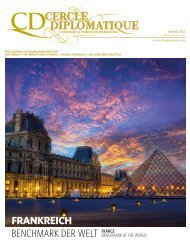

CERCLE DIPLOMATIQUE - issue 01/2020

CD is an independent and impartial magazine and is the medium of communication between foreign representatives of international and UN-organisations based in Vienna and the Austrian political classes, business, culture and tourism. CD features up-to-date information about and for the diplomatic corps, international organisations, society, politics, business, tourism, fashion and culture. Furthermore CD introduces the new ambassadors in Austria and informs about designations, awards and top-events. Interviews with leading personalities, country reports from all over the world and the presentation of Austria as a host country complement the wide range oft he magazine.

CD is an independent and impartial magazine and is the medium of communication between foreign representatives of international and UN-organisations based in Vienna and the Austrian political classes, business, culture and tourism. CD features up-to-date information about and for the diplomatic corps, international organisations, society, politics, business, tourism, fashion and culture. Furthermore CD introduces the new ambassadors in Austria and informs about designations, awards and top-events. Interviews with leading personalities, country reports from all over the world and the presentation of Austria as a host country complement the wide range oft he magazine.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

L’AUTRICHE ALTERNATIVE INVESTMENTS

Whisky Macallan 1926,

in einer Auktion verkauft

um 1,7 Millionen Euro.

Whisky Macallan 1926,

sold in an auction for 1.7

million euros.

Gemälde: „Vertiefte Regung“ (1928) von Wassily Kandinsky (links) und „Propped“ von Jenny Saville

(verkauft für 9,5 Millionen Pfund bei Sotheby‘s). Paintings: “Vertiefte Regung“ (“Deepened emotion“; 1928)

by Wassily Kandinsky (left) and „Propped“ by Jenny Saville (sold for £ 9.5 million at Sotheby‘s).

von Jeff Koons im Mai 2019 um rund 91

Millionen US-Dollar den Besitzer. Damit

wurde der Stahl-Hase zum teuersten Werk

eines noch lebenden Künstlers. In Summe

geht es aber auch billiger. Laut Artprice.

com wurden im ersten Halbjahr 2019 weltweit

44.203 Kunstwerke versteigert. Knapp

80 Prozent davon erzielten einen Preis zwischen

5.000 und 50.000 US-Dollar. Im

Schnitt war laut den Experten von Artprice

bis Mitte 2019 mit Kunstwerken bei einer

Behaltedauer von 13 Jahren eine jährliche

Rendite von 4,6 Prozent zu erzielen. Auf

Basis einer Auswertung für die Preisentwicklung

von 1.850 Kunstwerken zeigt sich

wiederum, dass ein Investment in Kunst

nicht automatisch von Erfolg gekrönt ist.

Bei 51 Prozent der Werke stieg der Preis,

bei 48 Prozent ging er zurück.

Bei Veranlagungen in alte Autos, die

auch als Garagengold gelten, sind die im

italienischen Maranello erzeugten Sportwagen

von Ferrari das Maß der Dinge. Das

gilt nicht nur wegen des 2018 versteigerten

GTO 250, der einen Preis von 70 Millionen

US-Dollar erzielte. Zwischen Anfang 2007

und Anfang 2016 stiegen die Preise für historische

Ferraris fast um 600 Prozent. Danach

gaben die Preise laut dem Hagerty´s

Ferrari Index aber um rund zehn Prozent

nach. Fast deckungsgleich entwickelten

sich die Preise deutscher Nachkriegsautos

von Porsche bis hin zu Sammlerstücken

von Mercedes Benz. Wer sich vergleichsweise

günstige Autos von Mercedes, BMW

oder Volkswagen, die in den 1980er- oder

1990er-Jahren gebaut wurden, in die Garage

stellte, blickt weiter auf gute Renditen.

Wer schon lange in Gold investiert hat,

blickt auf ansehnliche Gewinne. Hat sich

doch der Preis, in Euro gerechnet, seit 1980

verdreifacht. Aber auch bei Gold als Geldanlage

ist zeitweise Geduld gefragt. So

sackte der Goldkurs von Oktober 2012 bis

Ende 2013 um 38 Prozent ab. Erst ab

Herbstanfang 2018 zog der Preis wieder an.

How much can a car cost? The

answer is up to 70 million US dollars.

That‘s how much an American

businessman turned over at an auction

in 2018 for a Ferrari 250 GTO of which

only 36 were built. Even with noble crescences

you have to be wealthy to get a rare

specimen. For example, last year a bottle of

Macallan Whisky from 1926 changed

hands for 1.7 million euros.

In 2019, many stock markets performed

well. But it is good to have a plan B and to

make investments outside the financial

markets. There are enough alternatives.

These include paintings and sculptures, exquisite

whiskeys and wines as well as precious

stones, gold or even old cars.

Thomas Schröck, head of the gemstone

specialist The Natural Gem: „Gemstones

are a still little-known upscale asset class.

In investments, the red ruby, blue sapphire

and green emerald are the blue chips.

White diamond is not exciting.“ This is

shown by the returns achieved since the financial

crisis. For diamonds, prices have

remained almost constant since 2008.

Emeralds gained on average four percent in

value annually. Blue sapphires gained six

percent annually. For the rarest stone, red

ruby, the increase in value was eight percent

annually.

