Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ise again in 2013. Even the policy interest<br />

rate is expected to increase later in the<br />

year. This can dampen household<br />

borrowing and lead to a slightly weaker<br />

demand for housing. At the same time<br />

unemployment is expected to remain on<br />

the low level of around 3 percent in 2013.<br />

MSEK<br />

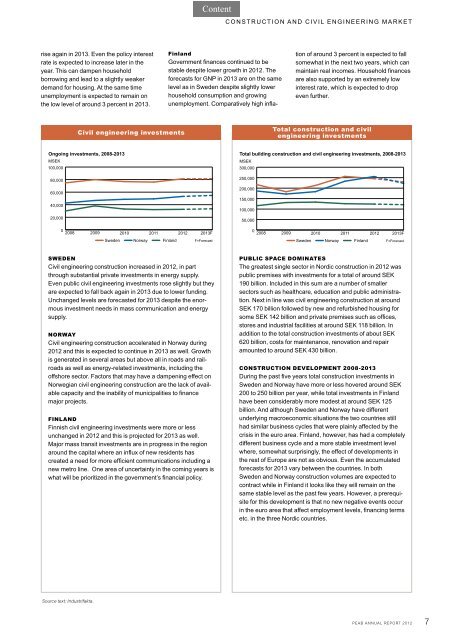

Civil engineering investments<br />

Ongoing investments, 2008-2013<br />

100,000<br />

80,000<br />

60,000<br />

40,000<br />

20,000<br />

0<br />

2008 2009<br />

2010<br />

2011<br />

Sweden Norway Finland<br />

<strong>2012</strong><br />

2013F<br />

F=Forecast<br />

SWEDEN<br />

Civil engineering construction increased in <strong>2012</strong>, in part<br />

through substantial private investments in energy supply.<br />

Even public civil engineering investments rose slightly but they<br />

are expected to fall back again in 2013 due to lower funding.<br />

Unchanged levels are forecasted for 2013 despite the enormous<br />

investment needs in mass communication and energy<br />

supply.<br />

NORWAY<br />

Civil engineering construction accelerated in Norway during<br />

<strong>2012</strong> and this is expected to continue in 2013 as well. Growth<br />

is generated in several areas but above all in roads and railroads<br />

as well as energy-related investments, including the<br />

offshore sector. Factors that may have a dampening effect on<br />

Norwegian civil engineering construction are the lack of available<br />

capacity and the inability of municipalities to finance<br />

major projects.<br />

FINLAND<br />

Finnish civil engineering investments were more or less<br />

unchanged in <strong>2012</strong> and this is projected for 2013 as well.<br />

Major mass transit investments are in progress in the region<br />

around the capital where an influx of new residents has<br />

created a need for more efficient communications including a<br />

new metro line. One area of uncertainty in the coming years is<br />

what will be prioritized in the government’s financial policy.<br />

Source text: Industrifakta.<br />

Finland<br />

Government finances continued to be<br />

stable despite lower growth in <strong>2012</strong>. The<br />

forecasts for GNP in 2013 are on the same<br />

level as in Sweden despite slightly lower<br />

household consumption and growing<br />

unemployment. Comparatively high infla-<br />

CONSTRUCTION AND CIVIL ENGINEERING MARKET<br />

MSEK<br />

Total construction and civil<br />

engineering investments<br />

Total building construction and civil engineering investments, 2008-2013<br />

300,000<br />

250,000<br />

200,000<br />

150,000<br />

100,000<br />

50,000<br />

0<br />

2008 2009<br />

tion of around 3 percent is expected to fall<br />

somewhat in the next two years, which can<br />

maintain real incomes. Household finances<br />

are also supported by an extremely low<br />

interest rate, which is expected to drop<br />

even further.<br />

2010<br />

2011<br />

Sweden Norway Finland<br />

<strong>2012</strong> 2013F<br />

F=Forecast<br />

PUBLIC SPACE DOMINATES<br />

The greatest single sector in Nordic construction in <strong>2012</strong> was<br />

public premises with investments for a total of around SEK<br />

190 billion. Included in this sum are a number of smaller<br />

sectors such as healthcare, education and public administration.<br />

Next in line was civil engineering construction at around<br />

SEK 170 billion followed by new and refurbished housing for<br />

some SEK 142 billion and private premises such as offices,<br />

stores and industrial facilities at around SEK 118 billion. In<br />

addition to the total construction investments of about SEK<br />

620 billion, costs for maintenance, renovation and repair<br />

amounted to around SEK 430 billion.<br />

CONSTRUCTION DEVELOPMENT 2008-2013<br />

During the past five years total construction investments in<br />

Sweden and Norway have more or less hovered around SEK<br />

200 to 250 billion per year, while total investments in Finland<br />

have been considerably more modest at around SEK 125<br />

billion. And although Sweden and Norway have different<br />

underlying macroeconomic situations the two countries still<br />

had similar business cycles that were plainly affected by the<br />

crisis in the euro area. Finland, however, has had a completely<br />

different business cycle and a more stable investment level<br />

where, somewhat surprisingly, the effect of developments in<br />

the rest of Europe are not as obvious. Even the accumulated<br />

forecasts for 2013 vary between the countries. In both<br />

Sweden and Norway construction volumes are expected to<br />

contract while in Finland it looks like they will remain on the<br />

same stable level as the past few years. However, a prerequisite<br />

for this development is that no new negative events occur<br />

in the euro area that affect employment levels, financing terms<br />

etc. in the three Nordic countries.<br />

PEAB ANNUAL REPORT <strong>2012</strong><br />

7