You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

25<br />

26<br />

27<br />

28<br />

29<br />

30<br />

31<br />

32<br />

33<br />

34<br />

35<br />

36<br />

37<br />

38<br />

39<br />

40<br />

41<br />

42<br />

43<br />

44<br />

45<br />

46<br />

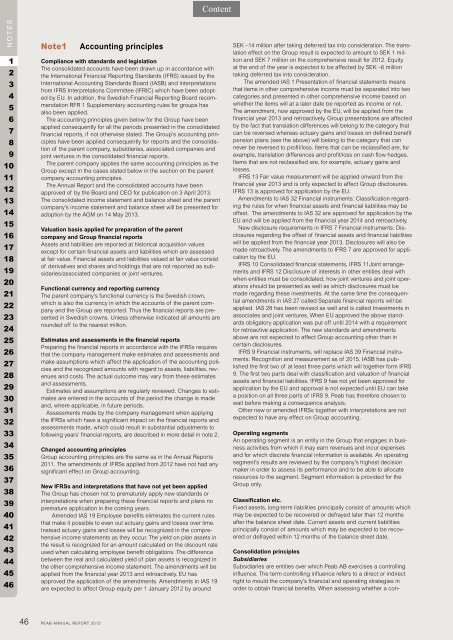

Note1 Accounting principles<br />

Compliance with standards and legislation<br />

The consolidated accounts have been drawn up in accordance with<br />

the International Financial Reporting Standards (IFRS) issued by the<br />

International Accounting Standards Board (IASB) and interpretations<br />

from IFRS Interpretations Committee (IFRIC) which have been adopted<br />

by EU. In addition, the Swedish Financial Reporting Board recommendation<br />

RFR 1 Supplementary accounting rules for groups has<br />

also been applied.<br />

The accounting principles given below for the Group have been<br />

applied consequently for all the periods presented in the consolidated<br />

financial <strong>report</strong>s, if not otherwise stated. The Group’s accounting principles<br />

have been applied consequently for <strong>report</strong>s and the consolidation<br />

of the parent company, subsidiaries, associated companies and<br />

joint ventures in the consolidated financial <strong>report</strong>s.<br />

The parent company applies the same accounting principles as the<br />

Group except in the cases stated below in the section on the parent<br />

company accounting principles.<br />

The <strong>Annual</strong> Report and the consolidated accounts have been<br />

approved of by the Board and CEO for publication on 3 April 2013.<br />

The consolidated income statement and balance sheet and the parent<br />

company’s income statement and balance sheet will be presented for<br />

adoption by the AGM on 14 May 2013.<br />

Valuation basis applied for preparation of the parent<br />

company and Group financial <strong>report</strong>s<br />

Assets and liabilities are <strong>report</strong>ed at historical acquisition values<br />

except for certain financial assets and liabilities which are assessed<br />

at fair value. Financial assets and liabilities valued at fair value consist<br />

of derivatives and shares and holdings that are not <strong>report</strong>ed as subsidaries/associated<br />

companies or joint ventures.<br />

Functional currency and <strong>report</strong>ing currency<br />

The parent company’s functional currency is the Swedish crown,<br />

which is also the currency in which the accounts of the parent company<br />

and the Group are <strong>report</strong>ed. Thus the financial <strong>report</strong>s are presented<br />

in Swedish crowns. Unless otherwise indicated all amounts are<br />

rounded off to the nearest million.<br />

Estimates and assessments in the financial <strong>report</strong>s<br />

Preparing the financial <strong>report</strong>s in accordance with the IFRSs requires<br />

that the company management make estimates and assessments and<br />

make assumptions which affect the application of the accounting policies<br />

and the recognized amounts with regard to assets, liabilities, revenues<br />

and costs. The actual outcome may vary from these estimates<br />

and assessments.<br />

Estimates and assumptions are regularly reviewed. Changes to estimates<br />

are entered in the accounts of the period the change is made<br />

and, where applicable, in future periods.<br />

Assessments made by the company management when applying<br />

the IFRSs which have a significant impact on the financial <strong>report</strong>s and<br />

assessments made, which could result in substantial adjustments to<br />

following years’ financial <strong>report</strong>s, are described in more detail in note 2.<br />

Changed accounting principles<br />

Group accounting principles are the same as in the <strong>Annual</strong> Reports<br />

