Ties That Bind - Bay Area Council Economic Institute

Ties That Bind - Bay Area Council Economic Institute

Ties That Bind - Bay Area Council Economic Institute

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

120<br />

<strong>Ties</strong> <strong>That</strong> <strong>Bind</strong><br />

IDMs such as Intel, Texas Instruments and NEC). The next largest foundries are China’s Semiconductor<br />

Manufacturing International Corp. (SMIC), Singapore’s Chartered Semiconductor<br />

Manufacturing, IBM, Japan’s NEC Corp. and two South Korean foundries. Taiwan chip companies,<br />

designers and producers earned $34 billion in revenues in 2005—nearly four times the $8.7<br />

billion total for mainland firms.<br />

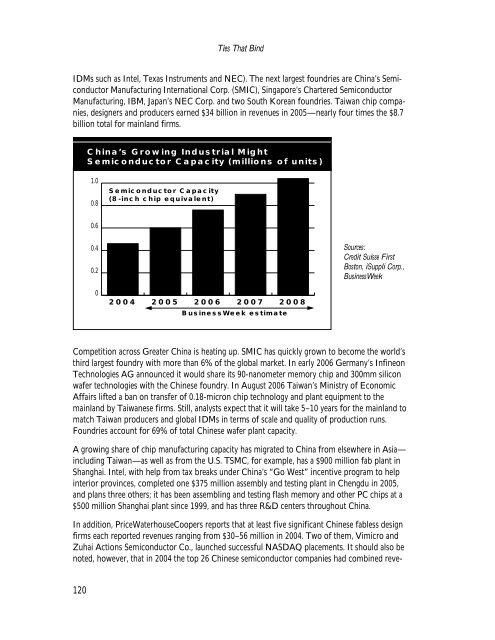

China’s Growing Industrial Might<br />

Semiconductor Capacity (millions of units)<br />

1.0<br />

0.8<br />

0.6<br />

0.4<br />

0.2<br />

0<br />

Semiconductor Capacity<br />

(8-inch chip equivalent)<br />

2004<br />

2005 2006 2007 2008<br />

BusinessWeek estimate<br />

Sources:<br />

Credit Suisse First<br />

Boston, iSuppli Corp.,<br />

BusinessWeek<br />

Competition across Greater China is heating up. SMIC has quickly grown to become the world’s<br />

third largest foundry with more than 6% of the global market. In early 2006 Germany’s Infineon<br />

Technologies AG announced it would share its 90-nanometer memory chip and 300mm silicon<br />

wafer technologies with the Chinese foundry. In August 2006 Taiwan’s Ministry of <strong>Economic</strong><br />

Affairs lifted a ban on transfer of 0.18-micron chip technology and plant equipment to the<br />

mainland by Taiwanese firms. Still, analysts expect that it will take 5–10 years for the mainland to<br />

match Taiwan producers and global IDMs in terms of scale and quality of production runs.<br />

Foundries account for 69% of total Chinese wafer plant capacity.<br />

A growing share of chip manufacturing capacity has migrated to China from elsewhere in Asia—<br />

including Taiwan—as well as from the U.S. TSMC, for example, has a $900 million fab plant in<br />

Shanghai. Intel, with help from tax breaks under China’s “Go West” incentive program to help<br />

interior provinces, completed one $375 million assembly and testing plant in Chengdu in 2005,<br />

and plans three others; it has been assembling and testing flash memory and other PC chips at a<br />

$500 million Shanghai plant since 1999, and has three R&D centers throughout China.<br />

In addition, PriceWaterhouseCoopers reports that at least five significant Chinese fabless design<br />

firms each reported revenues ranging from $30–56 million in 2004. Two of them, Vimicro and<br />

Zuhai Actions Semiconductor Co., launched successful NASDAQ placements. It should also be<br />

noted, however, that in 2004 the top 26 Chinese semiconductor companies had combined reve-