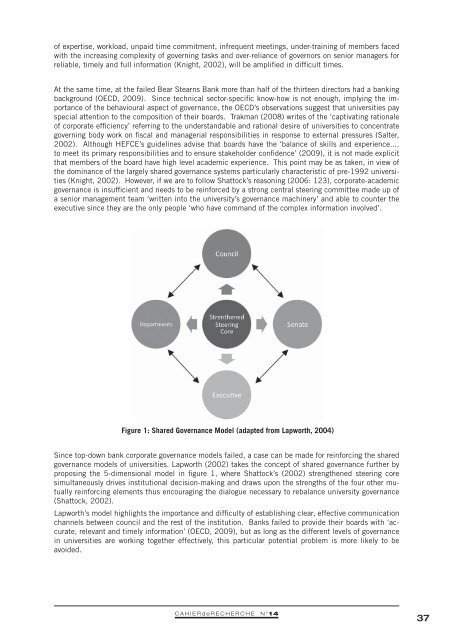

of expertise, workload, unpaid time commitment, infrequent meetings, un<strong>de</strong>r-training of members facedwith the increasing complexity of governing tasks and over-reliance of governors on senior managers forreliable, timely and full information (Knight, 2002), will be amplified in difficult times.At the same time, at the failed Bear Stearns Bank more than half of the thirteen directors had a bankingbackground (OECD, 2009). Since technical sector-specific know-how is not enough, implying the importanceof the behavioural aspect of governance, the OECD’s observations suggest that universities payspecial attention to the composition of their boards. Trakman (2008) writes of the ‘captivating rationaleof corporate efficiency’ referring to the un<strong>de</strong>rstandable and rational <strong>de</strong>sire of universities to concentrategoverning body work on fiscal and managerial responsibilities in response to external pressures (Salter,2002). Although HEFCE’s gui<strong>de</strong>lines advise that boards have the ‘balance of skills and experience....to meet its primary responsibilities and to ensure stakehol<strong>de</strong>r confi<strong>de</strong>nce’ (2009), it is not ma<strong>de</strong> explicitthat members of the board have high level aca<strong>de</strong>mic experience. This point may be as taken, in view ofthe dominance of the largely shared governance systems particularly characteristic of pre-1992 universities(Knight, 2002). However, if we are to follow Shattock’s reasoning (2006: 123), corporate-aca<strong>de</strong>micgovernance is insufficient and needs to be reinforced by a strong central steering committee ma<strong>de</strong> up ofa senior management team ‘written into the university’s governance machinery’ and able to counter theexecutive since they are the only people ‘who have command of the complex information involved’.Figure 1: Shared Governance Mo<strong>de</strong>l (adapted from Lapworth, 2004)Since top-down bank corporate governance mo<strong>de</strong>ls failed, a case can be ma<strong>de</strong> for reinforcing the sharedgovernance mo<strong>de</strong>ls of universities. Lapworth (2002) takes the concept of shared governance further byproposing the 5-dimensional mo<strong>de</strong>l in figure 1, where Shattock’s (2002) strengthened steering coresimultaneously drives institutional <strong>de</strong>cision-making and draws upon the strengths of the four other mutuallyreinforcing elements thus encouraging the dialogue necessary to rebalance university governance(Shattock, 2002).Lapworth’s mo<strong>de</strong>l highlights the importance and difficulty of establishing clear, effective communicationchannels between council and the rest of the institution. Banks failed to provi<strong>de</strong> their boards with ‘accurate,relevant and timely information’ (OECD, 2009), but as long as the different levels of governancein universities are working together effectively, this particular potential problem is more likely to beavoi<strong>de</strong>d.CAHIER<strong>de</strong>RECHERCHE N°1437

