Annual Report 2008 - Securitas

Annual Report 2008 - Securitas

Annual Report 2008 - Securitas

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

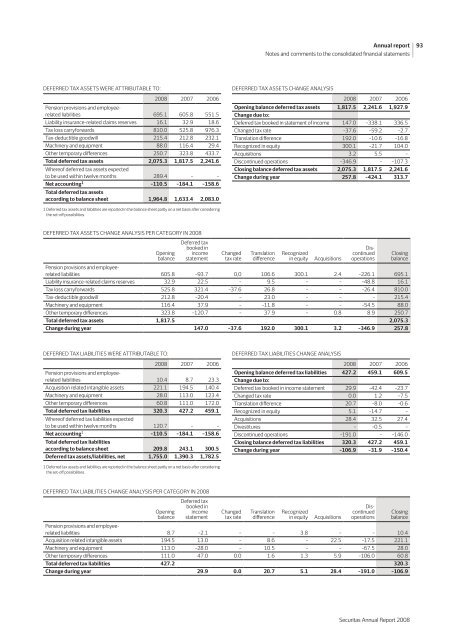

DEFERRED TAx ASSETS WERE ATTRIBUTABLE TO:<br />

<strong>2008</strong> 2007 2006<br />

Pension provisions and employee-<br />

related liabilities 695.1 605.8 551.5<br />

Liability insurance-related claims reserves 16.1 32.9 18.6<br />

Tax loss carryforwards 810.0 525.8 976.3<br />

Tax-deductible goodwill 215.4 212.8 232.1<br />

Machinery and equipment 88.0 116.4 29.4<br />

Other temporary differences 250.7 323.8 433.7<br />

Total deferred tax assets 2,075.3 1,817.5 2,241.6<br />

whereof deferred tax assets expected<br />

to be used within twelve months 289.4 – –<br />

Net accounting 1 –110.5 –184.1 –158.6<br />

Total deferred tax assets<br />

according to balance sheet 1,964.8 1,633.4 2,083.0<br />

1 Deferred tax assets and liabilities are reported in the balance sheet partly on a net basis after considering<br />

the set-off possibilities.<br />

DEFErrED TAX ASSETS cHANGE ANALySIS PEr cATEGOry IN <strong>2008</strong><br />

Opening<br />

balance<br />

Deferred tax<br />

booked in<br />

income<br />

statement<br />

DEFErrED TAX ASSETS cHANGE ANALySIS<br />

changed<br />

tax rate<br />

<strong>2008</strong> 2007 2006<br />

Opening balance deferred tax assets 1,817.5 2,241.6 1,927.9<br />

Change due to:<br />

Deferred tax booked in statement of income 147.0 –338.1 336.5<br />

changed tax rate –37.6 –59.2 –2.7<br />

Translation difference 192.0 –10.6 –16.8<br />

Recognized in equity 300.1 –21.7 104.0<br />

Acquisitions 3.2 5.5 –<br />

Discontinued operations –346.9 – –107.3<br />

Closing balance deferred tax assets 2,075.3 1,817.5 2,241.6<br />

Change during year 257.8 –424.1 313.7<br />

Translation<br />

difference<br />

Recognized<br />

in equity Acquisitions<br />

Discontinued<br />

operations<br />

closing<br />

balance<br />

Pension provisions and employee-<br />

related liabilities 605.8 –93.7 0,0 106.6 300.1 2.4 –226.1 695.1<br />

Liability insurance-related claims reserves 32.9 22.5 – 9.5 – – –48.8 16.1<br />

Tax loss carryforwards 525.8 321.4 –37.6 26.8 – – –26.4 810.0<br />

Tax-deductible goodwill 212.8 –20.4 – 23.0 – – – 215.4<br />

Machinery and equipment 116.4 37.9 – –11.8 – – –54.5 88.0<br />

Other temporary differences 323.8 –120.7 – 37.9 – 0.8 8.9 250.7<br />

Total deferred tax assets 1,817.5 2,075.3<br />

Change during year 147.0 –37.6 192.0 300.1 3.2 –346.9 257.8<br />

DEFERRED TAx LIABILITIES WERE ATTRIBUTABLE TO:<br />

<strong>2008</strong> 2007 2006<br />

Pension provisions and employee-<br />

related liabilities 10.4 8.7 23.3<br />

Acquisition related intangible assets 221.1 194.5 140.4<br />

Machinery and equipment 28.0 113.0 123.4<br />

Other temporary differences 60.8 111.0 172.0<br />

Total deferred tax liabilities 320.3 427.2 459.1<br />

whereof deferred tax liabilities expected<br />

to be used within twelve months 120.7 – –<br />

Net accounting 1 –110.5 –184.1 –158.6<br />

Total deferred tax liabilities<br />

according to balance sheet 209.8 243.1 300.5<br />

Deferred tax assets/liabilities, net 1,755.0 1,390.3 1,782.5<br />

1 Deferred tax assets and liabilities are reported in the balance sheet partly on a net basis after considering<br />

the set-off possibilities.<br />

DEFErrED TAX LIABILITIES cHANGE ANALySIS PEr cATEGOry IN <strong>2008</strong><br />

Opening<br />

balance<br />

Deferred tax<br />

booked in<br />

income<br />

statement<br />

DEFErrED TAX LIABILITIES cHANGE ANALySIS<br />

changed<br />

tax rate<br />

<strong>2008</strong> 2007 2006<br />

Opening balance deferred tax liabilities 427.2 459.1 609.5<br />

Change due to:<br />

Deferred tax booked in income statement 29.9 –42.4 –23.7<br />

changed tax rate 0.0 1.2 –7.5<br />

Translation difference 20.7 –8.0 –0.6<br />

Recognized in equity 5.1 –14.7 –<br />

Acquisitions 28.4 32.5 27.4<br />

Divestitures – –0.5 –<br />

Discontinued operations –191.0 – –146.0<br />

Closing balance deferred tax liabilities 320.3 427.2 459.1<br />

Change during year –106.9 –31.9 –150.4<br />

Translation<br />

difference<br />

Recognized<br />

in equity Acquisitions<br />

Discontinued<br />

operations<br />

<strong>Annual</strong> report<br />

Notes and comments to the consolidated financial statements<br />

closing<br />

balance<br />

Pension provisions and employee-<br />

related liabilities 8.7 –2.1 – – 3.8 – – 10.4<br />

Acquisition related intangible assets 194.5 13.0 – 8.6 – 22.5 –17.5 221.1<br />

Machinery and equipment 113.0 –28.0 – 10.5 – – –67.5 28.0<br />

Other temporary differences 111.0 47.0 0.0 1.6 1.3 5.9 –106.0 60.8<br />

Total deferred tax liabilities 427.2 320.3<br />

Change during year 29.9 0.0 20.7 5.1 28.4 –191.0 –106.9<br />

<strong>Securitas</strong> <strong>Annual</strong> report <strong>2008</strong><br />

93