I This document constitutes the base prospectus of ... - Volksbank AG

I This document constitutes the base prospectus of ... - Volksbank AG

I This document constitutes the base prospectus of ... - Volksbank AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

VB<strong>AG</strong> is active in a number <strong>of</strong> SEE markets that have or are close to European Monetary Union (<strong>the</strong><br />

EMU) membership. Leaving <strong>the</strong> EMU or potential delays on <strong>the</strong> path towards EMU accession might<br />

negatively impact CEE/SEE economies and potentially also VB<strong>AG</strong>'s ability to generate pr<strong>of</strong>its in this region.<br />

There is a heightened risk <strong>of</strong> credit losses due to local currency depreciation in CEE/SEE<br />

A significant amount <strong>of</strong> retail and commercial loans in <strong>the</strong> CEE/SEE region are denominated in CHF or<br />

EUR. Due to <strong>the</strong> current economic environment certain CEE/SEE countries might experience depreciation<br />

<strong>of</strong> <strong>the</strong>ir local currency versus CHF or EUR. <strong>This</strong> might lead to higher default rates and thus reduced pr<strong>of</strong>its<br />

by VB<strong>AG</strong>.<br />

VB<strong>AG</strong> owns or develops substantial real estate in <strong>the</strong> CEE and SEE region and is <strong>the</strong>refore exposed<br />

to price risks in <strong>the</strong> real estate area<br />

VB<strong>AG</strong>s substantial real estate holdings in <strong>the</strong> CEE/SEE region create a special risk that negative fluctuations<br />

in <strong>the</strong> fair value <strong>of</strong> its real estate will reduce <strong>the</strong>ir income or pr<strong>of</strong>its or <strong>the</strong> balance sheet value <strong>of</strong> its<br />

assets.<br />

VB<strong>AG</strong> is financing real estate developers in <strong>the</strong> CEE/SEE region and is <strong>the</strong>refore exposed to heightened<br />

credit losses because <strong>of</strong> <strong>the</strong> current economic downturn<br />

Because <strong>of</strong> <strong>the</strong> current economic crisis <strong>the</strong> ability <strong>of</strong> real estate developers active in this region to finalize<br />

and subsequently rent or sell <strong>the</strong>ir assets may decrease and might result in a potential for higher credit<br />

losses in this business segment. At <strong>the</strong> same time <strong>the</strong> potential risk for reduced real estate values exist<br />

which results in <strong>the</strong> increase <strong>of</strong> <strong>the</strong> loss potential for VB<strong>AG</strong> in case <strong>of</strong> a credit event and subsequent sell <strong>of</strong>f<br />

<strong>of</strong> <strong>the</strong> asset by VB<strong>AG</strong>.<br />

General political and economic environment<br />

In <strong>the</strong> 1990s, <strong>the</strong> economies in most <strong>of</strong> <strong>the</strong> CEE and SEE countries were characterised by relatively high<br />

inflation and correspondingly high interest rates, moderate growth in real gross domestic product, low disposable<br />

income, declining real wages and high national convertible currency debt (in relation to gross domestic<br />

product and convertible currency reserves). However, over <strong>the</strong> years CEE and SEE countries have<br />

achieved high real GDP growth and <strong>the</strong> macroeconomic framework has improved (disinflation, high foreign<br />

direct investments), while risks related to external imbalances have emerged in some countries.<br />

The political and legal framework has been continuously developed, institutions, legal and regulatory systems<br />

characteristic <strong>of</strong> parliamentary democracies were created and accession to <strong>the</strong> EU was <strong>the</strong> general<br />

main strategic and political guideline. Poland, <strong>the</strong> Czech Republic, Slovakia, Hungary and Slovenia joined<br />

<strong>the</strong> EU on 1 May 2004, Romania and Bulgaria have each been members since 1 January 2007. Slovakia has<br />

been a member <strong>of</strong> <strong>the</strong> EMU since 1 January 2009. Croatia intends to accede to <strong>the</strong> EU in 2009. Instable<br />

political conditions or a negative environment in <strong>the</strong> CEE or SEE countries including instable political<br />

conditions in neighbouring countries may have a material adverse affect on VB<strong>AG</strong>.<br />

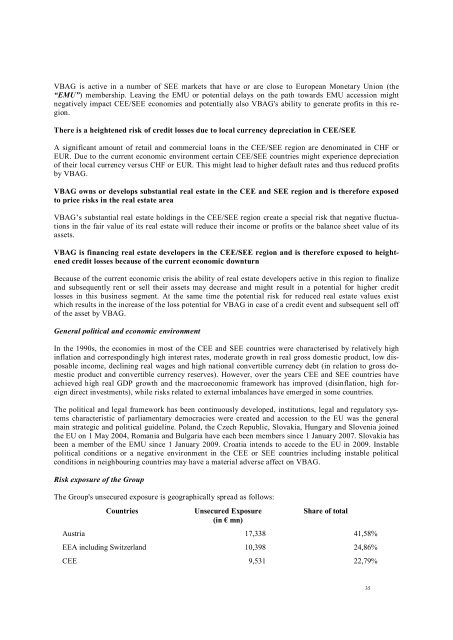

Risk exposure <strong>of</strong> <strong>the</strong> Group<br />

The Group's unsecured exposure is geographically spread as follows:<br />

Countries Unsecured Exposure<br />

(in mn)<br />

Share <strong>of</strong> total<br />

Austria 17,338 41,58%<br />

EEA including Switzerland 10,398 24,86%<br />

CEE 9,531 22,79%<br />

35