Official Gazette n° 02 of 10/01/2011 44 AMABWIRIZA ... - e-tegeko

Official Gazette n° 02 of 10/01/2011 44 AMABWIRIZA ... - e-tegeko

Official Gazette n° 02 of 10/01/2011 44 AMABWIRIZA ... - e-tegeko

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

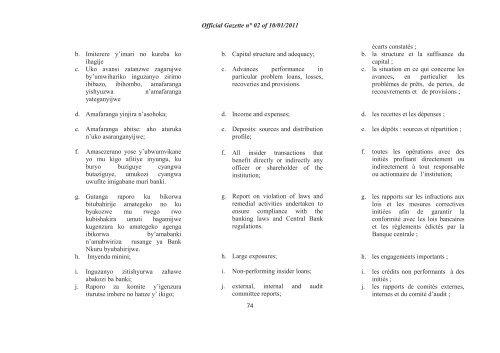

. Imiterere y’imari no kureba ko<br />

ihagije<br />

c. Uko avansi zatanzwe zagarujwe<br />

by’umwihariko inguzanyo zirimo<br />

ibibazo, ibihombo, amafaranga<br />

yishyuzwa n’amafaranga<br />

yateganyijwe<br />

d. Amafaranga yinjira n’asohoka;<br />

e. Amafaranga abitse: aho aturuka<br />

n’uko asaranganyijwe;<br />

f. Amasezerano yose y’ubwumvikane<br />

yo mu kigo afitiye inyungu, ku<br />

buryo buziguye cyangwa<br />

butaziguye, umukozi cyangwa<br />

uwufite imigabane muri banki.<br />

g. Gutanga raporo ku bikorwa<br />

bitubahirije ama<strong>tegeko</strong> no ku<br />

byakozwe mu rwego rwo<br />

kubishakira umuti hagamijwe<br />

kugenzura ko ama<strong>tegeko</strong> agenga<br />

ibikorwa by’amabanki<br />

n’amabwiriza rusange ya Bank<br />

Nkuru byubahirijwe.<br />

h. Imyenda minini;<br />

i. Inguzanyo zitishyurwa zahawe<br />

abakozi ba banki;<br />

j. Raporo za komite y’igenzura<br />

iturutse imbere no hanze y’ ikigo;<br />

<strong>Official</strong> <strong>Gazette</strong> <strong>n°</strong> <strong>02</strong> <strong>of</strong> <strong>10</strong>/<strong>01</strong>/2<strong>01</strong>1<br />

b. Capital structure and adequacy;<br />

c. Advances performance in<br />

particular problem loans, losses,<br />

recoveries and provisions.<br />

d. Income and expenses;<br />

e. Deposits: sources and distribution<br />

pr<strong>of</strong>ile;<br />

f. All insider transactions that<br />

benefit directly or indirectly any<br />

<strong>of</strong>ficer or shareholder <strong>of</strong> the<br />

institution;<br />

g. Report on violation <strong>of</strong> laws and<br />

remedial activities undertaken to<br />

ensure compliance with the<br />

banking laws and Central Bank<br />

regulations.<br />

h. Large exposures;<br />

i. Non-performing insider loans;<br />

j. external, internal and audit<br />

committee reports;<br />

74<br />

écarts constatés ;<br />

b. la structure et la suffisance du<br />

capital ;<br />

c. la situation en ce qui concerne les<br />

avances, en particulier les<br />

problèmes de prêts, de pertes, de<br />

recouvrements et de provisions ;<br />

d. les recettes et les dépenses ;<br />

e. les dépôts : sources et répartition ;<br />

f. toutes les opérations avec des<br />

initiés pr<strong>of</strong>itant directement ou<br />

indirectement à tout responsable<br />

ou actionnaire de l’institution;<br />

g. les rapports sur les infractions aux<br />

lois et les mesures correctives<br />

initiées afin de garantir la<br />

conformité avec les lois bancaires<br />

et les règlements édictés par la<br />

Banque centrale ;<br />

h. les engagements importants ;<br />

i. les crédits non performants à des<br />

initiés ;<br />

j. les rapports de comités externes,<br />

internes et du comité d’audit ;