Annual Report 2008 - Securitas

Annual Report 2008 - Securitas

Annual Report 2008 - Securitas

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

104<br />

<strong>Annual</strong> report<br />

Notes and comments to the consolidated financial statements<br />

Number of shares outstanding December 31, <strong>2008</strong> MSEK<br />

Series A 17,142,600<br />

Series B 347,916,297<br />

each share with a quota<br />

value of SEK 1.00 17.1<br />

each share with a quota<br />

value of SEK 1.00 348.0<br />

Total 365,058,897 365.1<br />

The number of Series A and Series B shares is unchanged in relation to<br />

December 31, 2007. As of December 31, <strong>2008</strong> there where no outstanding<br />

convertible debenture loans that could result in any dilution ot the share<br />

capital.<br />

Each Series A share carried ten votes and each Series B share one vote.<br />

This is the only difference between the two series of shares.<br />

Shareholders with more than 10 percent of the votes<br />

The principal shareholders are Investment AB Latour, which together with<br />

SäkI AB, Förvaltnings AB wasatornet and Karpalunds Ångbryggeri AB holds<br />

11.6 percent of the capital and 30.0 percent of the votes, and Melker Schörling<br />

AB, which holds 5.6 percent of the capital and 11.8 percent of the votes.<br />

Dividend<br />

The Board of Directors and the President propose a dividend to the<br />

shareholders of the Parent company of SEK 2.90 per share, or a total of<br />

MSEK 1,058.7. The dividend to the shareholders for the previous year<br />

2007, which was paid out in <strong>2008</strong>, was SEK 3.10 per share, or a total of<br />

MSEK 1,131.7. The dividend to the shareholders for 2006, which was<br />

paid in 2007, was SEK 3.10 per share, or a total of MSEK 1,131.7.<br />

Presentation of Shareholders’ Equity<br />

According to IAS 1 a company should as a minimum present issued capital<br />

and other reserves in balance sheet. <strong>Securitas</strong> AB has chosen to specify<br />

Shareholders’ equity into further components in accordance with the table<br />

above;<br />

• Share capital<br />

• Other capital contributed<br />

• Other reserves<br />

• retained earnings<br />

The Share capital shows the registered share capital of the Parent company.<br />

There were no changes in the share capital in <strong>2008</strong>.<br />

In other capital contributed, the total amount of all transactions <strong>Securitas</strong><br />

AB has had with its shareholders is included. Transactions that have taken<br />

place with shareholders are issued capital to premium.<br />

The amount presented in this sub-component corresponds to capital<br />

received (reduced by commission costs) in excess of par value of issued<br />

capital. Other capital contributed amounts to MSEK 7,362.6 as of December<br />

31, <strong>2008</strong> (7,362.6 and 7,362.6).<br />

Other reserves shows certain income and expense items that according<br />

to certain standards should be recognized directly in equity. In the case of<br />

<strong>Securitas</strong>, the item consists of translation differences attributable to the<br />

translation of foreign subsidiaries according to IAS 21, and of the hedging<br />

reserve of cash flow hedges.<br />

Retained earnings corresponds to the accumulated profits earned and<br />

losses incurred in total for the Group.<br />

The amount in the hedging reserve will be transfered to the statement<br />

of income over the following two year period.<br />

<strong>Securitas</strong> <strong>Annual</strong> report <strong>2008</strong><br />

Note 30. Convertible debenture loans<br />

Loan 2002/2007 Series 1–4<br />

The loan was issued within the framework of <strong>Securitas</strong>’s employee incentive<br />

program on May 2, 2002 to <strong>Securitas</strong> Employee convertible 2002 Holding<br />

S.A., a special-purpose, Luxembourg-based company in which employees<br />

had subscribed for shares. The loan matured on May 2, 2007 when the loan<br />

was fully paid back and no conversions have taken place.<br />

For further information, refer to <strong>Securitas</strong> <strong>Annual</strong> report 2007, Note 30.<br />

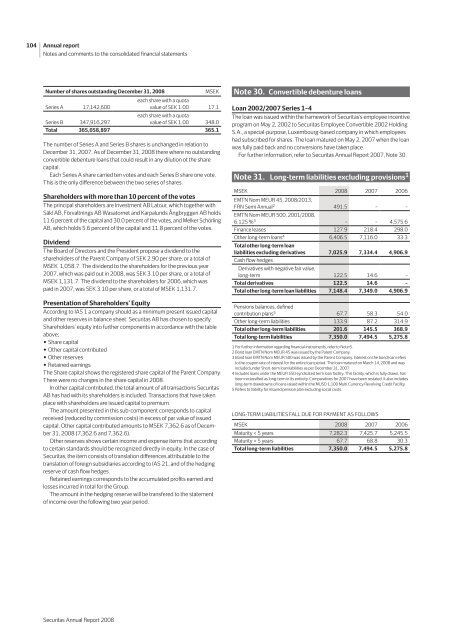

Note 31. Long-term liabilities excluding provisions 1<br />

MSEK <strong>2008</strong> 2007 2006<br />

EMTN Nom MEUr 45, <strong>2008</strong>/2013,<br />

FrN Semi <strong>Annual</strong> 2 491.5 – –<br />

EMTN Nom MEUr 500, 2001/<strong>2008</strong>,<br />

6.125 % 3 – – 4,575.6<br />

Finance leases 127.9 218.4 298.0<br />

Other long-term loans 4 6,406.5 7,116.0 33.3<br />

Total other long-term loan<br />

liabilities excluding derivatives 7,025.9 7,334.4 4,906.9<br />

Cash flow hedges<br />

Derivatives with negative fair value,<br />

long-term 122.5 14.6 –<br />

Total derivatives 122.5 14.6 –<br />

Total other long-term loan liabilities 7,148.4 7,349.0 4,906.9<br />

Pensions balances, defined<br />

contribution plans 5 67.7 58.3 54.0<br />

Other long-term liabilities 133.9 87.2 314.9<br />

Total other long-term liabilities 201.6 145.5 368.9<br />

Total long-term liabilities 7,350.0 7,494.5 5,275.8<br />

1 For further information regarding financial instruments, refer to Note 6.<br />

2 Bond loan EMTN Nom MEUr 45 was issued by the Parent company.<br />

3 Bond loan EMTN Nom MEUr 500 was issued by the Parent company. Interest on the bond loan refers<br />

to the coupon rate of interest for the entire loan period. The loan matured on March 14, <strong>2008</strong> and was<br />

included under Short-term loan liabilities as per December 31, 2007.<br />

4 Includes loans under the MEUr 550 syndicated term loan facility. This facility, which is fully drawn, has<br />

been reclassified as long-term in its entirety. Comparatives for 2007 have been restated. It also includes<br />

long-term drawdowns of loans raised within the MUSD 1,100 Multi currency revolving credit Facility.<br />

5 refers to liability for insured pension plan excluding social costs.<br />

LONG-TErM LIABILITIES FALL DUE FOr PAyMENT AS FOLLOwS<br />

MSEK <strong>2008</strong> 2007 2006<br />

Maturity < 5 years 7,282.3 7,425.7 5,245.5<br />

Maturity > 5 years 67.7 68.8 30.3<br />

Total long-term liabilities 7,350.0 7,494.5 5,275.8