Where the first whisky was distilled is

unclear. Irish and Scotsmen are still arguing

today about who invented the drink

originally called the „water of life“.

Whoever chooses whisky as a financial investment

should focus on Scottish single

malts. Among the most sought-after crescents

are products from the distilleries

Macallan, Ardbeg, Bowmore, Dalmore,

Springbank, Lagavulin, Glenmorangie or

Laphroaig. In addition, there are whisk(e)

ys from Karuizawa in Japan and the Irish

Scotch Island. Among the most valuable

ones are those distilled before 1975. The

age and quality of the casks are also reflected

in the price.

The return potential of whisk(e)ys is

shown by the Rare Whisky Apex 1000 Index

which reflects the price development of

1,000 single malt Scotch whiskys in demand.

Between the end of 2010 and the

end of January this year, the whisky barometer

rose by 557 per cent, also fueled by

high demand from China, India and Singapore.

According to real estate consultant

Knight Frank, rare whisk(e)y was even the

PHOTOS: BARNEBYS, DALIM, BEIGESTELLT

best alternative asset class in 2018 with a 40

percent increase in value. But the pace cannot

always be kept up. This was evident last

year when the Whisky Apex 1000 Index

rose by only seven percent. It should also

be noted that the index is calculated on the

basis of the performance of bottles, some of

which are very rare, that were auctioned.

In the ranking of the most expensive

whiskys, products from the Macallan Distillery

are in the top five places. Since 2010,

the price per bottle paid at auctions has

ranged from 367,000 to 1.7 million euros.

This is followed by bottles from Dalmore,

Bowmore and Yamazaki, some of which

are more than 60 years old and have fetched

auction proceeds of 114,000 to

145,000 euros. One should not assume that

every bottle of the brown liquid increases

in value. And it is not advisable to buy in

internet shops or at online auctions that are

not specialised in whisk(e)ys, as fake bottles

keep turning up.

In 1945, the Domaine de la Romanée-

Conti winery in Burgundy, France, produced

600 bottles of red wine. Two bottles

came under the hammer at Sotheby‘s New

York in October 2018. One achieved a price

of 558,000 dollars, making it the most

expensive wine in the world. For years, the

purchase of top wines has been worthwhile.

This is shown by the Liv-ex Fine Wine 100

Index, which tracks the performance of 95

of the world‘s best collector‘s wines and five

champagnes. On a five-year view, the index

rose by 27 percent. But setbacks are also

possible. For example, the index fell by 32

percent from mid-2011 to the end of March

2014. Therefore, even an investment in top

wines is no guarantee for lasting capital

growth. In general, value increases are possible

with “Collectibles“, which are

collector‘s items. These are mostly pressed

by top French winemakers in the Bordeaux,

Burgundy and Rhône growing regions.

In mid-May 2019, Claude Monet‘s painting

“Meules“, created in 1890, went under

the hammer at Sotheby‘s New York. The

painting found a buyer for 110.7 million

US dollars. This work shows how, ideally, a

fortune can be made with art. In 1986, the

painting was worth 2.5 million dollars,

only a fraction of the last proceeds.

Also, for sculptures lovers dig deep into

their pockets. For example, Jeff Koons‘

one-meter-high, stainless steel sculpture

“Rabbit“, created in 1986, changed hands

for around 91 million US dollars in May

2019. The steel rabbit thus became the most

expensive work by an artist still alive. But

there are also cheaper options.

According to Artprice.com,

44,203 works of art were auctioned

off worldwide in the

first half of 2019. Almost 80

percent of them fetched a price

between 5,000 and 50,000 US

dollars. According to Artprice

experts, an average annual return

of 4.6 percent could be

achieved by mid-2019 with

works of art with a retention

period of 13 years. On the basis

of an evaluation of the price development

of 1,850 works of art, it is again clear that

an investment in art is not automatically

crowned with success. For 51 percent of the

works, the price rose, for 48 percent it fell.

When it comes to investments in old

cars, which are also considered garage gold,

Ferrari‘s sports cars produced in Maranello,

Italy, are the measure of all things. This

is not only because of the GTO 250, which

was auctioned in 2018 and fetched a price

of 70 million US dollars. Between the beginning

of 2007 and the beginning of 2016,

prices for historic Ferraris rose by almost

600 percent. After that, however, prices fell

by around ten percent according to the

Hagerty‘s Ferrari Index. The prices of German

post-war cars ranging from Porsche to

Mercedes Benz collector‘s items developed

almost identically. Those who put comparatively

inexpensive cars from Mercedes,

BMW or Volkswagen, built in the 1980s or

1990s, into their garages can still look forward

to good returns.

Anyone who has invested

in gold for a long time made

considerable profits. The price

in euro has tripled since

1980. But even with gold as an

investment, patience is required

at times. For example, the

price of gold plummeted by

38 percent from October

2012 to the end of 2013. Only

from the beginning of autumn

2018 did the price rise

again.

Skulptur „Rabbit“ von Jeff

Koons – 91 Millionen

US-Dollar Auktionserlös.

Sculpture “Rabbit“ by Jeff

Koons, sold in an auction for

91 million US dollar.

80 Cercle Diplomatique 1/2020

Cercle Diplomatique 1/2020

81