You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

25<br />

26<br />

27<br />

28<br />

29<br />

30<br />

31<br />

32<br />

33<br />

34<br />

35<br />

36<br />

37<br />

38<br />

39<br />

40<br />

41<br />

42<br />

43<br />

44<br />

45<br />

46<br />

These loans are recognized at the translated rate on balance sheet<br />

day. The effective part of the period’s exchange rate changes in relation<br />

to hedge instruments is recognized in and the accumulated<br />

changes in a separate component of equity (the translation reserve),<br />

in order to meet and partly match the translation differences that<br />

affect other comprehensive income concerning net assets in the<br />

hedged operations abroad. In the cases where the hedge is not<br />

effective, the ineffective part is recognized directly in profit for the<br />

year as a financial item.<br />

Holdings of convertible certificates of claim<br />

Convertible certificates of claim may be converted to shares through<br />

the exercise of the option to convert the claim to shares. The option to<br />

convert a convertible certificate of claim to shares is not closely related<br />

to the claim right and therefore it is separated as an “embedded<br />

derivative” belonging to the valuation category financial assets held<br />

for trading. Therefore the derivative part is initially valued and subsequently<br />

on an ongoing basis according to a valuation model at fair<br />

value. Value changes are recognized in profit for the year as financial<br />

income and expenses. The claim part is ascribed to the loan and<br />

accounts receivable category and initially valued as the difference<br />

between the acquisition value of the convertible and the initial fair<br />

value of the option. Subsequently the claim part is valued at accrued<br />

acquisition value based on the derived implicit interest rate which<br />

gives an even return over the contractual life of the claim.<br />

Issued convertible promissory notes<br />

Convertible promissory notes can be converted to shares if the counterparty<br />

exercises the option to convert the claim to shares and are<br />

recognized as a compound financial instrument divided into a liability<br />

part and an equity part. The fair value of the liability at the time of<br />

issue is calculated by discounting future payment flows at the current<br />

market rate for similar liabilities without conversion rights. The value of<br />

the equity capital instrument is calculated as the difference between<br />

the issuing funds when the convertible promissory note was issued<br />

and the fair value of the financial liability at the time of issue. Deferred<br />

tax attributable to liabilities at the issue date is deducted from the<br />

recognized value of the equity instrument. Interest expenses are recognized<br />

in profit for the year and are calculated applying the effective<br />

interest rate method.<br />

Tangible fixed assets<br />

Owned assets<br />

Tangible fixed assets are recognized in consolidated accounts at<br />

acquisition value minus accumulated depreciation and amortization<br />

and any write-downs. The acquisition value consists of the purchase<br />

price and costs directly attributable to putting the asset in place in the<br />

condition required for utilisation in accordance with the purpose of<br />

the acquisition. Borrowing costs are included in the acquisition value<br />

of internally produced fixed assets according to IAS 23. The accounting<br />

principles applying to impairment loss are listed below.<br />

The value of a tangible fixed asset is derecognized from the balance<br />

sheet upon scrapping or divestment or when no future financial<br />

benefits are expected from the use or scrapping/divestment of the<br />

asset. Gains and losses arising from divestment or scrapping of an<br />

asset consist of the difference between the sale price and the asset’s<br />

booked value minus direct costs of sale.<br />

Leased assets<br />

Leasing is classified in the consolidated accounts either as financial<br />

or operating leasing. Financial leasing applies in circumstances<br />

where the financial risks and benefits associated with ownership are<br />

substantially transferred to the lessee. Where such is not the case,<br />

operating leasing applies.<br />

Assets which are rented under financial leasing agreements are<br />

recognized as assets in the consolidated balance sheet. Payment<br />

obligations associated with future leasing charges have been recognized<br />

as long-term current liabilities. The leased assets are depreciated<br />

according to plan while leasing payments are entered under interest<br />

and amortisation of liabilities.<br />

Assets which are rented under operational leasing agreements have<br />

not been recognized as assets in the consolidated balance sheet.<br />

Leasing charges for operational leasing agreements are charged to<br />

income in a straight line over the life of the lease.<br />

Assets which are rented out under financial leasing agreements are<br />

50 PEAB ANNUAL REPORT <strong>2012</strong><br />

not recognized as tangible fixed assets since the risks and opportunities<br />

connected to ownership of the assets are transferred to the lessee.<br />

A financial receivable referring to future minimum leasing fees is<br />

<strong>report</strong>ed instead.<br />

Future expenses<br />

Future expenses are only added to the acquisition value if it is likely<br />

that the future financial benefits associated with the asset will benefit<br />

the company and the acquisition value can be reliably estimated. All<br />

other future expenses are recognized as costs as they arise.<br />

Borrowing costs<br />

Borrowing costs which are directly attributable to the purchase, construction<br />

