You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

SPECIAL FEATURE: ASIA-PACIFIC FLIGHT ACTIVITY <strong>2020</strong> JAN-AUG<br />

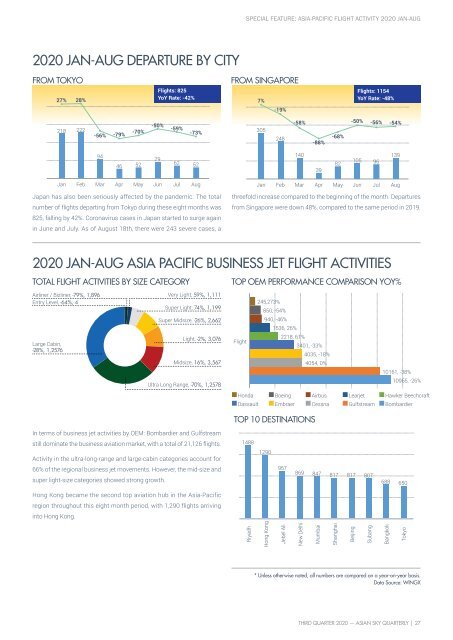

<strong>2020</strong> JAN-AUG DEPARTURE BY CITY<br />

FROM TOKYO<br />

27%<br />

28%<br />

Flights: 825<br />

YoY Rate: -42%<br />

FROM SINGAPORE<br />

7%<br />

Flights: 1154<br />

YoY Rate: -48%<br />

-19%<br />

218<br />

222<br />

-56%<br />

-79%<br />

-70%<br />

-50%<br />

-59%<br />

-73%<br />

305<br />

248<br />

-58%<br />

-88%<br />

-68%<br />

-50%<br />

-56%<br />

-54%<br />

94<br />

46<br />

52<br />

79<br />

62<br />

52<br />

140<br />

39<br />

82<br />

105<br />

96<br />

139<br />

Jan<br />

Feb<br />

Mar<br />

Apr<br />

May<br />

Jun<br />

Jul<br />

Aug<br />

Jan<br />

Feb<br />

Mar<br />

Apr<br />

May<br />

Jun<br />

Jul<br />

Aug<br />

Japan has also been seriously affected by the pandemic. The total<br />

number of flights departing from Tokyo during these eight months was<br />

825, falling by 42%. Coronavirus cases in Japan started to surge again<br />

in June and July. As of August 18th, there were 243 severe cases, a<br />

threefold increase compared to the beginning of the month. Departures<br />

from Singapore were down 48%, compared to the same period in 2019.<br />

<strong>2020</strong> JAN-AUG ASIA PACIFIC BUSINESS JET FLIGHT ACTIVITIES<br />

TOTAL FLIGHT ACTIVITIES BY SIZE CATEGORY<br />

TOP OEM PERFORMANCE COMPARISON YOY%<br />

Airliner / Bizliner, -79%, 1,896<br />

Entry Level, -64%, 4<br />

Large Cabin,<br />

-28%, 1,2576<br />

Very Light, 59%, 1,111<br />

Super Light, 74%, 1,199<br />

Super Midsize, -26%, 2,662<br />

Light, -2%, 3,076<br />

Midsize, 16%, 3,567<br />

Ultra Long Range, -70%, 1,2578<br />

Flight<br />

245,273%<br />

850, -54%<br />

940, -46%<br />

1536, 26%<br />

2218, 61%<br />

3401, -33%<br />

4035, -18%<br />

4054, 0%<br />

10161, -38%<br />

10965, -26%<br />

Honda<br />

Dassault<br />

Boeing<br />

Embraer<br />

Airbus<br />

Cessna<br />

Learjet<br />

Gulfstream<br />

Hawker Beechcraft<br />

Bombardier<br />

TOP 10 DESTINATIONS<br />

In terms of business jet activities by OEM: Bombardier and Gulfstream<br />

still dominate the business aviation market, with a total of 21,126 flights.<br />

Activity in the ultra-long-range and large-cabin categories account for<br />

66% of the regional business jet movements. However, the mid-size and<br />

super light-size categories showed strong growth.<br />

1488<br />

1290<br />

957<br />

869<br />

847<br />

817 817<br />

807<br />

688<br />

650<br />

Hong Kong became the second top aviation hub in the Asia-Pacific<br />

region throughout this eight month period, with 1,290 flights arriving<br />

into Hong Kong.<br />

Riyadh<br />

Hong Kong<br />

Jebel Ali<br />

New Delhi<br />

Mumbai<br />

Shanghai<br />

Beijing<br />

Subang<br />

Bangkok<br />

Tokyo<br />

* Unless otherwise noted, all numbers are compared on a year-on-year basis.<br />

Data Source: WINGX<br />

THIRD QUARTER <strong>2020</strong> — ASIAN SKY QUARTERLY | 27