Annual Report 2008 - Securitas

Annual Report 2008 - Securitas

Annual Report 2008 - Securitas

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

116<br />

<strong>Annual</strong> report<br />

Notes and comments to the Parent Company financial statements<br />

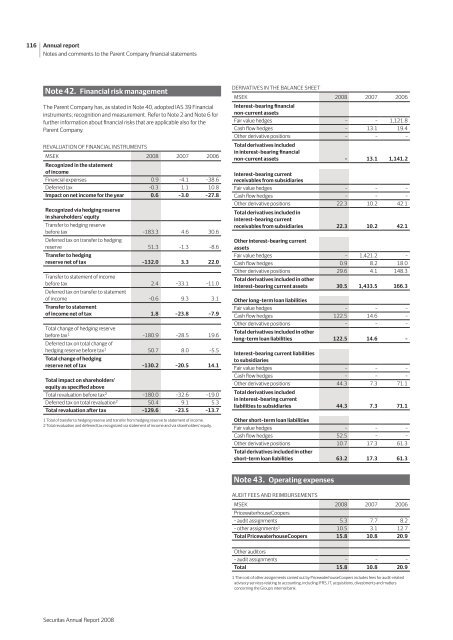

Note 42. Financial risk management<br />

The Parent company has, as stated in Note 40, adopted IAS 39 Financial<br />

instruments; recognition and measurement. refer to Note 2 and Note 6 for<br />

further information about financial risks that are applicable also for the<br />

Parent company.<br />

rEvALUATION OF FINANcIAL INSTrUMENTS<br />

MSEK <strong>2008</strong> 2007 2006<br />

Recognized in the statement<br />

of income<br />

Financial expenses 0.9 –4.1 –38.6<br />

Deferred tax –0.3 1.1 10.8<br />

Impact on net income for the year 0.6 –3.0 –27.8<br />

Recognized via hedging reserve<br />

in shareholders' equity<br />

Transfer to hedging reserve<br />

before tax –183.3 4.6 30.6<br />

Deferred tax on transfer to hedging<br />

reserve 51.3 –1.3 –8.6<br />

Transfer to hedging<br />

reserve net of tax –132.0 3.3 22.0<br />

Transfer to statement of income<br />

before tax 2.4 –33.1 –11.0<br />

Deferred tax on transfer to statement<br />

of income –0.6 9.3 3.1<br />

Transfer to statement<br />

of income net of tax 1.8 –23.8 –7.9<br />

Total change of hedging reserve<br />

before tax 1 –180.9 –28.5 19.6<br />

Deferred tax on total change of<br />

hedging reserve before tax 1 50.7 8.0 –5.5<br />

Total change of hedging<br />

reserve net of tax –130.2 –20.5 14.1<br />

Total impact on shareholders'<br />

equity as specified above<br />

Total revaluation before tax 2 –180.0 –32.6 –19.0<br />

Deferred tax on total revaluation 2 50.4 9.1 5.3<br />

Total revaluation after tax –129.6 –23.5 –13.7<br />

1 Total of transfer to hedging reserve and transfer from hedging reserve to statement of income.<br />

2 Total revaluation and deferred tax recognized via statement of income and via shareholders’ equity.<br />

<strong>Securitas</strong> <strong>Annual</strong> report <strong>2008</strong><br />

DErIvATIvES IN THE BALANcE SHEET<br />

MSEK <strong>2008</strong> 2007 2006<br />

Interest–bearing financial<br />

non-current assets<br />

Fair value hedges – – 1,121.8<br />

Cash flow hedges – 13.1 19.4<br />

Other derivative positions – – –<br />

Total derivatives included<br />

in interest–bearing financial<br />

non-current assets – 13.1 1,141.2<br />

Interest–bearing current<br />

receivables from subsidiaries<br />

Fair value hedges – – –<br />

Cash flow hedges – – –<br />

Other derivative positions 22.3 10.2 42.1<br />

Total derivatives included in<br />

interest–bearing current<br />

receivables from subsidiaries 22.3 10.2 42.1<br />

Other interest–bearing current<br />

assets<br />

Fair value hedges – 1,421.2 –<br />

Cash flow hedges 0.9 8.2 18.0<br />

Other derivative positions 29.6 4.1 148.3<br />

Total derivatives included in other<br />

interest–bearing current assets 30.5 1,433.5 166.3<br />

Other long–term loan liabilities<br />

Fair value hedges – – –<br />

Cash flow hedges 122.5 14.6 –<br />

Other derivative positions – – –<br />

Total derivatives included in other<br />

long–term loan liabilities 122.5 14.6 –<br />

Interest–bearing current liabilities<br />

to subsidiaries<br />

Fair value hedges – – –<br />

Cash flow hedges – – –<br />

Other derivative positions 44.3 7.3 71.1<br />

Total derivatives included<br />

in interest–bearing current<br />

liabilities to subsidiaries 44.3 7.3 71.1<br />

Other short–term loan liabilities<br />

Fair value hedges – – –<br />

Cash flow hedges 52.5 – –<br />

Other derivative positions 10.7 17.3 61.3<br />

Total derivatives included in other<br />

short–term loan liabilities 63.2 17.3 61.3<br />

Note 43. Operating expenses<br />

AUDIT FEES AND rEIMBUrSEMENTS<br />

MSEK <strong>2008</strong> 2007 2006<br />

Pricewaterhousecoopers<br />

– audit assignments 5.3 7.7 8.2<br />

– other assignments 1 10.5 3.1 12.7<br />

Total PricewaterhouseCoopers 15.8 10.8 20.9<br />

Other auditors<br />

– audit assignments – – –<br />

Total 15.8 10.8 20.9<br />

1 The cost of other assignments carried out by Pricewaterhousecoopers includes fees for audit-related<br />

advisory services relating to accounting, including IFrS, IT, acquisitions, divestments and matters<br />

concerning the Group’s internal bank.