property unit trust incorporated in Jersey. On the<br />

11 March 2016, the company disposed of its investment in Langney Shopping Centre Unit Trust.<br />

(c) Dragon Retail Properties Limited – (“Dragon”) is owned equally by the company and London & Associated Properties <strong>PLC</strong>. Dragon is<br />

accounted as a joint venture and is treated as a non-current asset investment. During 2012 the company lent £2million to Dragon at 6.875 per<br />

cent annual interest which has been classified as a trading balance and which is unsecured and payable on demand.<br />

(d) Ezimbokodweni Mining (Pty) Limited – Ezimbokodweni Mining is a prospective coal production company based in South Africa.<br />

Ezimbokodweni Mining (Pty) Limited is a joint venture and a loan to the joint venture is treated as part of the net investment in the joint venture.<br />

Further details on the net investment in Ezimbokodweni can be found in note 13.<br />

Details of key management personnel compensation and interest in share options are shown in the Directors’ Remuneration Report on pages 36 and<br />

37 under the headings Directors’ remuneration, Pension schemes and incentives and Share option schemes which is within the audited part of this<br />

report. Refer also to note 25 for details of IFRS 2 charges. The total employers’ national insurance paid in relation to the remuneration of key<br />

management was £156,000 (2016: 143,000). In 2012 a loan was made to one of the directors, Mr A R Heller, for £116,000. Interest is payable on the<br />

Director’s Loan at a rate of 6.14 per cent. There is no fixed repayment date for the Director’s Loan. The loan amount outstanding at year end was<br />

£56,000 (2016: £71,000) and a repayment of £15,000 (2016: £15,000) was made during the year.<br />

The non-controlling interest to Vunani Limited is shown in note 26. In addition, the group holds an investment in Vunani Limited classified as noncurrent<br />

available for sale investments with a fair value of £51,000 (2016: £32,000).<br />

Bisichi Mining <strong>PLC</strong><br />

85