You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

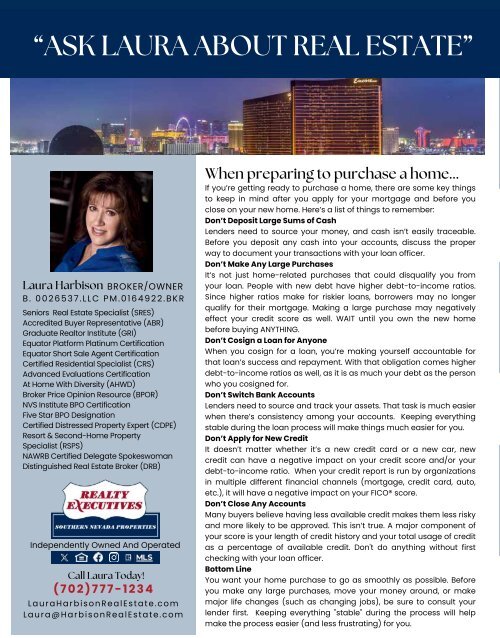

“ASK LAURA ABOUT REAL ESTATE”<br />

Laura Harbison BROKER/OWNER<br />

B. 0026537.LLC PM.0164922.BKR<br />

Seniors Real Estate Specialist (SRES)<br />

Accredited Buyer Representative (ABR)<br />

Graduate Realtor Institute (GRI)<br />

Equator Platform Platinum Certification<br />

Equator Short Sale Agent Certification<br />

Certified Residential Specialist (CRS)<br />

Advanced Evaluations Certification<br />

At Home With Diversity (AHWD)<br />

Broker Price Opinion Resource (BPOR)<br />

NVS Institute BPO Certification<br />

Five Star BPO Designation<br />

Certified Distressed Property Expert (CDPE)<br />

Resort & Second-Home Property<br />

Specialist (RSPS)<br />

NAWRB Certified Delegate Spokeswoman<br />

Distinguished Real Estate Broker (DRB)<br />

Independently Owned And Operated<br />

Call Laura Today!<br />

(702)777-1234<br />

LauraHarbisonRealEstate.com<br />

Laura@HarbisonRealEstate.com<br />

2<br />

February 2024<br />

When preparing to purchase a home...<br />

If you’re getting ready to purchase a home, there are some key things<br />

to keep in mind after you apply for your mortgage and before you<br />

close on your new home. Here’s a list of things to remember:<br />

Don’t Deposit Large Sums of Cash<br />

Lenders need to source your money, and cash isn’t easily traceable.<br />

Before you deposit any cash into your accounts, discuss the proper<br />

way to document your transactions with your loan officer.<br />

Don’t Make Any Large Purchases<br />

It’s not just home-related purchases that could disqualify you from<br />

your loan. People with new debt have higher debt-to-income ratios.<br />

Since higher ratios make for riskier loans, borrowers may no longer<br />

qualify for their mortgage. Making a large purchase may negatively<br />

effect your credit score as well. WAIT until you own the new home<br />

before buying ANYTHING.<br />

Don’t Cosign a Loan for Anyone<br />

When you cosign for a loan, you’re making yourself accountable for<br />

that loan’s success and repayment. With that obligation comes higher<br />

debt-to-income ratios as well, as it is as much your debt as the person<br />

who you cosigned for.<br />

Don’t Switch Bank Accounts<br />

Lenders need to source and track your assets. That task is much easier<br />

when there’s consistency among your accounts. Keeping everything<br />

stable during the loan process will make things much easier for you.<br />

Don’t Apply for New Credit<br />

It doesn’t matter whether it’s a new credit card or a new car, new<br />

credit can have a negative impact on your credit score and/or your<br />

debt-to-income ratio. When your credit report is run by organizations<br />

in multiple different financial channels (mortgage, credit card, auto,<br />

etc.), it will have a negative impact on your FICO® score.<br />

Don’t Close Any Accounts<br />

Many buyers believe having less available credit makes them less risky<br />

and more likely to be approved. This isn’t true. A major component of<br />

your score is your length of credit history and your total usage of credit<br />

as a percentage of available credit. Don't do anything without first<br />

checking with your loan officer.<br />

Bottom Line<br />

You want your home purchase to go as smoothly as possible. Before<br />

you make any large purchases, move your money around, or make<br />

major life changes (such as changing jobs), be sure to consult your<br />

lender first. Keeping everything "stable" during the process will help<br />

make the process easier (and less frustrating) for you.