By ‘extending right through the institution’ and incorporating the ‘countervailing effect’ of aca<strong>de</strong>micboards and communities (Shattock, 2006: 1, 2-3), shared governance limits the exposure of institutionsto weak governance and reinforces the overseeing and <strong>de</strong>cision-making roles of the governing body, evenif ‘planning from the top is one thing, implementation quite another’ (Dearlove, 2002). At the sametime, appropriate and regular training should be given to governing members to enable them to fulfiltheir responsibilities. If the gui<strong>de</strong>lines provi<strong>de</strong>d for in the Co<strong>de</strong> of Practice un<strong>de</strong>r sections on ‘induction’and ‘further <strong>de</strong>velopment’ are followed by universities, then the supervisory <strong>de</strong>ficiencies highlighted atNorthern Rock and put down partly to ina<strong>de</strong>quate supervisory staff resources and training (OECD, 2009)could at least be addressed.2. Due ProcessManaging the agenda and owning the business are linked to the monitoring issues discussed above,and recalls Governors’ responsibility for ‘the proper conduct of public business’ (Shattock, 2006: 132).The UBS sharehol<strong>de</strong>r report on write-downs (2008) said sub-prime issues were brought up on severaloccasions to board, but were not acted upon partly due to an over-charged agenda. Similarly, UBS un<strong>de</strong>rlinesthe ineffectiveness of committees in ‘owning the business and its members’ inability to criticallychallenge each other on the <strong>de</strong>velopment of new enterprises’. It has been observed that bank boardswere generally good at approving strategies, but performed less well in monitoring implementation andthat ‘issues are increasingly becoming too specialist for meaningful oversight by the whole board’ (UBS,2008: 47). This says much about the potential difficulties of managing due process, arising from thepressure of events, the apathy of members and what would appear to be a lack of commitment at crucialmoments. None of this is new to HEIs, where <strong>de</strong>ficiencies in overseeing ‘the proper conduct of publicbusiness’ have been i<strong>de</strong>ntified by Shattock (2006: 131-132), and for whom the crux of such difficultieslies in most governing body members being non-executives and university secretaries often failing ina<strong>de</strong>quately informing them about business. Concerning actual university board activity, Bennett (2002)reports the following figures:• Only 10.2% of items submitted gave rise to questioning or challenging from the board.• Each item, on average, was given about 2 minutes of board time.• Only 35% of governors had received any induction training.• Only 26% had received any <strong>de</strong>velopment training.• It takes 18 months for a new member to build up the necessary knowledge and experienceto make an effective contribution.Such documented experience of HE governance challenges and breakdowns, plus the reports from thebanking sector serve as a remin<strong>de</strong>r that as privately managed public sector institutions (Bennett, 2002)imparting major, complex and wi<strong>de</strong> responsibilities on generally untrained and over-committed lay governingbody members, universities should be able to provi<strong>de</strong> them with ‘professional support’ (Shattock,2006: 132) if governance is to be effective. This will be even more so as we move into an increasinglychallenging era for university management.38CAHIER<strong>de</strong>RECHERCHE N°14

- Page 1 and 2: CAHIERdeRECHERCHE N°14Institut de

- Page 4: SommaireComment classer les actionn

- Page 7 and 8: RésuméA l’origine, la théorie

- Page 9 and 10: influence via un contrôle externe

- Page 12 and 13: La très grande richesse des travau

- Page 14 and 15: a prévalu pendant de nombreuses an

- Page 16 and 17: Lorsque l’actionnariat a majorita

- Page 18 and 19: ConclusionAinsi, il existe différe

- Page 20 and 21: Huynh, Q. T. (2009), L’influence

- Page 22 and 23: Intrinsic Motivation,Tacit Knowledg

- Page 24 and 25: IntroductionAlthough the importance

- Page 26 and 27: to direct the ability to balance th

- Page 28 and 29: The empirical material is elicited

- Page 30 and 31: on after I am gone. It is of no use

- Page 32 and 33: ReferencesAnderson JR (1982), “Ac

- Page 34 and 35: CAHIERdeRECHERCHE N°1433

- Page 36 and 37: University Corporate Governancein t

- Page 40 and 41: 3. Scenario PlanningUncertainty is

- Page 42 and 43: 6. Risk GovernanceRisk governance i

- Page 44 and 45: ReferencesBaird, J. (2007) ‘Takin

- Page 46 and 47: CAHIERdeRECHERCHE N°1445

- Page 48 and 49: Une analyse de la gestionde la perf

- Page 50 and 51: I. Les outils de gestion de la perf

- Page 52 and 53: définissant les finalités des act

- Page 54 and 55: Pour trois-quarts des collectivité

- Page 56 and 57: Au-delà de leur relative nouveaut

- Page 58 and 59: 2. Une mise en œuvre opérationnel

- Page 60 and 61: Or, une démarche de performance se

- Page 62 and 63: 3. L’adaptation du système local

- Page 64 and 65: esponsabilisation et d’évaluatio

- Page 66 and 67: I. NONAKA, “A dynamic theory of o

- Page 68: PROGRAMME GRANDE ÉCOLE, GRADE MAST