Annual Report 2008 - Securitas

Annual Report 2008 - Securitas

Annual Report 2008 - Securitas

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Acquisitions<br />

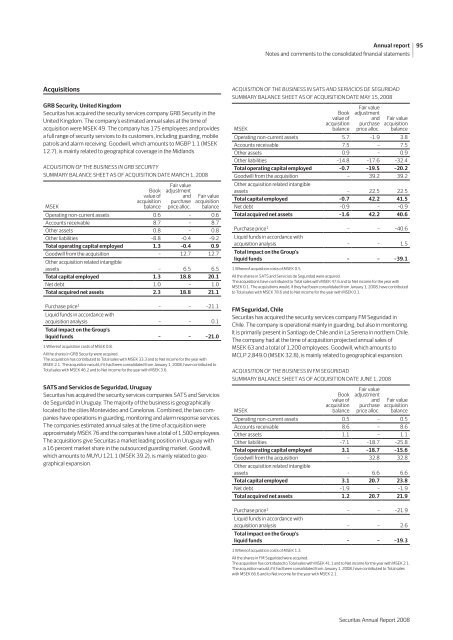

GRB Security, United Kingdom<br />

<strong>Securitas</strong> has acquired the security services company GrB Security in the<br />

United Kingdom. The company’s estimated annual sales at the time of<br />

acquisition were MSEK 49. The company has 175 employees and provides<br />

a full range of security services to its customers, including guarding, mobile<br />

patrols and alarm receiving. Goodwill, which amounts to MGBP 1.1 (MSEK<br />

12.7), is mainly related to geographical coverage in the Midlands.<br />

aCquIsItION Of thE busINEss IN GRb sECuRIty<br />

SUMMAry BALANcE SHEET AS OF AcqUISITION DATE MArcH 1, <strong>2008</strong><br />

MSEK<br />

Book<br />

value of<br />

acquisition<br />

balance<br />

Fair value<br />

adjustment<br />

and<br />

purchase<br />

price alloc.<br />

Fair value<br />

acquisition<br />

balance<br />

Operating non-current assets 0.6 – 0.6<br />

Accounts receivable 8.7 – 8.7<br />

Other assets 0.8 – 0.8<br />

Other liabilities –8.8 –0.4 –9.2<br />

Total operating capital employed 1.3 –0.4 0.9<br />

Goodwill from the acquisition – 12.7 12.7<br />

Other acquisition related intangible<br />

assets – 6.5 6.5<br />

Total capital employed 1.3 18.8 20.1<br />

Net debt 1.0 – 1.0<br />

Total acquired net assets 2.3 18.8 21.1<br />

Purchase price 1 – – –21.1<br />

Liquid funds in accordance with<br />

acquisition analysis – – 0.1<br />

Total impact on the Group’s<br />

liquid funds – – –21.0<br />

1 whereof acquisition costs of MSEK 0.8.<br />

All the shares in GrB Security were acquired.<br />

The acquisition has contributed to Total sales with MSEK 33.3 and to Net income for the year with<br />

MSEK 2.1. The acquisition would, if it had been consolidated from January 1, <strong>2008</strong>, have contributed to<br />

Total sales with MSEK 46.2 and to Net income for the year with MSEK 3.6.<br />

SATS and Servicios de Seguridad, Uruguay<br />

<strong>Securitas</strong> has acquired the security services companies SATS and Servicios<br />

de Seguridad in Uruguay. The majority of the business is geographically<br />

located to the cities Montevideo and canelonas. combined, the two companies<br />

have operations in guarding, monitoring and alarm response services.<br />

The companies estimated annual sales at the time of acquisition were<br />

approximately MSEK 76 and the companies have a total of 1,500 employees.<br />

The acquisitions give <strong>Securitas</strong> a market leading position in Uruguay with<br />

