Revista Tinerilor EconomiÅti - Centru E-learning de Instruire al ...

Revista Tinerilor EconomiÅti - Centru E-learning de Instruire al ...

Revista Tinerilor EconomiÅti - Centru E-learning de Instruire al ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

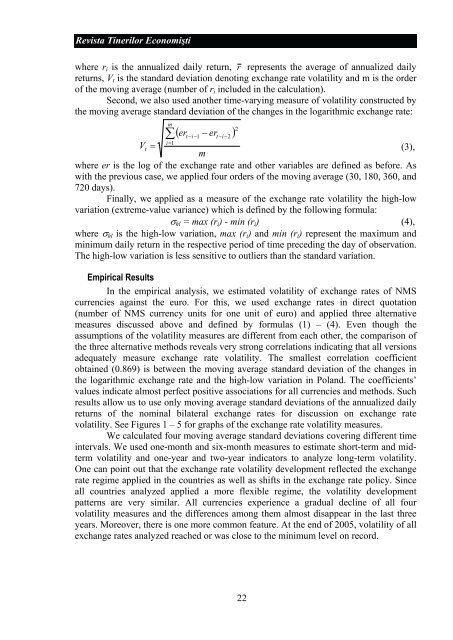

<strong>Revista</strong> <strong>Tinerilor</strong> Economiştiwhere r i is the annu<strong>al</strong>ized daily return, r represents the average of annu<strong>al</strong>ized dailyreturns, V t is the standard <strong>de</strong>viation <strong>de</strong>noting exchange rate volatility and m is the or<strong>de</strong>rof the moving average (number of r i inclu<strong>de</strong>d in the c<strong>al</strong>culation).Second, we <strong>al</strong>so used another time-varying measure of volatility constructed bythe moving average standard <strong>de</strong>viation of the changes in the logarithmic exchange rate:m∑( ert−i−1− ert−i−2)2i=1Vt= (3),mwhere er is the log of the exchange rate and other variables are <strong>de</strong>fined as before. Aswith the previous case, we applied four or<strong>de</strong>rs of the moving average (30, 180, 360, and720 days).Fin<strong>al</strong>ly, we applied as a measure of the exchange rate volatility the high-lowvariation (extreme-v<strong>al</strong>ue variance) which is <strong>de</strong>fined by the following formula:σ hl = max (r i ) - min (r i ) (4),where σ hl is the high-low variation, max (r i ) and min (r i ) represent the maximum andminimum daily return in the respective period of time preceding the day of observation.The high-low variation is less sensitive to outliers than the standard variation.Empiric<strong>al</strong> ResultsIn the empiric<strong>al</strong> an<strong>al</strong>ysis, we estimated volatility of exchange rates of NMScurrencies against the euro. For this, we used exchange rates in direct quotation(number of NMS currency units for one unit of euro) and applied three <strong>al</strong>ternativemeasures discussed above and <strong>de</strong>fined by formulas (1) – (4). Even though theassumptions of the volatility measures are different from each other, the comparison ofthe three <strong>al</strong>ternative methods reve<strong>al</strong>s very strong correlations indicating that <strong>al</strong>l versionsa<strong>de</strong>quately measure exchange rate volatility. The sm<strong>al</strong>lest correlation coefficientobtained (0.869) is between the moving average standard <strong>de</strong>viation of the changes inthe logarithmic exchange rate and the high-low variation in Poland. The coefficients’v<strong>al</strong>ues indicate <strong>al</strong>most perfect positive associations for <strong>al</strong>l currencies and methods. Suchresults <strong>al</strong>low us to use only moving average standard <strong>de</strong>viations of the annu<strong>al</strong>ized dailyreturns of the nomin<strong>al</strong> bilater<strong>al</strong> exchange rates for discussion on exchange ratevolatility. See Figures 1 – 5 for graphs of the exchange rate volatility measures.We c<strong>al</strong>culated four moving average standard <strong>de</strong>viations covering different timeinterv<strong>al</strong>s. We used one-month and six-month measures to estimate short-term and midtermvolatility and one-year and two-year indicators to an<strong>al</strong>yze long-term volatility.One can point out that the exchange rate volatility <strong>de</strong>velopment reflected the exchangerate regime applied in the countries as well as shifts in the exchange rate policy. Since<strong>al</strong>l countries an<strong>al</strong>yzed applied a more flexible regime, the volatility <strong>de</strong>velopmentpatterns are very similar. All currencies experience a gradu<strong>al</strong> <strong>de</strong>cline of <strong>al</strong>l fourvolatility measures and the differences among them <strong>al</strong>most disappear in the last threeyears. Moreover, there is one more common feature. At the end of 2005, volatility of <strong>al</strong>lexchange rates an<strong>al</strong>yzed reached or was close to the minimum level on record.22