2011. The amendments of IFRSs applied from <strong>2012</strong> have not had any<br />

significant effect on Group accounting.<br />

New IFRSs and interpretations that have not yet been applied<br />

The Group has chosen not to prematurely apply new standards or<br />

interpretations when preparing these financial <strong>report</strong>s and plans no<br />

premature application in the coming years.<br />

Amended IAS 19 Employee benefits eliminates the current rules<br />

that make it possible to even out actuary gains and losses over time.<br />

Instead actuary gains and losses will be recognized in the comprehensive<br />

income statements as they occur. The yield on plan assets in<br />

the result is recognized for an amount calculated on the discount rate<br />

used when calculating employee benefit obligations. The difference<br />

between the real and calculated yield of plan assets is recognized in<br />

the other comprehensive income statement. The amendments will be<br />

applied from the financial year 2013 and retroactively. EU has<br />

approved the application of the amendments. Amendments in IAS 19<br />

are expected to affect Group equity per 1 January <strong>2012</strong> by around<br />

46 PEAB ANNUAL REPORT <strong>2012</strong><br />

SEK –14 million after taking deferred tax into consideration. The translation<br />

effect on the Group result is expected to amount to SEK 1 million<br />

and SEK 7 million on the comprehensive result for <strong>2012</strong>. Equity<br />

at the end of the year is expected to be affected by SEK –6 million<br />

taking deferred tax into consideration.<br />

The amended IAS 1 Presentation of financial statements means<br />

that items in other comprehensive income must be separated into two<br />

categories and presented in other comprehensive income based on<br />

whether the items will at a later date be <strong>report</strong>ed as income or not.<br />

The amendment, now approved by the EU, will be applied from the<br />

financial year 2013 and retroactively. Group presentations are affected<br />

by the fact that translation differences will belong to the category that<br />

can be reversed whereas actuary gains and losses on defined benefit<br />

pension plans (see the above) will belong to the category that can<br />

never be reversed to profit/loss. Items that can be reclassified are, for<br />

example, translation differences and profit/loss on cash flow hedges.<br />

Items that are not reclassified are, for example, actuary gains and<br />

losses.<br />

IFRS 13 Fair value measurement will be applied onward from the<br />

financial year 2013 and is only expected to affect Group disclosures.<br />

IFRS 13 is approved for application by the EU.<br />

Amendments to IAS 32 Financial instruments: Classification regarding<br />

the rules for when financial assets and financial liabilities may be<br />

offset. The amendments to IAS 32 are approved for application by the<br />

EU and will be applied from the financial year 2014 and retroactively.<br />

New disclosure requirements in IFRS 7 Financial instruments: Disclosures<br />

regarding the offset of financial assets and financial liabilities<br />

will be applied from the financial year 2013. Disclosures will also be<br />

made retroactively. The amendments to IFRS 7 are approved for application<br />

by the EU.<br />

IFRS 10 Consolidated financial statements, IFRS 11Joint arrangements<br />

and IFRS 12 Disclosure of interests in other entities deal with<br />

when entities must be consolidated, how joint ventures and joint operations<br />

should be presented as well as which disclosures must be<br />

made regarding these investments. At the same time the consequential<br />

amendments in IAS 27 called Separate financial <strong>report</strong>s will be<br />

applied. IAS 28 has been revised as well and is called Investments in<br />

associates and joint ventures. When EU approved the above standards<br />

obligatory application was put off until 2014 with a requirement<br />

for retroactive application. The new standards and amendments<br />

above are not expected to affect Group accounting other than in<br />

certain disclosures.<br />

IFRS 9 Financial instruments, will replace IAS 39 Financial instruments:<br />

Recognition and measurement as of 2015. IASB has published<br />

the first two of at least three parts which will together form IFRS<br />

9. The first two parts deal with classification and valuation of financial<br />

assets and financial liabilities. IFRS 9 has not yet been approved for<br />

application by the EU and approval is not expected until EU can take<br />

a position on all three parts of IFRS 9. <strong>Peab</strong> has therefore chosen to<br />

wait before making a consequence analysis.<br />

Other new or amended IFRSs together with interpretations are not<br />

expected to have any effect on Group accounting.<br />

Operating segments<br />

An operating segment is an entity in the Group that engages in business<br />

activities from which it may earn revenues and incur expenses<br />

and for which discrete financial information is available. An operating<br />

segment’s results are reviewed by the company’s highest decision<br />

maker in order to assess its performance and to be able to allocate<br />

resources to the segment. Segment information is provided for the<br />

Group only.<br />

Classification etc.<br />

Fixed assets, long-term liabilities principally consist of amounts which<br />

may be expected to be recovered or defrayed later than 12 months<br />

after the balance sheet date. Current assets and current liabilities<br />

principally consist of amounts which may be expected to be recovered<br />

or defrayed within 12 months of the balance sheet date.<br />

Consolidation principles<br />

Subsidiaries<br />

Subsidiaries are entities over which <strong>Peab</strong> AB exercises a controlling<br />

influence. The term controlling influence refers to a direct or indirect<br />

right to mould the company’s financial and operating strategies in<br />

order to obtain financial benefits. When assessing whether a con-