a 16 percent market share in the outsourced guarding market. Goodwill,<br />

which amounts to MUyU 121.1 (MSEK 39.2), is mainly related to geographical<br />

expansion.<br />

aCquIsItION Of thE busINEss IN sats aNd sERvICIOs dE sEGuRIdad<br />

SUMMAry BALANcE SHEET AS OF AcqUISITION DATE MAy 15, <strong>2008</strong><br />

MSEK<br />

Book<br />

value of<br />

acquisition<br />

balance<br />

Fair value<br />

adjustment<br />

and<br />

purchase<br />

price alloc.<br />

Fair value<br />

acquisition<br />

balance<br />

Operating non-current assets 5.7 –1.9 3.8<br />

Accounts receivable 7.5 – 7.5<br />

Other assets 0.9 – 0.9<br />

Other liabilities –14.8 –17.6 –32.4<br />

Total operating capital employed –0.7 –19.5 –20.2<br />

Goodwill from the acquisition – 39.2 39.2<br />

Other acquisition related intangible<br />

assets – 22.5 22.5<br />

Total capital employed –0.7 42.2 41.5<br />

Net debt –0.9 – –0.9<br />

Total acquired net assets –1.6 42.2 40.6<br />

Purchase price 1 – – –40.6<br />

Liquid funds in accordance with<br />

acquisition analysis – – 1.5<br />

Total impact on the Group’s<br />

liquid funds – – –39.1<br />

1 whereof acquisition costs of MSEK 0.5.<br />

All the shares in SATS and Servicios de Seguridad were acquired.<br />

The acquisitions have contributed to Total sales with MSEK 47.6 and to Net income for the year with<br />

MSEK 0.1. The acquisitions would, if they had been consolidated from January 1, <strong>2008</strong>, have contributed<br />

to Total sales with MSEK 78.6 and to Net income for the year with MSEK 0.1.<br />

FM Seguridad, Chile<br />

<strong>Securitas</strong> has acquired the security services company FM Seguridad in<br />

chile. The company is operational mainly in guarding, but also in monitoring.<br />

It is primarily present in Santiago de chile and in La Serena in northern chile.<br />

The company had at the time of acquisition projected annual sales of<br />

MSEK 63 and a total of 1,200 employees. Goodwill, which amounts to<br />

McLP 2,849.0 (MSEK 32.8), is mainly related to geographical expansion.<br />

aCquIsItION Of thE busINEss IN fm sEGuRIdad<br />

SUMMAry BALANcE SHEET AS OF AcqUISITION DATE JUNE 1, <strong>2008</strong><br />

MSEK<br />

Book<br />

value of<br />

acquisition<br />

balance<br />

Fair value<br />

adjustment<br />

and<br />

purchase<br />

price alloc.<br />

Fair value<br />

acquisition<br />

balance<br />

Operating non-current assets 0.5 – 0.5<br />

Accounts receivable 8.6 – 8.6<br />

Other assets 1.1 – 1.1<br />

Other liabilities –7.1 –18.7 –25.8<br />

Total operating capital employed 3.1 –18.7 –15.6<br />

Goodwill from the acquisition – 32.8 32.8<br />

Other acquisition related intangible<br />

assets – 6.6 6.6<br />

Total capital employed 3.1 20.7 23.8<br />

Net debt –1.9 – –1.9<br />

Total acquired net assets 1.2 20.7 21.9<br />

Purchase price 1 – – –21.9<br />

Liquid funds in accordance with<br />

acquisition analysis – – 2.6<br />

Total impact on the Group’s<br />

liquid funds – – –19.3<br />

1 whereof acquisition costs of MSEK 1.3.<br />

<strong>Annual</strong> report<br />

Notes and comments to the consolidated financial statements<br />

All the shares in FM Seguridad were acquired.<br />

The acquisition has contributed to Total sales with MSEK 41.1 and to Net income for the year with MSEK 2.1.<br />

The acquisition would, if it had been consolidated from January 1, <strong>2008</strong>, have contributed to Total sales<br />

with MSEK 66.6 and to Net income for the year with MSEK 2.1.<br />

<strong>Securitas</strong> <strong>Annual</strong> report <strong>2008</strong><br />

95