or production of an asset and which require considerable<br />

time to complete for the intended use or sale are included in the<br />

acquisition value of the asset. Borrowing costs are activated provided<br />

that it is probable that they will result in future financial benefits and<br />

the costs can be reliably measured.<br />

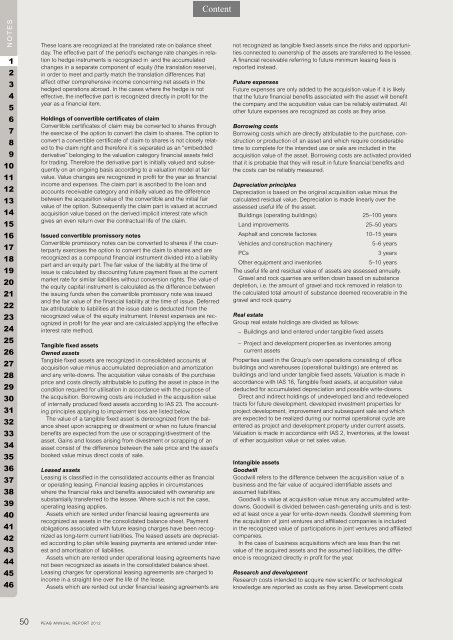

Depreciation principles<br />

Depreciation is based on the original acquisition value minus the<br />

calculated residual value. Depreciation is made linearly over the<br />

assessed useful life of the asset.<br />

Buildings (operating buildings) 25–100 years<br />

Land improvements 25–50 years<br />

Asphalt and concrete factories 10–15 years<br />

Vehicles and construction machinery 5–6 years<br />

PCs 3 years<br />

Other equipment and inventories 5–10 years<br />

The useful life and residual value of assets are assessed annually.<br />

Gravel and rock quarries are written down based on substance<br />

depletion, i.e. the amount of gravel and rock removed in relation to<br />

the calculated total amount of substance deemed recoverable in the<br />

gravel and rock quarry.<br />

Real estate<br />

Group real estate holdings are divided as follows:<br />

– Buildings and land entered under tangible fixed assets<br />

– Project and development properties as inventories among<br />

current assets<br />

Properties used in the Group’s own operations consisting of office<br />

buildings and warehouses (operational buildings) are entered as<br />

buildings and land under tangible fixed assets. Valuation is made in<br />

accordance with IAS 16, Tangible fixed assets, at acquisition value<br />

deducted for accumulated depreciation and possible write-downs.<br />

Direct and indirect holdings of undeveloped land and redeveloped<br />

tracts for future development, developed investment properties for<br />

project development, improvement and subsequent sale and which<br />

are expected to be realized during our normal operational cycle are<br />

entered as project and development property under current assets.<br />

Valuation is made in accordance with IAS 2, Inventories, at the lowest<br />

of either acquisition value or net sales value.<br />

Intangible assets<br />

Goodwill<br />

Goodwill refers to the difference between the acquisition value of a<br />

business and the fair value of acquired identifiable assets and<br />

assumed liabilities.<br />

Goodwill is value at acquisition value minus any accumulated writedowns.<br />

Goodwill is divided between cash-generating units and is tested<br />

at least once a year for write-down needs. Goodwill stemming from<br />

the acquisition of joint ventures and affiliated companies is included<br />

in the recognized value of participations in joint ventures and affiliated<br />

companies.<br />

In the case of business acquisitions which are less than the net<br />

value of the acquired assets and the assumed liabilities, the difference<br />

is recognized directly in profit for the year.<br />

Research and development<br />

Research costs intended to acquire new scientific or technological<br />

knowledge are <strong>report</strong>ed as costs as they arise. Development costs