Annual Report 2008 - Securitas

Annual Report 2008 - Securitas

Annual Report 2008 - Securitas

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

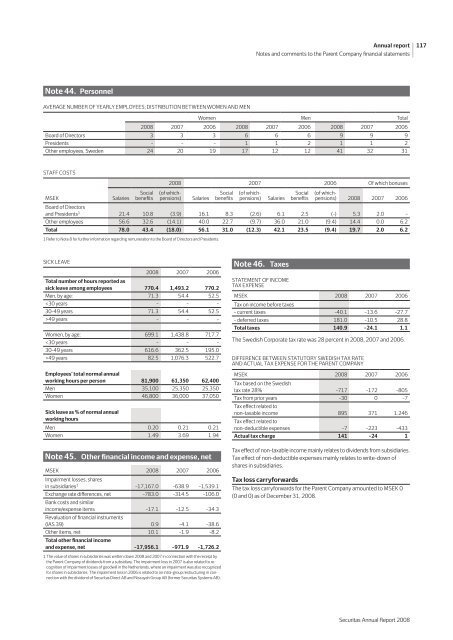

Note 44. Personnel<br />

AvErAGE NUMBEr OF yEArLy EMPLOyEES; DISTrIBUTION BETwEEN wOMEN AND MEN<br />

women Men Total<br />

<strong>2008</strong> 2007 2006 <strong>2008</strong> 2007 2006 <strong>2008</strong> 2007 2006<br />

Board of Directors 3 3 3 6 6 6 9 9 9<br />

Presidents – – – 1 1 2 1 1 2<br />

Other employees, Sweden 24 20 19 17 12 12 41 32 31<br />

STAFF cOSTS<br />

MSEK Salaries<br />

Social<br />

benefits<br />

<strong>2008</strong> 2007 2006 Of which bonuses<br />

(of whichpensions)<br />

Salaries<br />

Social<br />

benefits<br />

(of whichpensions)<br />

Salaries<br />

Social<br />

benefits<br />

(of whichpensions)<br />

<strong>2008</strong> 2007 2006<br />

Board of Directors<br />

and Presidents 1 21.4 10.8 (3.9) 16.1 8.3 (2.6) 6.1 2.5 (–) 5.3 2.0 –<br />

Other employees 56.6 32.6 (14.1) 40.0 22.7 (9.7) 36.0 21.0 (9.4) 14.4 0.0 6.2<br />

Total 78.0 43.4 (18.0) 56.1 31.0 (12.3) 42.1 23.5 (9.4) 19.7 2.0 6.2<br />

1 refer to Note 8 for further information regarding remuneration to the Board of Directors and Presidents.<br />

SIcK LEAvE<br />

<strong>2008</strong> 2007 2006<br />

Total number of hours reported as<br />

sick leave among employees 770.4 1,493.2 770.2<br />

Men, by age: 71.3 54.4 52.5<br />

49 years – – –<br />

Women, by age: 699.1 1,438.8 717.7<br />

49 years 82.5 1,076.3 522.7<br />

Employees’ total normal annual<br />

working hours per person 81,900 61,350 62,400<br />

Men 35,100 25,350 25,350<br />

women 46,800 36,000 37,050<br />

Sick leave as % of normal annual<br />

working hours<br />

Men 0.20 0.21 0.21<br />

women 1.49 3.69 1.94<br />

Note 45. Other financial income and expense, net<br />

MSEK <strong>2008</strong> 2007 2006<br />

Impairment losses, shares<br />

in subsidiaries 1 –17,167.0 –638.9 –1,539.1<br />

Exchange rate differences, net –783.0 –314.5 –106.0<br />

Bank costs and similar<br />

income/expense items –17.1 –12.5 –34.3<br />

Revaluation of financial instruments<br />

(IAS 39) 0.9 –4.1 –38.6<br />

Other items, net 10.1 –1.9 –8.2<br />

Total other financial income<br />

and expense, net –17,956.1 –971.9 –1,726.2<br />

1 The value of shares in subsidiaries was written down <strong>2008</strong> and 2007 in connection with the receipt by<br />

the Parent company of dividends from a subsidiary. The impairment loss in 2007 is also related to recognition<br />

of impairment losses of goodwill in the Netherlands, where an impairment was also recognized<br />

for shares in subsidiaries. The impairment loss in 2006 is related to an intra–group restructuring in connection<br />

with the dividend of <strong>Securitas</strong> Direct AB and Niscayah Group AB (former <strong>Securitas</strong> Systems AB).<br />

Note 46. Taxes<br />

STATEMENT OF INcOME<br />

TAX EXPENSE<br />

MSEK <strong>2008</strong> 2007 2006<br />

Tax on income before taxes<br />

– current taxes –40.1 –13.6 –27.7<br />

– deferred taxes 181.0 –10.5 28.8<br />

Total taxes 140.9 –24.1 1.1<br />

The Swedish corporate tax rate was 28 percent in <strong>2008</strong>, 2007 and 2006.<br />

DIFFErENcE BETwEEN STATUTOry SwEDISH TAX rATE<br />

AND AcTUAL TAX EXPENSE FOr THE PArENT cOMPANy<br />

MSEK <strong>2008</strong> 2007 2006<br />

Tax based on the Swedish<br />

tax rate 28% –717 –172 –805<br />

Tax from prior years –30 0 –7<br />

Tax effect related to<br />

non–taxable income 895 371 1.246<br />

Tax effect related to<br />

non–deductible expenses –7 –223 –433<br />

Actual tax charge 141 –24 1<br />

Tax effect of non–taxable income mainly relates to dividends from subsidiaries.<br />

Tax effect of non–deductible expenses mainly relates to write–down of<br />

shares in subsidiaries.<br />

Tax loss carryforwards<br />

<strong>Annual</strong> report<br />

Notes and comments to the Parent Company financial statements<br />

The tax loss carryforwards for the Parent company amounted to MSEK 0<br />

(0 and 0) as of December 31, <strong>2008</strong>.<br />

<strong>Securitas</strong> <strong>Annual</strong> report <strong>2008</strong><br />

117