JPMORGAN CHASE WHALE TRADES: A CASE HISTORY OF DERIVATIVES RISKS AND ABUSES

JPMORGAN CHASE WHALE TRADES: A CASE HISTORY OF DERIVATIVES RISKS AND ABUSES

JPMORGAN CHASE WHALE TRADES: A CASE HISTORY OF DERIVATIVES RISKS AND ABUSES

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

56<br />

credit protection did not serve as an offset for any bank loan losses involving American<br />

Airlines. 356 The CIO’s Chief Risk Officer, Irvin Goldman, also told the Subcommittee that the<br />

CIO’s own $350 billion Available-for-Sale portfolio did not have single-name credit exposure, 357<br />

would not have sustained losses from any individual corporate bankruptcy, and so was not using<br />

the SCP’s 2011 trading strategy as a hedge.<br />

In the view of the OCC capital markets examiner responsible for JPMorgan Chase, the<br />

2011 gain was “outsized,” based on an “idiosyncratic trade,” and the CIO “shouldn’t have been<br />

358<br />

doing this.” In light of the disconnect between the credit derivative trading that took place and<br />

any credit risk or loss to the bank, the 2011 profit-taking appears to have been an example of<br />

proprietary trading intended to make money for the bank, rather than protect it from loss.<br />

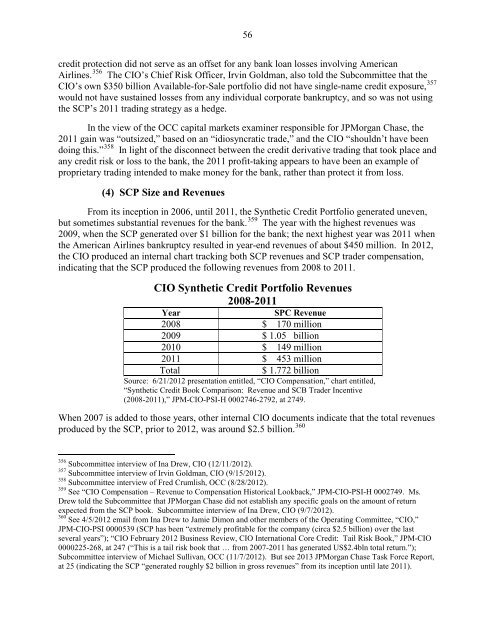

(4) SCP Size and Revenues<br />

From its inception in 2006, until 2011, the Synthetic Credit Portfolio generated uneven,<br />

but sometimes substantial revenues for the bank. 359<br />

The year with the highest revenues was<br />

2009, when the SCP generated over $1 billion for the bank; the next highest year was 2011 when<br />

the American Airlines bankruptcy resulted in year-end revenues of about $450 million. In 2012,<br />

the CIO produced an internal chart tracking both SCP revenues and SCP trader compensation,<br />

indicating that the SCP produced the following revenues from 2008 to 2011.<br />

CIO Synthetic Credit Portfolio Revenues<br />

2008-2011<br />

Year SPC Revenue<br />

2008 $ 170 million<br />

2009 $ 1.05 billion<br />

2010 $ 149 million<br />

2011 $ 453 million<br />

Total $ 1.772 billion<br />

Source: 6/21/2012 presentation entitled, “CIO Compensation,” chart entitled,<br />

“Synthetic Credit Book Comparison: Revenue and SCB Trader Incentive<br />

(2008-2011),” JPM-CIO-PSI-H 0002746-2792, at 2749.<br />

When 2007 is added to those years, other internal CIO documents indicate that the total revenues<br />

produced by the SCP, prior to 2012, was around $2.5 billion. 360<br />

356 Subcommittee interview of Ina Drew, CIO (12/11/2012).<br />

357 Subcommittee interview of Irvin Goldman, CIO (9/15/2012).<br />

358 Subcommittee interview of Fred Crumlish, OCC (8/28/2012).<br />

359 See “CIO Compensation – Revenue to Compensation Historical Lookback,” JPM-CIO-PSI-H 0002749. Ms.<br />

Drew told the Subcommittee that JPMorgan Chase did not establish any specific goals on the amount of return<br />

expected from the SCP book. Subcommittee interview of Ina Drew, CIO (9/7/2012).<br />

360 See 4/5/2012 email from Ina Drew to Jamie Dimon and other members of the Operating Committee, “CIO,”<br />

JPM-CIO-PSI 0000539 (SCP has been “extremely profitable for the company (circa $2.5 billion) over the last<br />

several years”); “CIO February 2012 Business Review, CIO International Core Credit: Tail Risk Book,” JPM-CIO<br />

0000225-268, at 247 (“This is a tail risk book that … from 2007-2011 has generated US$2.4bln total return.”);<br />

Subcommittee interview of Michael Sullivan, OCC (11/7/2012). But see 2013 JPMorgan Chase Task Force Report,<br />

at 25 (indicating the SCP “generated roughly $2 billion in gross revenues” from its inception until late 2011).